Is Car Insurance Monthly Payment Worth the Cost?

Yes, car insurance can be paid monthly. This payment option provides flexibility for many drivers.

Car insurance is essential for protecting yourself and your vehicle. Some people prefer paying their premium annually, but monthly payments can be more manageable. This option allows you to spread the cost over the year, making it easier to budget.

Monthly payments can help you avoid a large, upfront expense and provide peace of mind. In this blog, we will explore the pros and cons of monthly car insurance payments. We’ll discuss how this payment method works and whether it suits your financial situation. Understanding your options can help you make an informed decision about your car insurance. So, let’s dive into the details of monthly car insurance payments.

Introduction To Car Insurance

Car insurance is a contract between you and an insurance company. You pay a monthly fee. The company helps cover costs in case of accidents or damage. It can also help if your car is stolen. The main goal is to protect you from big expenses. You can choose different types of coverage. Some cover only accidents. Others cover theft, natural disasters, and more. It is important to choose the right one.

Car insurance is very important. It protects you and others on the road. Without insurance, you might pay a lot of money if you cause an accident. It helps cover medical bills for you and others. It also covers repair costs. In many places, it is required by law. Driving without it can lead to fines or legal trouble. Having insurance gives peace of mind. It keeps you safe financially. Always make sure your insurance is up to date.

Credit: www.insure.com

Monthly Payments Explained

Monthly payments for car insurance break your total yearly cost into 12 smaller payments. This makes it easier to manage. Instead of paying a large sum upfront, you pay smaller amounts each month. It helps in budgeting your money better.

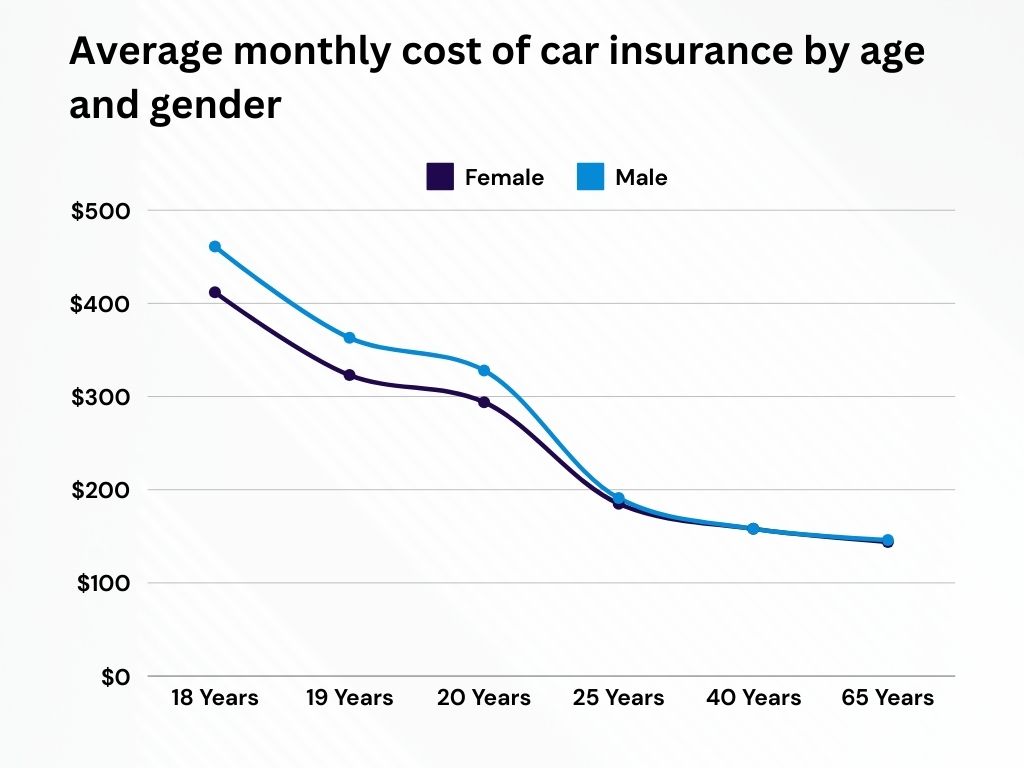

Several factors affect your monthly car insurance payments. Your age and driving history are important. Younger drivers or those with accidents may pay more. The type of car you drive also matters. Sports cars can cost more to insure. Where you live affects rates too. Cities might have higher rates than rural areas.

