Why Did My Car Insurance Go Up State Farm: Uncovering the Reasons

Your car insurance went up with State Farm. You might be wondering why.

Several factors can cause an increase in your premium. Understanding why your insurance costs more can be confusing. Sometimes, it feels like rates go up for no reason. But, there are many reasons behind these changes. It could be due to your driving record, the value of your car, or even changes in the insurance market.

Knowing these reasons helps you better manage your costs. This blog post will explore the common factors influencing your State Farm car insurance rate. You’ll gain insight into what might have caused the increase and how you can address it.

Changes In Personal Circumstances

Accidents or traffic tickets can raise your insurance. Even minor violations can impact rates. Safe driving is crucial. Always follow traffic rules. Drive responsibly to avoid penalties. Your driving record is important.

Insurance companies check your credit score. A low score can increase premiums. Pay bills on time. Reduce debts. Improve your credit score for better rates. Keep track of your credit report. Stay financially responsible.

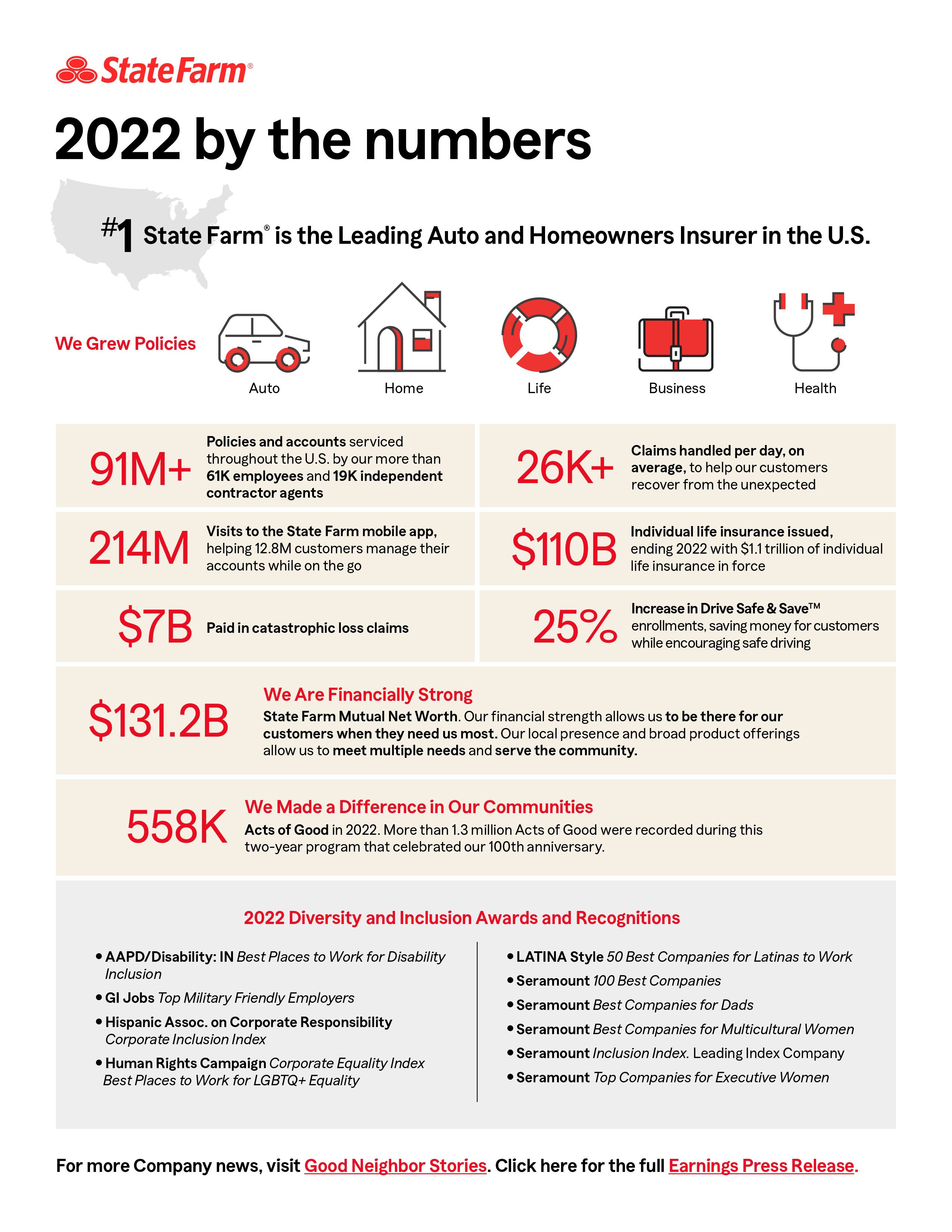

Credit: newsroom.statefarm.com

Vehicle-related Factors

Vehicle-related factors can cause your State Farm car insurance to increase. Changes in your car’s age, model, or mileage can impact premiums.

New Car Purchase

Buying a new car might cause your insurance to increase. New cars often cost more to repair or replace. Insurance companies may charge more for new cars. They can also be stolen more often. This raises the risk for the insurer. Higher risk means higher premiums.

Car Modifications

Changing your car can also affect your insurance. Adding new parts might make your car more expensive to fix. Modifications can also make your car more attractive to thieves. Increased risk leads to higher insurance costs. Even small changes might have an impact.

Location-based Influences

Location-based factors can lead to higher car insurance rates with State Farm. Moving to areas with more accidents or crime often raises premiums. Local laws and repair costs also impact insurance prices.

Moving To A New Area

Changing your address can affect your car insurance rates. New areas may have different risks. A safer neighborhood might lower costs. A high-crime area can raise them. Insurance companies look at local data. This helps them decide your premium. They assess factors like theft rates and road conditions. Even weather patterns matter. Areas with more accidents can be pricier. Always update your address with your insurer. It ensures you get the right rate.

