How Much Car Can I Afford: A Comprehensive Guide to Smart Buying

You can afford a car that fits your budget. First, consider your income and expenses.

Next, set a realistic price range. Deciding how much car you can afford can feel overwhelming. Many factors influence this decision, including your monthly income, existing debts, and overall financial health. It’s important to find a balance between getting the car you want and staying within your budget.

A good rule of thumb is to spend no more than 15% of your monthly income on car payments. This approach ensures you can comfortably manage your finances while enjoying your new ride. In this guide, we’ll explore practical tips and strategies to help you determine the right amount to spend on a car without straining your wallet.

Credit: www.instagram.com

Assessing Your Budget

Assessing your budget helps determine how much you can afford for a new car. Consider monthly income, expenses, and savings.

Monthly Income Evaluation

First, calculate your total monthly income. This includes your salary, any side jobs, and other sources of income. Knowing your exact monthly income helps in setting a clear budget for a new car. Aim to keep car expenses within 15% of your monthly income.

Current Expenses Breakdown

List all your current expenses. This includes rent, food, utilities, and other bills. It is crucial to understand how much you spend each month. Subtract these expenses from your income to see what is left. This helps you know how much you can spend on a car.

Savings And Emergency Fund

Ensure you have enough savings and an emergency fund. Experts suggest keeping at least three to six months of expenses saved. This fund is important for unexpected costs. Do not use this money for buying a car. It keeps you financially safe.

Credit: www.youtube.com

Understanding Car Costs

Upfront costs include the down payment. Sometimes, there are extra fees. These can be dealer fees or registration costs. Save enough money for these expenses. Plan ahead.

Monthly payments are the money you pay every month. You pay this for the car loan. The interest rate affects this payment. A higher rate means more money. Choose a loan with a good rate.

Cars need regular maintenance. This keeps them running well. Oil changes and tire rotations are common. Sometimes, unexpected repairs happen. Save money for these costs.

Insurance is a must. It protects you in case of an accident. Car taxes also add to the cost. These vary by location. Check your local rules.

Loan And Financing Options

Bank loans are common for car financing. You can get fixed or variable rates. Fixed rates stay the same. Variable rates can change over time. Banks check your credit score before giving a loan. Better scores get better rates.

Credit unions offer lower interest rates. You must be a member to apply. Membership often requires a small fee. They are known for better customer service. Credit unions may have more flexible terms.

Dealer financing is quick and convenient. You can get financing at the car dealership. Sometimes, dealers offer special promotions. These may include low or zero interest rates. Always read the fine print.

Leasing and buying have different benefits. Leasing means you rent the car. Monthly payments are often lower. But you do not own the car. Buying means you own the car. Payments may be higher, but you keep the car. Consider your budget and needs.