Benefits Of Monthly Payments

Monthly payments offer financial flexibility. You don’t need to pay a big sum at once. This helps in managing your budget better. With smaller payments, your savings can stay more stable. It is easier to handle unexpected expenses.

Monthly payments make budget management simple. You can plan your expenses more effectively. It reduces the risk of financial strain. You can set aside a fixed amount each month. This ensures that your car insurance is always covered.

Credit: www.policygenius.com

Drawbacks Of Monthly Payments

Monthly payments often lead to a higher overall cost. Insurance companies may charge extra fees. These fees can add up quickly. Paying yearly can save money. The yearly plan usually has less fees.

Monthly payments might include extra charges. Late fees are common. Missed payments can increase costs. Some companies also add administrative fees. These fees make monthly payments expensive.

Comparing Monthly Vs. Annual Payments

Monthly payments may seem easier on your budget. But they can be more expensive. Insurance companies often charge extra fees for monthly plans. Annual payments, on the other hand, usually have discounts. You might save money by paying once a year. Consider your budget and cash flow before deciding.

Monthly payments are convenient for those with tight budgets. You can spread the cost over the year. Annual payments mean you pay just once. No need to worry about monthly bills. Choose what fits your lifestyle best. Think about how you manage your money. Both options have their pros and cons.

Tips To Reduce Monthly Payments

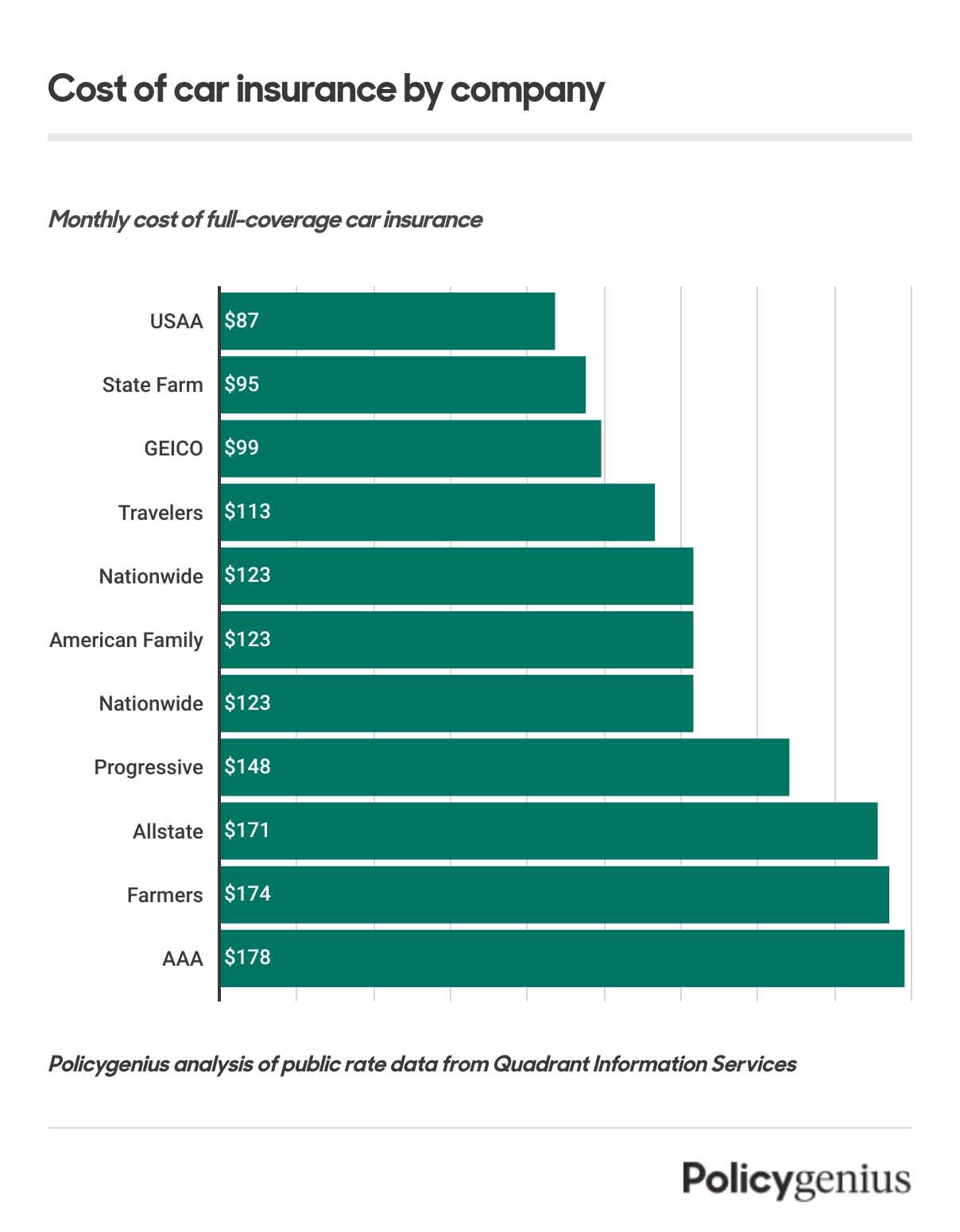

Get quotes from different insurance companies. This helps you find the best deal. Different companies offer different prices. Comparing prices can save you money. Check at least three or four companies. Use online tools for quick comparisons. Always ask about discounts. Some companies have special offers for good drivers.

Raising your deductible can lower your premium. A higher deductible means you pay more out of pocket if you have an accident. This can save you money each month. Make sure you can afford the higher deductible if needed. Many people choose a higher deductible to save on monthly costs.

