How Much is Car Insurance in Massachusetts: Your Ultimate Guide

Car insurance in Massachusetts varies widely. Many factors influence the cost.

Understanding these factors can help you find better rates. Massachusetts, known for its bustling cities and scenic drives, has unique insurance requirements. Your driving record, age, and type of vehicle all play crucial roles. Where you live in the state also affects your insurance premium.

Comparing different insurance providers can save you money. By knowing what influences your insurance rates, you can make informed decisions. This helps you find the best coverage for your budget. Let’s dive into the details and uncover what you need to know about car insurance costs in Massachusetts.

Introduction To Car Insurance In Massachusetts

Car insurance in Massachusetts varies based on several factors. These include driving history, age, and the type of vehicle. On average, expect to pay around $1,200 annually.

Importance Of Car Insurance

Car insurance is very important. It protects you and others. Without it, you might pay a lot of money. Accidents can happen anytime. Insurance helps cover costs. It gives you peace of mind. Everyone should have it.

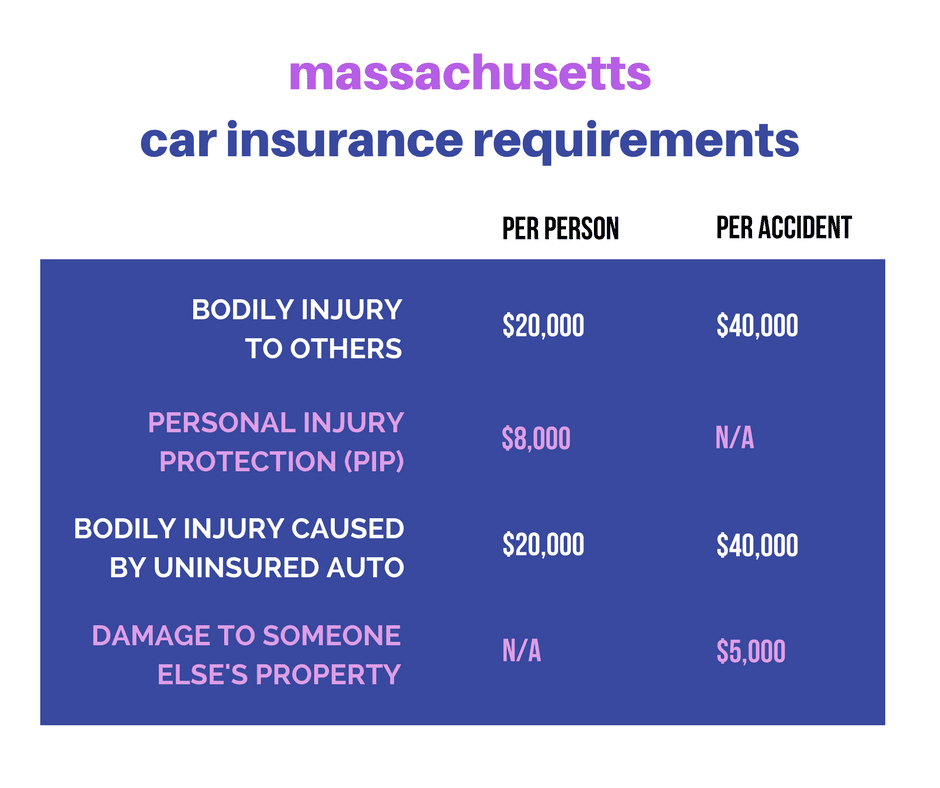

Overview Of Massachusetts Auto Insurance Laws

Massachusetts has strict laws. You must have car insurance. Liability coverage is a must. It covers bodily injury and property damage. There are minimum limits you must meet. Other types of coverage are available. Some are optional, like collision and comprehensive. It is good to know all your options.

Factors Affecting Car Insurance Rates

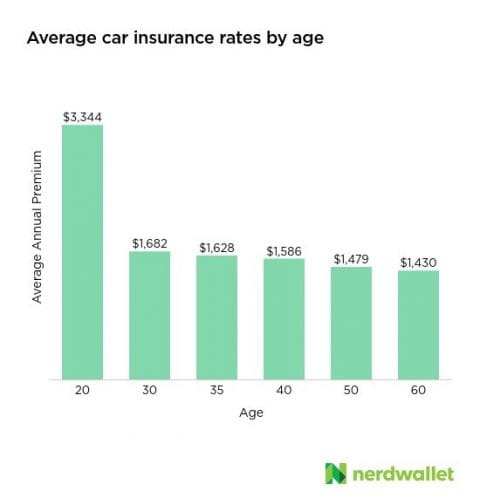

Young drivers often pay more for car insurance. They lack experience. Older drivers with more experience usually get lower rates. Experience helps in avoiding accidents.

Expensive cars cost more to insure. They have higher repair costs. Sports cars can have higher rates too. Safer cars with good ratings may lower your insurance.

A clean record can save you money. Accidents and tickets raise your rates. Safe drivers get discounts. Insurance companies check your record carefully.

Types Of Car Insurance Coverage

Car insurance costs in Massachusetts vary based on coverage types like liability, collision, and comprehensive. Rates depend on factors such as age, driving history, and vehicle type.

Liability Coverage

Liability coverage pays for damage you cause to others. It includes bodily injury and property damage. Bodily injury covers medical costs for injuries. Property damage covers repair costs for damaged property. Massachusetts requires minimum liability coverage. Higher limits offer better protection.

Collision Coverage

Collision coverage pays for your car’s repairs after an accident. It covers collisions with other vehicles or objects. This coverage is optional but recommended. It helps you avoid high repair costs. Deductibles may apply.

