How Much is the Average Car Payment Per Month: Discover the Shocking Truth

The average car payment per month varies. It depends on factors like loan term and interest rate.

Owning a car often means dealing with monthly payments. Knowing the average car payment can help you plan better. Whether you are buying a new or used car, understanding what others pay is useful. This information helps you budget and avoid overpaying.

In this blog, we will explore typical monthly car payments. We will discuss new and used car payment averages. By the end, you will have a clear idea of what to expect. This knowledge will help you make informed financial decisions. Stay with us to learn more about average car payments.

Average Car Payment Overview

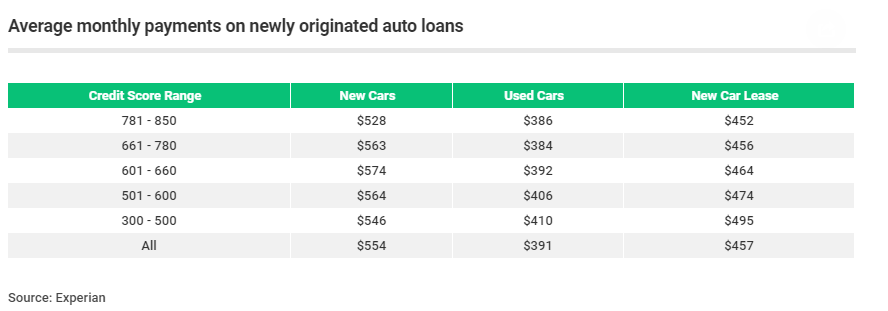

The average car payment per month for a new car is around $563. For used cars, it’s about $397 each month. These figures depend on the car’s price and loan terms. Most people choose loans between 60 to 72 months.

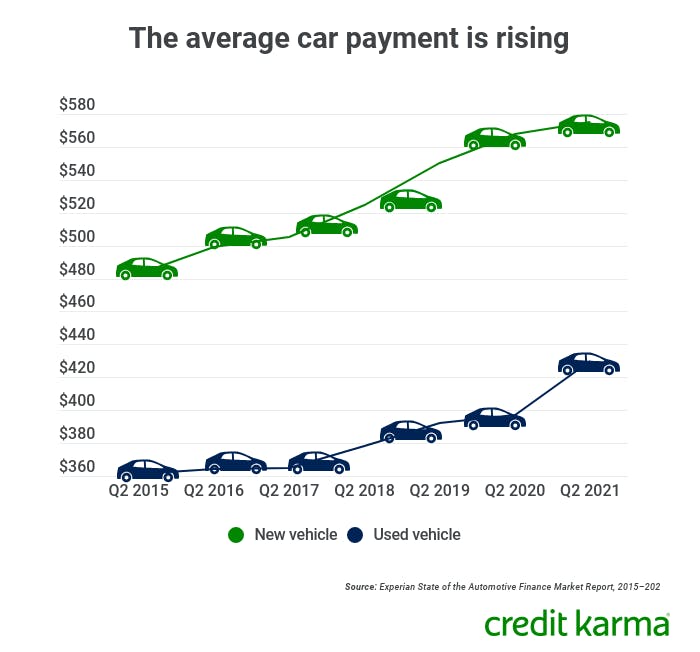

In past years, average car payments have increased. Ten years ago, the average payment was much lower. This rise is due to higher car prices and longer loan terms. Interest rates also affect monthly payments. Lower rates can make payments more affordable.

Factors Influencing Car Payments

Loan terms affect how much you pay each month. Shorter loan terms mean higher monthly payments. Longer loan terms mean lower monthly payments. But, you pay more interest over time.

Interest rates change the amount you pay. Lower rates mean lower monthly payments. Higher rates mean higher monthly payments. Your credit score impacts your rate.

Credit scores play a big role. Good credit scores get better interest rates. Bad credit scores get higher rates. This affects how much you pay each month.

New Vs. Used Car Payments

New cars cost more than used cars. Monthly payments for new cars are higher. New car loans often have better interest rates. Yet, the total cost is still more. Used cars cost less. Monthly payments are lower. Interest rates can be higher for used cars. But, the total cost is usually less.

