Interest Rate Vs APR Car Loan: Understanding the Difference

Understanding the difference between interest rate and APR for car loans can be confusing. Both terms are important, but they serve different purposes.

When you apply for a car loan, you will encounter the terms “interest rate” and “APR. ” The interest rate is the cost of borrowing money, expressed as a percentage. It does not include fees. APR, or Annual Percentage Rate, includes the interest rate plus any additional fees or costs.

This makes APR a more comprehensive measure of what you will pay over the life of the loan. Knowing the difference helps you make better financial decisions. Understanding these terms can save you money and avoid surprises. In this blog post, we will explore these differences in detail to help you make informed choices.

Introduction To Car Loan Rates

Knowing the difference between interest rate and APR is important. It affects the total cost of your car loan. The interest rate is the cost of borrowing money. APR includes the interest rate plus other fees. These fees can be processing fees or documentation charges.

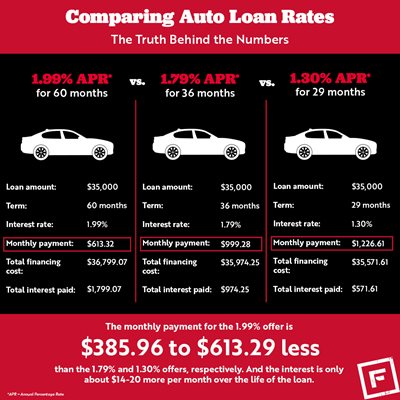

The interest rate affects the monthly payments. A lower rate means less interest paid over time. APR gives a more complete picture of the loan costs. It includes extra charges. So, APR is usually higher than the interest rate. Knowing both helps in comparing loans better.

The total loan cost is affected by both interest rate and APR. A lower interest rate reduces monthly payments. But, if the APR is high, you may pay more in the end. Always check the APR before signing the loan. This ensures you understand the full cost of the loan.

What Is Interest Rate?

The interest rate is the cost of borrowing money. It is shown as a percentage. This rate is only the charge for borrowing. It does not include other fees.

A higher interest rate means higher monthly payments. Lower rates mean lower payments. This affects how much you pay each month. It also affects the total amount paid over time.

What Is Apr?

APR stands for Annual Percentage Rate. It shows the total cost of a loan. This includes the interest rate and other fees. APR helps you know the real cost of borrowing money. It is shown as a percentage.

APR includes many fees. These might be origination fees, processing fees, and more. It also adds any additional costs to the loan. This makes it easy to compare loans.

Credit: mytresl.com

Key Differences Between Interest Rate And Apr

The interest rate is the cost of borrowing money. It is a percentage of the loan amount. The APR includes the interest rate and other fees. APR gives the total cost of the loan. Lenders must disclose the APR. This helps you compare loans easily.

Interest rate does not include additional fees. APR includes all costs. This makes the loan terms clearer. Knowing the APR helps you understand what you pay. It is easier to compare loans with APR. Look at both interest rate and APR before deciding.

Pros And Cons Of Interest Rate

Interest rates help you know the cost of your loan. They are often lower than APR. This can make your monthly payments smaller. Simple and clear, interest rates are easy to understand. They help you compare loans quickly. You can save money with a lower interest rate. It is good for budgeting. A fixed rate means stable payments. This avoids surprises. Easier planning for you.

Interest rates do not show all costs. They can hide fees. This may surprise you later. Only focusing on interest rate can be misleading. You might miss the bigger picture. APR includes more costs. It is more complete. Interest rates can change. This can make budgeting hard. Variable rates may increase over time. This can lead to higher payments.

Credit: www.rategenius.com

Pros And Cons Of Apr

APR helps compare loan costs easily. It includes interest rate and fees. This makes it clear what you are paying. It can be helpful when you are shopping for a car loan. You can see which loan is cheaper. Lenders must show APR by law. This makes comparison fair.

APR can be confusing sometimes. It mixes interest and fees. Some fees may not be included. This can make the loan look better or worse. APR is often higher than the interest rate. This can be misleading to some people. Always read the details of the loan. Ask questions if you do not understand. This helps you avoid surprises later.

Factors Influencing Interest Rate And Apr

A high credit score can get you a lower interest rate. Lenders trust people with good credit scores more. A low credit score means higher interest rates.

Shorter loan terms usually have lower interest rates. Longer loan terms may have higher rates. You pay more over time with longer terms.

Interest rates change with the market. If the economy is strong, rates might be higher. During weak times, rates may drop. Always check current market rates before you get a loan.

Credit: www.frontwavecu.com

Choosing The Best Option For Your Car Loan

Before picking a car loan, look at your finances. Think about your monthly income. Check your expenses and savings. Know how much you can pay each month. This helps avoid debt problems. A budget helps. Write down all your costs. Include rent, food, and other bills. This shows what you can afford for a car. Knowing your limits is key. Never borrow more than you can pay back.

Compare different lenders. Look at their interest rates. Check the APR. APR includes extra costs. Interest rate is just the cost of borrowing. A lower interest rate is good. But a low APR might be better. Ask lenders for details. Get quotes from banks and credit unions. Use online tools to compare. Read reviews of each lender. This helps you find the best deal. Remember, the right lender can save you money.

Frequently Asked Questions

What Is An Apr For A Car Loan?

APR stands for Annual Percentage Rate. It includes the interest rate plus other fees. APR gives a complete cost picture of a car loan.

How Does Interest Rate Differ From Apr?

The interest rate is just the cost of borrowing money. APR includes interest plus additional fees. APR provides a more accurate cost assessment.

Why Is Apr Important In Car Loans?

APR helps you compare loan offers accurately. It includes all costs, making it easier to identify the best deal.

Can Apr Be Higher Than The Interest Rate?

Yes, APR can be higher than the interest rate. It includes additional fees and charges, which increase the overall cost.

Conclusion

Choosing between interest rate and APR in a car loan is crucial. Understanding both helps you make better decisions. Interest rates show the cost of borrowing. APR includes fees and other charges. Comparing APRs gives a clearer picture. Always read the fine print.

Shop around for the best offers. Your wallet will thank you. Stay informed and drive away happy.