Comprehensive Coverage

Comprehensive coverage pays for non-collision damage. This includes theft, fire, and vandalism. It also covers weather damage like hail. Comprehensive coverage is optional but valuable. It protects your car from various risks.

Personal Injury Protection

Personal Injury Protection (PIP) covers medical expenses and lost wages. It pays for your injuries after an accident. Massachusetts requires PIP coverage. It covers you regardless of fault. PIP can also cover passengers in your car.

Credit: www.valuepenguin.com

Average Car Insurance Costs In Massachusetts

The average cost of car insurance in Massachusetts is around $1,200 per year. Costs vary based on many factors. These include your driving record and age. Also, your vehicle type and location affect rates.

Massachusetts car insurance is cheaper compared to the national average. The national average is about $1,500 per year. So, Massachusetts drivers pay less on average.

| City | Average Annual Cost |

|---|---|

| Boston | $1,300 |

| Springfield | $1,100 |

| Worcester | $1,150 |

| Cambridge | $1,200 |

Ways To Lower Your Car Insurance Premiums

Combine car and home insurance. It can save money. Ask your insurer. They often give discounts. Bundling is simple and effective.

Avoid accidents and tickets. Insurance companies like safe drivers. They offer lower rates to them. Drive carefully. It pays off.

Choose a higher deductible. This can lower monthly premiums. Be sure you can pay if an accident happens. It’s a good way to save.

Top Car Insurance Companies In Massachusetts

Massachusetts has many good car insurance companies. Geico, State Farm, and Progressive are popular choices. They offer many plans. Each plan has different coverage options. Prices vary from company to company.

Customer reviews help you choose the right provider. Geico has high ratings for customer service. State Farm gets praise for quick claims. Progressive is known for its discounts. Look at reviews before making a decision.

| Company | Average Annual Rate | Coverage Options |

|---|---|---|

| Geico | $1,200 | Basic, Full, Comprehensive |

| State Farm | $1,250 | Basic, Full, Comprehensive |

| Progressive | $1,300 | Basic, Full, Comprehensive |

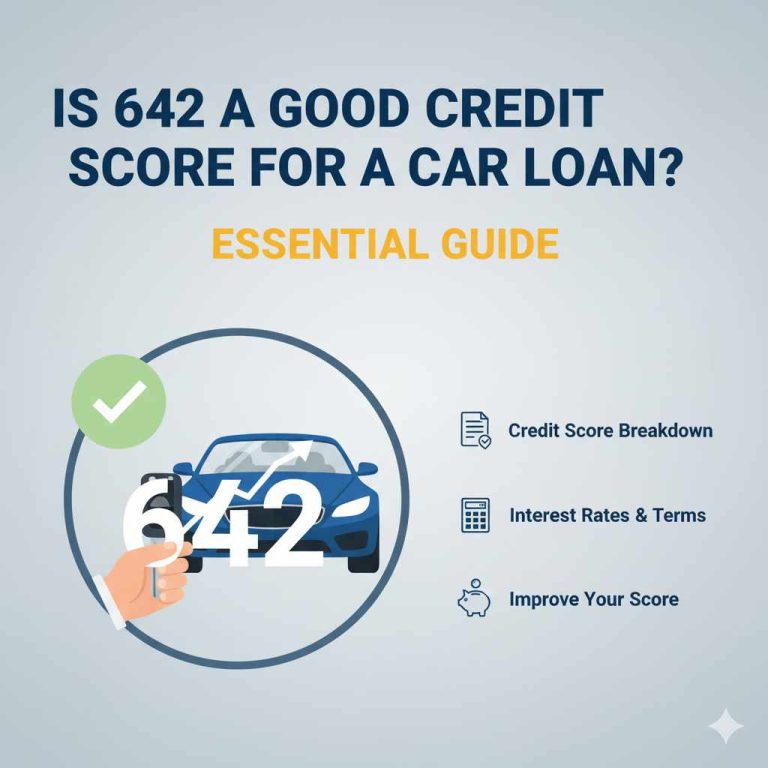

How To Get Car Insurance Quotes

Many websites offer free quotes for car insurance. You can compare different companies. This helps you find the best price. Fill out a form with your personal details. Get a quote in minutes. Some sites show quotes from many insurers. Others focus on one.

Agents can help find the best insurance for you. They know the market well. They can explain different options. An agent might get you special deals. This helps save money. They handle all paperwork. This makes things easier for you.

Always read the fine print. It shows important details. Know what is covered. Also, know what is not covered. Look for hidden fees. Understand the terms. This helps avoid surprises later. Always ask questions if unsure.

Credit: clearsurance.com

Credit: www.plymouthrock.com

Frequently Asked Questions

How Much Is Car Insurance In Ma Monthly?

Car insurance in Massachusetts averages $115 per month. Rates vary based on factors like age, driving history, and coverage level.

Is $200 A Month A Lot For Car Insurance?

$200 a month for car insurance can be considered high. Rates vary based on factors like location, age, and driving history. Always compare quotes to find the best deal.

Is Car Insurance High In Massachusetts?

Yes, car insurance rates in Massachusetts are generally high. Factors include state regulations, traffic density, and accident rates.

How Much Is A 12 Month Car Insurance?

The cost of a 12-month car insurance policy varies. It depends on factors like your age, driving history, and vehicle type. Prices can range from $500 to $2,000 or more. For an accurate quote, compare rates from different insurers.

Conclusion

Understanding car insurance costs in Massachusetts is crucial. Rates vary widely. Factors like age, driving record, and type of car impact premiums. Shop around for the best rates. Compare different providers. Consider coverage options carefully. Discounts can help lower costs.

Regularly review your policy for changes. Stay informed and make wise decisions. This ensures you’re not overpaying. Affordable car insurance is achievable. Follow these tips and save money. Drive safely and protect your finances.