What is Financing a Car: Your Ultimate Guide to Smart Buying

Financing a car means getting a loan to buy a car. The lender pays for the car, and you repay them over time with interest.

Buying a car is a significant decision. Not everyone has enough money to pay upfront. That’s where car financing comes in. It helps you spread the cost over months or years. This can make car ownership more accessible. But, it’s important to understand how it works.

Car financing involves interest rates, loan terms, and monthly payments. Knowing these details can help you make better choices. In this blog post, we’ll explain everything you need to know about financing a car. By the end, you’ll have a clear understanding of the process. Let’s dive in!

Introduction To Car Financing

Financing a car means you borrow money to buy a car. You then pay back the money over time with interest. This can make buying a car easier. You do not need all the money upfront.

Financing a car has many benefits. You can drive a better car. You can build your credit score by making payments on time. You can also keep your savings for emergencies.

Many people think financing is too expensive. They worry about high interest rates. Some believe only new cars can be financed. This is not true. Used cars can be financed too.

Credit: www.bankofamerica.com

Types Of Car Loans

Secured loans use the car as collateral. This means the bank can take the car if you don’t pay. These loans often have lower interest rates. They are easier to get if you have bad credit. But, you risk losing your car.

Unsecured loans do not use the car as collateral. They can be harder to get. They often have higher interest rates. These loans do not risk the car. They may need better credit.

Choosing The Right Lender

Banks are well-known and have many branches. They offer many services. Credit unions are smaller and member-owned. They often provide lower interest rates. But, they may have fewer services. Consider your needs before choosing.

Online lenders are easy to access. They often have faster approval times. Some offer better rates than banks. But, they may not have physical locations. Research online reviews before applying.

Understanding Interest Rates

Fixed rates stay the same over time. They do not change. You always know what you will pay. This can make planning easier. You have the same payment every month. It is stable and predictable. Fixed rates can be good if you like steady payments.

Variable rates can go up or down. They change with the market. Sometimes they are low. Sometimes they are high. You never know what they will be. It can be risky. Your payments can change. This can make budgeting hard. Variable rates can be tricky.

Down Payments And Monthly Payments

Down payments are the money you pay upfront. They reduce the total loan amount. A higher down payment can lower your monthly payments. This also means less interest over time. It’s wise to save for a bigger down payment. This can help you save money in the long run.

Monthly payments depend on the loan amount, interest rate, and loan term. Use a car loan calculator to get an estimate. Enter the loan amount, interest rate, and term. The calculator will show your monthly payment. Always budget to make sure you can afford these payments. This ensures you won’t face financial stress later.

Credit Score And Car Financing

A good credit score can lower your interest rate. Lower rates mean lower monthly payments. A bad credit score means higher rates. Higher rates mean more money paid over time. Lenders check your score before giving you a loan. It tells them how risky you are.

Pay your bills on time. This can help your score. Keep credit card balances low. Do not open too many new accounts at once. Check your credit report for mistakes. Fix any errors you find. These steps can make your score better.

Trade-in Options

Trading in your car is quick and easy. You get instant credit towards your new car. Selling it yourself takes more time. You might get more money by selling. But, it involves more work. You have to find a buyer. You need to handle all the paperwork. Trading is less hassle. Decide what works best for you.

Keep your car clean and well-maintained. Fix any minor issues. Make sure all services are up to date. Present all records to the dealer. This shows you took care of the car. It can increase the value. Remove personal items. A neat car looks more appealing. Research your car’s value online. Know what it is worth. This helps you negotiate better.

