What Percent Down Payment for Car: Unlock Savings Secrets

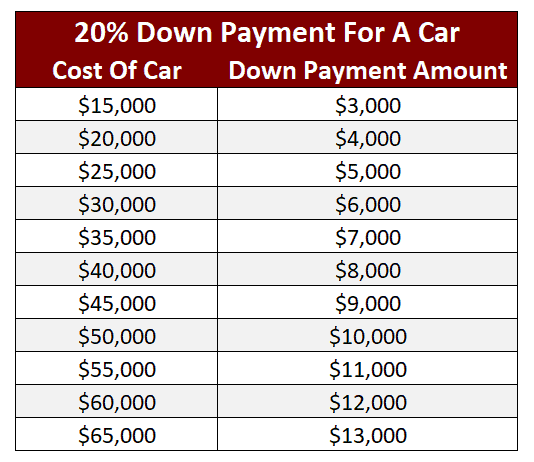

You might wonder, what percent down payment should you make for a car? Generally, experts recommend at least 20%.

Buying a car is a significant financial decision. Making a proper down payment can impact your overall costs. A higher down payment can lower your monthly payments and reduce interest rates. But how much should you really aim to put down?

While 20% is the standard advice, it may not be feasible for everyone. Various factors, such as your financial situation, credit score, and the car’s price, can influence your decision. In this blog post, we will explore different down payment options. This will help you make an informed choice that suits your needs and budget.

Credit: www.thelordlovesyou.com

Importance Of Down Payments

A good down payment shows you have saved money. It can help you avoid high monthly payments. Paying a larger amount upfront means you borrow less. This can lead to lower interest rates. It also makes you a less risky borrower. Saving for a down payment also teaches discipline.

Lenders look at your down payment first. A higher down payment can increase your chances of getting the loan. It shows you are serious and prepared. This can also lead to better loan terms. Better terms mean you pay less over time. It’s easier to get approved with a good down payment.

Typical Down Payment Percentages

Car buyers often pay a down payment of 10% to 20%. This helps lower the loan amount. Paying more upfront can save on interest.

Luxury cars may need a higher down payment. Often around 20% to 30%. Used cars might only need 10%. New cars usually fall in the middle range.

Benefits Of A Larger Down Payment

A larger down payment means you owe less on your car. This leads to smaller monthly payments. Paying less each month can help you save money. You’ll have more cash for other needs. It makes budgeting easier. You can plan better for your future.

Putting down more money often means lower interest rates. Lenders view larger down payments as less risky. This can lead to better loan terms. Lower interest rates mean you pay less over time. This saves you money in the long run.

Risks Of A Smaller Down Payment

A smaller down payment means a larger loan. This leads to higher monthly payments. The interest rate can also be higher. You might end up paying much more over time. Lenders see a smaller down payment as risky. They charge more to protect themselves. This can put a strain on your budget.

Negative equity happens when your car is worth less than the loan. A smaller down payment can make this happen faster. Cars lose value quickly. With a big loan, you owe more than the car’s value. Selling the car won’t cover the loan. This can be a big problem if you need to sell. You may have to pay the difference out of pocket.

Calculating The Right Down Payment

Start by looking at your savings. How much can you spare without hurting your budget? Most experts suggest at least 20%. This can lower your monthly payments. It also reduces interest. Some might afford more. It’s good if you can. Higher down payments mean less debt.

Use a down payment calculator. It helps find the right amount. Enter the car price. Then, add your savings. The calculator shows the ideal down payment. It also tells you about monthly payments. You see how much you save in interest. Understanding these numbers helps you make better decisions.

Saving For A Down Payment

Setting clear goals helps you save faster. Decide how much money you need. Stick to this goal. Write it down. Track your progress. It is very important.

Make saving a habit. Save a small amount every week. Cut unnecessary expenses. Use a budget app. This helps you see where money goes. Avoid impulse buys. Every little bit helps.

Financing Options

Dealerships often offer special deals on car loans. They may have low-interest rates or special promotions. The process is quick and easy. You can apply for a loan at the dealership. They handle all the paperwork. But, be careful. Some deals may have hidden fees. Always read the terms and conditions.

Banks offer traditional car loans. These loans usually have fixed interest rates. You can go to your bank and apply for a loan. Banks may require a good credit score. They may also ask for proof of income. Bank loans can be a safe option. You can trust the bank. But, the process might take longer than dealership financing.

Credit: www.moneysmartguides.com

Government Programs And Incentives

First-time buyer programs help new car buyers. These programs offer low down payments. Sometimes, they offer zero down payments. These programs make buying a car easier. They often provide lower interest rates. This makes monthly payments smaller. It helps new buyers save money. It can also improve credit scores.

Tax credits can lower the cost of a car. They reduce the amount of tax you owe. Some electric cars qualify for tax credits. This can save you thousands of dollars. These credits make green cars more affordable. They also help the environment. Check if your car qualifies for tax credits. It can make a big difference in cost.

Credit: www.media4math.com

Frequently Asked Questions

How Much Should I Put Down For A 30k Car?

A 20% down payment is recommended for a $30,000 car. This equals $6,000.

Is It Smart To Put 50% Down On A Car?

Putting 50% down on a car can be smart. It reduces monthly payments and interest, saving money long-term.

Do You Have To Put 20% Down On A Car?

No, you do not have to put 20% down on a car. Down payment requirements vary by lender. Some may accept less, while others may require more based on credit score and other factors.

What Percent Is A Typical Down Payment On A Car?

A typical down payment on a car is around 10% to 20% of the vehicle’s purchase price.

Conclusion

Choosing the right down payment for your car is crucial. A larger down payment reduces monthly payments. It also lowers the interest rate. Saving up beforehand helps you avoid financial strain. Aim for a down payment of at least 20%.

This ensures better financing options. Ultimately, it’s about balancing your budget and needs. Consider your financial situation carefully. Make an informed decision. Happy car shopping!