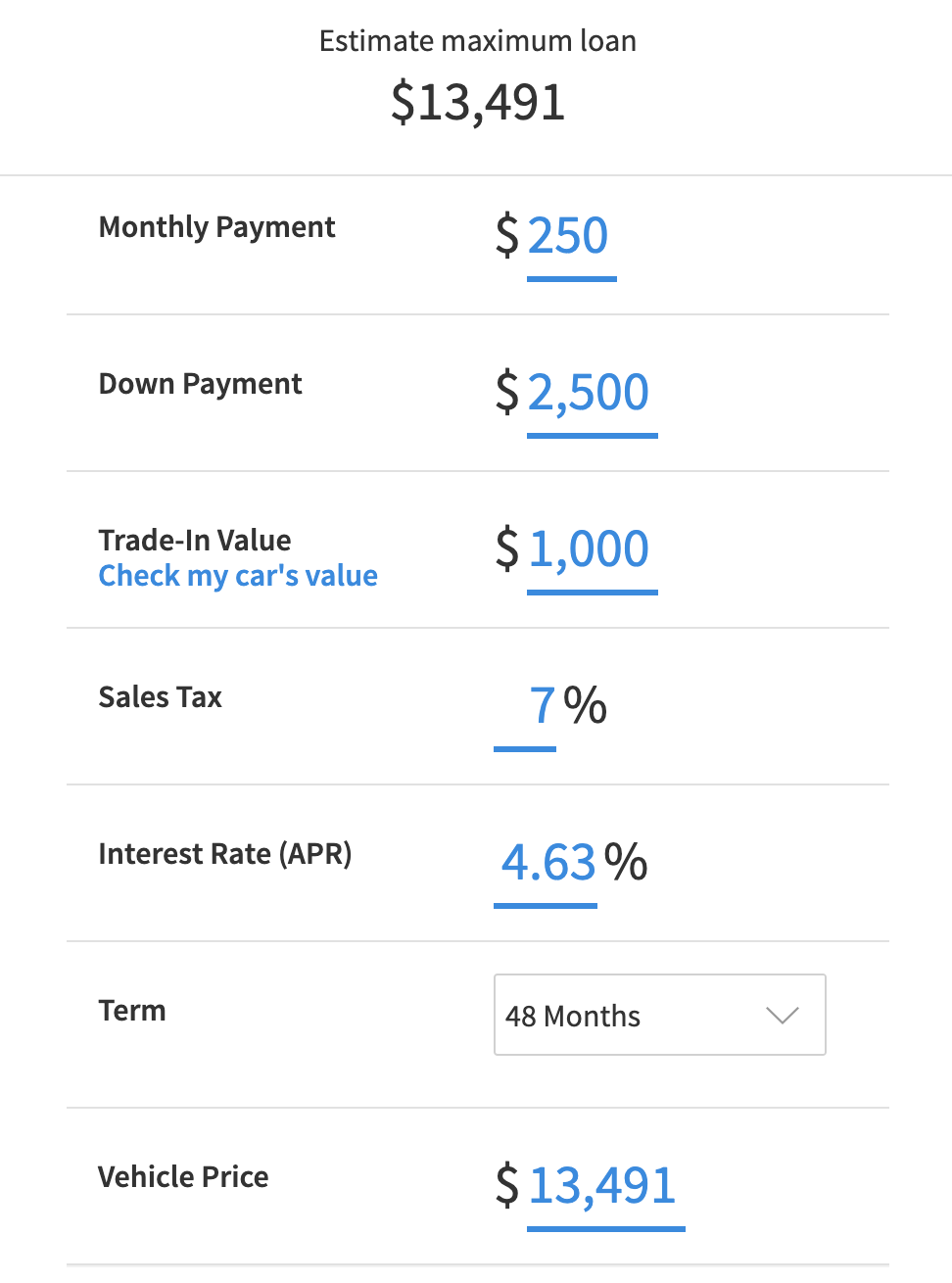

Calculating Affordability

Determine your car budget by considering monthly income and expenses. Factor in insurance, maintenance, and loan payments. Make an informed decision.

Down Payment Calculation

Start with the down payment. This is the amount you pay upfront. A larger down payment reduces your monthly payments. Aim to put down at least 20% of the car’s price. This helps avoid extra costs like insurance. A bigger down payment also gives you better loan terms.

Interest Rates Impact

Interest rates affect your monthly payments. Higher rates mean you pay more over time. Shop around for the best rates. Even a small difference in rate can save you money. Your credit score influences the rate you get. A higher score usually means a lower interest rate.

Loan Term Considerations

Loan term is the length of your car loan. Shorter terms mean higher monthly payments but less interest paid. Longer terms have lower payments but more interest over time. Balance the term with what you can afford monthly. A common loan term is 60 months.

Exploring Different Car Types

New cars often come with the latest features. They also have a warranty. This can give peace of mind. Used cars are usually cheaper. They may not have the newest tech. But they can still be reliable. Make sure to check the car’s history.

Sedans are smaller and often more fuel-efficient. They are easier to park. SUVs are larger and can hold more passengers. Great for families. They may use more gas. Think about your needs before choosing.

Hybrid cars use both gas and electric power. They can save money on fuel. Electric cars run only on batteries. No gas needed. They are better for the environment. Charging stations are becoming more common. Consider your daily travel distance.

Credit: therideshareguy.com

Research And Comparison

Many websites help you compare car prices. You can read reviews and see ratings. Some sites show detailed specs and features. Use these tools to find the best car for your budget.

Read comments from other buyers. They share real experiences. This helps in making a smart decision.

Visiting a dealership allows you to see cars in person. You can talk to salespeople. They provide detailed information. Check different dealerships for the best deals.

Ask about special offers and financing options. This can save you money.

Always test drive a car before buying. This helps you feel the car. Check if it is comfortable. Test the brakes and steering.

Drive on different roads. Make sure the car fits your needs. Pay attention to how it handles.

Negotiating The Best Deal

Research the car’s market value. This helps you know the fair price. Be ready to walk away if the price is too high. Always start with a low offer. Dealerships often expect this. Be polite but firm in your price. Stay calm and confident throughout the negotiation.

Know your car’s trade-in value before going to the dealer. Clean your car and fix small issues. This can increase its value. Get quotes from multiple dealers. This helps you get the best offer. Don’t accept the first offer. Negotiate for a better deal.

Check for available incentives and rebates. These can lower the car’s price. Look for special offers from the manufacturer. Sometimes, dealers have their own discounts. Ask about all available incentives. This can save you a lot of money.

Finalizing Your Purchase

Determine your budget by calculating monthly payments. Consider all costs including insurance, taxes, and maintenance. Make a smart choice.

Paperwork And Contracts

Before driving off, sign all necessary documents. These include the sales contract, loan agreement, and title transfer. Read everything carefully. Make sure all details are correct. Ask questions if confused. Never rush through this step. A mistake could cost you later.

Extended Warranties

Dealers often offer extended warranties. These cover repairs after the original warranty ends. Think about your car’s reliability. Decide if extra coverage is worth the cost. Compare prices from other providers. Extended warranties can be useful. But they are not always necessary.

Post-purchase Tips

Keep your car in good shape. Follow the maintenance schedule. Change oil, check tires, and inspect brakes. Regular care avoids big repair bills. Also, save all service records. These help if you sell the car later.

Frequently Asked Questions

How Much Car Can I Afford On My Salary?

You can afford a car that costs around 10-15% of your annual salary. Use online calculators for a precise estimate.

How Much Should I Spend On A Car If I Make $100,000?

Spend 10-15% of your annual income on a car. For a $100,000 salary, budget $10,000-$15,000.

What Is The 20 4 10 Rule For Buying A Car?

The 20/4/10 rule advises putting 20% down, financing for 4 years, and keeping car expenses under 10% of your income.

What Car Can I Afford On A $60000 Salary?

On a $60,000 salary, you can afford a car between $15,000 and $25,000. Consider financing options and monthly payments.

Conclusion

Determining your car budget is crucial. Focus on your monthly expenses. Consider loan options carefully. Include insurance and maintenance costs. Save for unexpected repairs. Research car prices and compare deals. Always test drive before buying. Seek advice from friends and experts.

Stay within your budget. Enjoy a stress-free car ownership experience. Remember, the right car can enhance your daily life. Make smart financial choices and drive with confidence.