New cars lose value fast. This is called depreciation. In the first year, a new car can lose 20% of its value. After five years, it may lose 60%. Used cars have already lost value. They depreciate slower. This means less loss in value over time. Lower depreciation helps keep the total cost down.

Credit: wiserinvestor.com

Lease Vs. Buy Monthly Payments

Lease agreements often have lower monthly payments. The reason is you only pay for the car’s depreciation. This means you don’t own the car at the end of the lease. But, you can always get a new car every few years. Leases also include maintenance in some cases. This can save you money. However, you must follow mileage limits. Going over the limit costs extra.

Buying a car usually has higher monthly payments. This is because you are paying off the full price of the car. But, once the loan is paid off, the car is yours. There are no mileage limits. You can keep it as long as you want. You can also sell it later. Owning a car can have other costs. These include repairs and maintenance. But, you have the freedom to drive as much as you want.

Regional Differences In Car Payments

Car payments often differ in urban and rural areas. Urban areas usually have higher living costs. This can lead to higher car payments. Rural areas often have lower costs. People might pay less for cars there. Insurance rates also differ. Urban areas often have higher rates. This adds to the total car payment. Rural areas may have lower rates. This helps keep payments low. Income levels can also affect car payments. Urban incomes are often higher. People may afford higher car payments. Rural incomes may be lower. This keeps payments smaller.

| State | Average Monthly Payment |

|---|---|

| California | $500 |

| Texas | $450 |

| New York | $480 |

| Florida | $460 |

| Ohio | $430 |

Credit: www.creditkarma.com

Impact Of Down Payments

Higher down payments lower monthly car payments. The average monthly car payment is around $530 for new cars. Reduce expenses by paying more upfront.

Upfront Costs

A larger down payment means you pay less each month. Paying more upfront reduces the total loan amount. This can save interest costs over the loan’s life. A smaller down payment might seem easier. But it could cost more in the long run. Dealers often suggest 20% down to balance costs. Always consider your budget before deciding.

Monthly Payment Reduction

A big down payment lowers your monthly bill. This makes it easier to manage payments. Smaller down payments result in higher monthly costs. Lowering the loan amount reduces interest paid. This makes the car more affordable. Smaller monthly payments mean less financial stress. Plan your budget wisely to make the best choice.

How To Lower Your Car Payment

Refinancing your car loan can help you save money. A new loan with a lower interest rate means lower monthly payments. Check with your bank for better rates. Compare offers from different lenders. Make sure to read all terms carefully.

Speak to your lender about lowering your payment. Be polite but firm. Explain your financial situation. Ask if they can adjust the interest rate. Sometimes, extending the loan term can help. This means you pay over a longer time. Use any offers from other lenders as leverage.

