How is Interest Calculated on Car Loan: A Simple Guide

Interest on a car loan is calculated based on the principal amount and the interest rate. The method of calculation can impact how much you end up paying over time.

Understanding how interest is calculated on a car loan is crucial for managing your finances. Interest can add a significant cost to your loan, making it essential to know how it works. Whether you’re considering a new or used car, knowing the interest calculation helps you make informed decisions.

This guide will explain the different ways interest can be calculated on a car loan. We will cover simple interest and precomputed interest, and how each affects your payments. By the end, you will be better equipped to choose the best loan option for your needs.

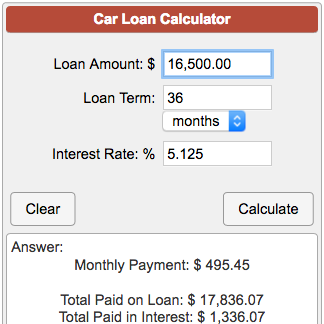

Credit: www.calculatorsoup.com

Types Of Car Loan Interest

Fixed rate interest stays the same for the whole loan period. This means your monthly payment will not change. It is easy to plan your budget this way. Stability is the main benefit. But, if market rates go down, you cannot take advantage. This type of interest is predictable.

Variable rate interest can change over time. It often starts lower than fixed rates. But, it can go up or down. Your monthly payment can change. This type of interest follows the market. It can save money if rates stay low. But, it is less predictable. You need to be ready for changes in your payments.

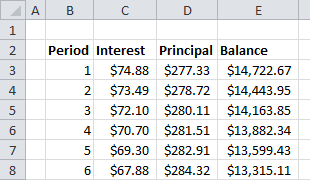

Credit: www.exceltactics.com

Key Factors Affecting Interest Rates

Interest on a car loan depends on factors such as the principal amount, loan term, and annual percentage rate (APR). Lenders also consider credit scores to determine the interest rate. This ensures the loan is tailored to the borrower’s financial situation.

Credit Score

Your credit score plays a big role. Higher scores mean lower rates. A low score means higher rates. Lenders check your score to decide your risk.

Loan Term

The loan term affects interest rates. Shorter terms have lower rates. Longer terms mean higher rates. Think about the total cost.

Down Payment

A down payment can lower your interest rate. Paying more upfront reduces risk for lenders. This often leads to better rates. Save for a good down payment.

Fixed Rate Interest Calculation

The monthly payment formula helps you find out how much you pay each month. The formula is simple. Use the principal amount, the interest rate, and the number of months. Divide the interest rate by 12 to get the monthly rate. Multiply this by the principal. Then divide by one minus the result of one plus the monthly rate raised to the power of negative months.

Let’s say you borrow $10,000 at a 5% annual interest rate for 5 years. First, convert the annual rate to a monthly rate. That’s 0.05 divided by 12. Next, calculate the number of payments. That’s 5 years times 12 months, so 60 payments. Now, plug these into the formula to get your monthly payment.

Variable Rate Interest Calculation

Variable rate loans have interest rates that can change. The monthly payment can go up or down. This depends on the current interest rate. If rates go up, your payment may increase. If rates go down, your payment may decrease. This means that your loan cost over time can vary.

| Month | Interest Rate | Monthly Payment |

|---|---|---|

| 1 | 3% | $300 |

| 2 | 3.5% | $310 |

| 3 | 4% | $320 |

Amortization Schedule

An amortization schedule outlines how car loan payments are divided into interest and principal. Interest is calculated based on the remaining loan balance. Early payments mostly cover interest, while later payments reduce the principal more.

Definition

An amortization schedule shows how a loan is paid off. It breaks down each payment. You can see what part goes to interest. You also see what part goes to the principal. This schedule helps you understand your loan. It shows how much you still owe. It updates with each payment.

Impact On Payments

The amortization schedule affects your payments. Early payments mostly go to interest. Over time, more goes to the principal. This means you pay less interest later. Your loan balance drops faster. Always check your schedule. It helps you plan your finances. Understanding it can save you money.

Comparing Loan Offers

APR and interest rate are not the same. Interest rate is the cost of borrowing money. APR includes fees and other costs. APR gives a full picture of loan cost. Always check both when comparing loans. A low interest rate could have high fees. APR shows the true cost.

The total loan cost is not just the monthly payments. It includes the principal and interest. Also, consider any fees. Upfront fees or closing costs add to the total. Calculate the full amount to see what you will pay over time. Always look at the big picture.

Tips To Lower Interest Rates

Pay bills on time. Reduce debts. Check credit report for errors. Dispute any mistakes found. Keep credit card balances low. Avoid opening new credit accounts.

Choose a shorter loan term. This can reduce total interest paid. Monthly payments may be higher. But, the car will be paid off sooner.

Save more money for the down payment. This reduces the loan amount. Larger down payments can lead to lower interest rates. Lenders see less risk with bigger down payments.

Credit: www.calculatestuff.com

Common Mistakes To Avoid

Many car loans have hidden fees. These fees can be in the form of processing charges, administrative fees, or late payment penalties. These charges can increase the cost of the loan. Always ask the lender about any extra fees. This helps you plan your budget better. Be smart and read the fine print.

Loan terms include the interest rate, duration, and monthly payments. Sometimes, lower monthly payments mean a longer loan duration. This can lead to paying more interest over time. Shorter loan terms may have higher monthly payments but save money on interest. Make sure to understand the loan terms fully. This helps you make an informed decision.

Frequently Asked Questions

How Is Interest On A Car Loan Calculated?

Interest on a car loan is usually calculated using simple interest. The formula is: Principal x Interest Rate x Time.

What Is The Difference Between Simple And Compound Interest?

Simple interest is calculated only on the principal amount. Compound interest is calculated on the principal plus any accumulated interest.

Can I Reduce My Car Loan Interest Rate?

Yes, you can reduce your car loan interest rate by improving your credit score. You can also negotiate with lenders.

What Factors Affect Car Loan Interest Rates?

Factors affecting car loan interest rates include your credit score, loan term, down payment, and lender’s policies.

Conclusion

Understanding car loan interest is vital. It helps you manage your finances better. Remember, different loans have different calculations. Always read the terms carefully. Compare rates before deciding. Use online calculators to estimate payments. This can save you money in the long run.

Stay informed and make wise choices. A good loan can make car ownership easier. Happy driving!