Credit: www.youtube.com

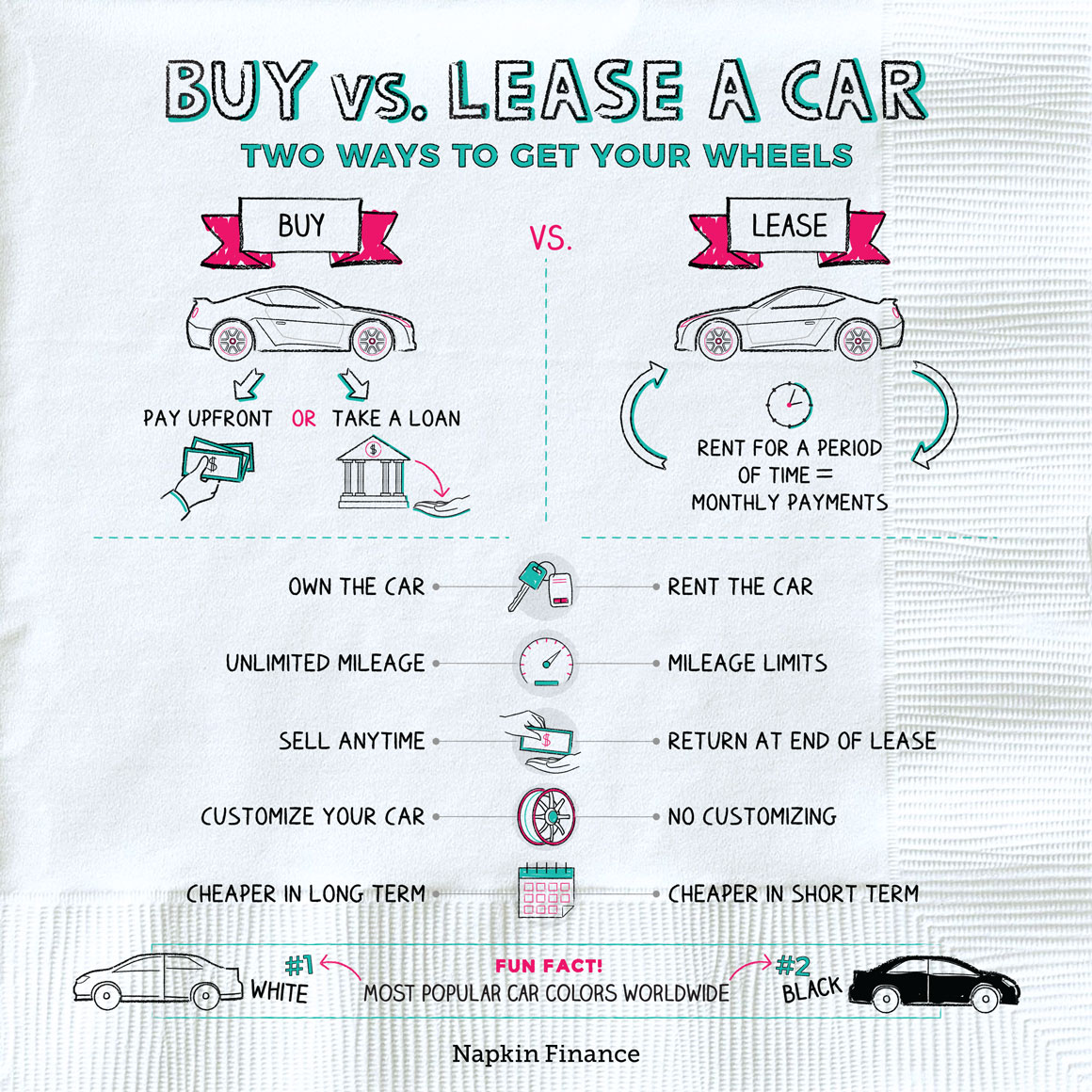

Lease Vs Buy

Leasing a car has its advantages. Monthly payments are often lower. You can drive a new car every few years. No need to worry about selling the car later. But, there are drawbacks too. You never own the car. There are mileage limits. Extra charges for wear and tear.

Buying a car can be a good choice. You own the car. No mileage limits. You can customize it. Selling the car is your choice. Yet, there are downsides. Monthly payments can be higher. Car value drops over time. Maintenance costs can add up.

Credit: napkinfinance.com

Frequently Asked Questions

What Does Financing Mean In A Car?

Financing a car means taking out a loan to pay for the vehicle, then repaying it over time with interest.

Is It A Good Idea To Finance A Car?

Financing a car can be a good idea if you need a vehicle and have a stable income. Evaluate interest rates and loan terms before deciding. Consider your budget and financial situation to ensure it fits your needs.

How Does Financing Work?

Financing involves borrowing money to purchase items or fund projects. You repay the loan over time with interest. Common options include personal loans, credit cards, and mortgages. Monthly payments include principal and interest. Always review terms and conditions before committing.

How Much Is A $30,000 Car Payment For 60 Months?

A $30,000 car payment for 60 months typically costs around $500 per month, excluding interest and fees. Exact amounts depend on interest rates and loan terms. Always use an auto loan calculator for precise figures.

Conclusion

Financing a car involves loans, monthly payments, and interest rates. It’s crucial to understand terms before committing. Research lenders and compare offers for the best deal. Always budget wisely to avoid financial strain. A well-planned car loan can make owning a vehicle easier.

Happy driving!