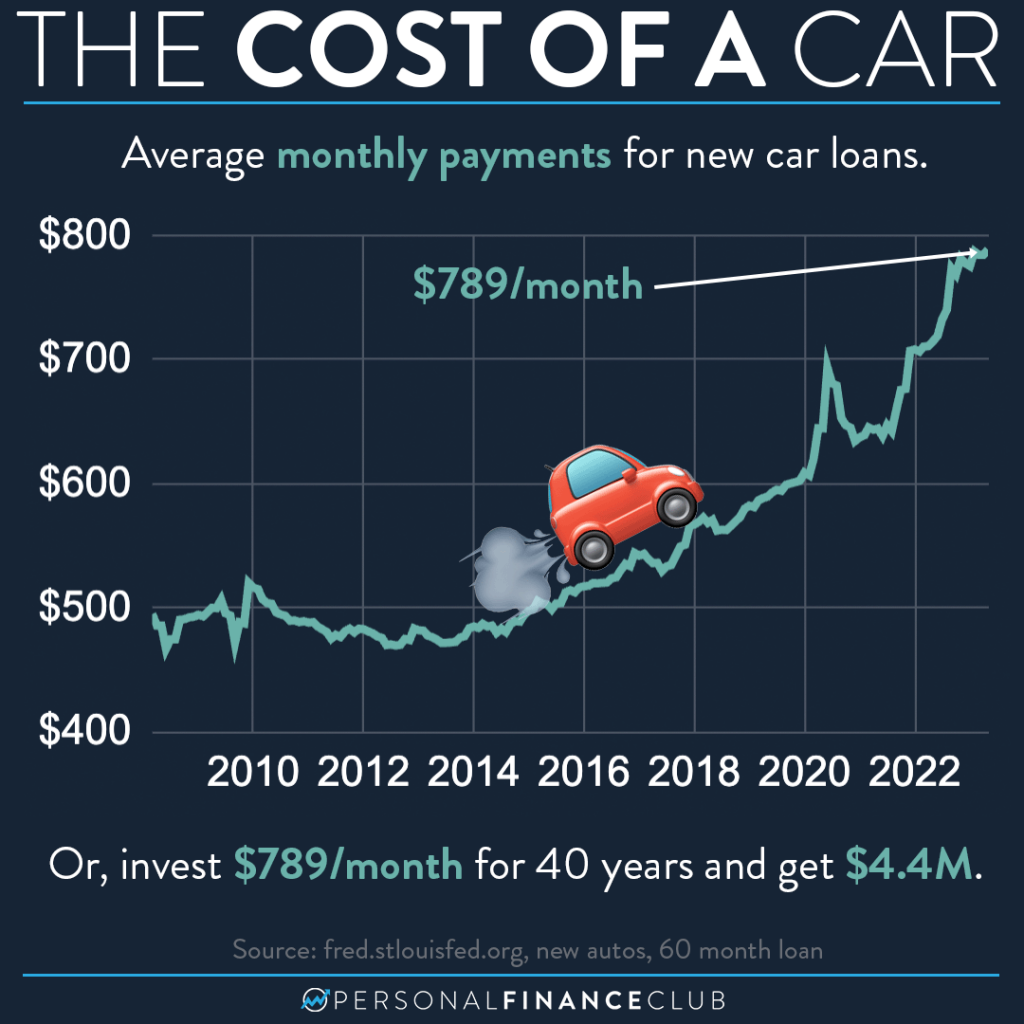

Credit: www.personalfinanceclub.com

Future Trends In Car Payments

The average car payment per month is rising, with many consumers paying around $500 to $600. As technology evolves, flexible payment options like digital wallets and subscription services may become more popular.

Electric And Hybrid Vehicles

Electric and hybrid vehicles are growing in popularity. People want cleaner and greener options. These cars often cost more upfront. But, they save money on gas over time. Monthly payments can be higher. Yet, the savings on fuel and maintenance help balance the cost. More people are choosing these vehicles each year. The trend shows no signs of slowing down.

Economic Influences

Economic factors can change car payments. Interest rates play a big role. Low rates mean lower monthly payments. High rates increase the cost. Inflation also affects car prices. When prices rise, monthly payments go up. Economic stability helps keep payments predictable. Unstable economies make it hard to plan. Always watch the economy when buying a car.

Frequently Asked Questions

What Is The Average Car Payment Per Month?

The average car payment per month is around $550 for new cars. For used cars, it’s approximately $400.

How Do Car Payment Amounts Vary?

Car payment amounts vary based on the car’s price, loan term, and interest rate. Newer cars typically have higher payments.

What Factors Influence Monthly Car Payments?

Monthly car payments are influenced by the car’s price, loan term, interest rate, and down payment amount.

Can I Lower My Monthly Car Payment?

Yes, you can lower your monthly car payment by increasing your down payment or extending the loan term.

Conclusion

The average car payment per month varies based on several factors. Your credit score, loan term, and vehicle type all play a role. It’s essential to budget carefully before taking on a car loan. Aim for a monthly payment that fits your financial situation.

Research and compare offers to find the best deal. Remember, understanding your monthly car payment helps you manage your finances better. Stay informed and make wise financial decisions.