Real-life Examples

John pays for his car insurance every month. He finds it easier to budget. Each month, he knows the exact amount to set aside. This helps him avoid large, unexpected bills. John prefers this method because it makes his finances more predictable. Monthly payments can be a smart choice for those who have a tight budget. It also spreads the cost over time.

Sarah chose to pay her car insurance in a lump sum. She likes to get it out of the way. Paying once a year means no monthly bills. This method can save money in the long run. Insurance companies often offer discounts for lump-sum payments. Sarah feels more at ease without monthly reminders. This is a good option for those who have savings ready.

Credit: www.insure.com

Frequently Asked Questions

Are Car Insurance Payments Monthly?

Yes, car insurance payments are often monthly. Many insurers offer flexible payment options, including monthly installments.

Is $200 A Month A Lot For Car Insurance?

$200 a month for car insurance can be high. Rates vary by location, driving record, and coverage. Compare quotes to find the best deal.

Is Insurance A Monthly Bill?

Yes, insurance can be a monthly bill. Payments can be monthly, quarterly, semi-annual, or annual, depending on the policy.

Is $300 A Month Bad For Insurance?

$300 a month for insurance isn’t necessarily bad. It depends on coverage, location, and individual needs. Always compare quotes.

Conclusion

Choosing monthly car insurance payments can ease financial stress. It offers flexibility and control over your budget. You avoid large, upfront costs and can manage expenses better. Remember to compare different plans. Find what fits your needs. Monthly payments might be higher overall, but they provide peace of mind.

Weigh the pros and cons carefully. Make informed decisions for your financial health. Regularly review and adjust your plan as needed. This ensures you always get the best deal. Your car insurance should protect you without breaking the bank. Stay informed, stay insured, and drive confidently.