Local Accident Rates

Local accident rates impact your car insurance. More accidents in your area can increase premiums. Insurers see high-risk zones as costly. They need to cover more claims. Fewer accidents mean lower rates. Safe driving areas are cheaper. Your insurer uses local data to set prices. They consider past accident records. Busy streets and highways often mean higher rates. Rural areas might cost less. Always check local accident trends when moving.

Credit: www.statefarm.com

Policy Adjustments

Changes in your coverage can increase your car insurance cost. Adding more coverage types, like comprehensive or collision, can raise your premium. Reducing your coverage may lower your cost, but it also means less protection. More coverage means more security, but also higher prices.

A lower deductible means you pay less out of pocket in an accident. But, it also means higher premiums. A higher deductible can save you money each month. But, you pay more if you have a claim. Balancing your deductible and premium is key to managing costs.

Insurance Market Dynamics

The insurance industry is always changing. New technology and data can make prices go up. Accidents and claims also affect prices. More accidents mean higher costs. Natural disasters like storms can raise costs too. All these things make insurance rates change.

Each state has its own rules for insurance. Laws can change, making prices go up. Some states have more accidents than others. This can affect your rates. State Farm must follow these rules. Your location can make a big difference. Moving to a new state might change your rate.

Claims History

Recent claims can increase your insurance cost. Insurance companies see you as a higher risk. This is true even for small claims. The more claims you make, the higher your premium.

Making claims often can also raise your rates. Insurance providers track how often you claim. Frequent claims suggest higher risk. Even if claims are small, they still count. Being careful and safe can help keep costs down.

Discounts And Benefits

Sometimes you lose discounts over time. For example, a safe driver discount might end. It happens if you get a ticket or have an accident. Other discounts, like bundling home and auto, might be lost if you change policies. Losing a good student discount is also common. This happens when a student graduates or their grades drop. Even small changes can impact your rate.

New discounts can lower your premium. State Farm offers many options. For instance, you might get a discount for having a new car. There is also a discount for low annual mileage. Safe driver programs can help too. Sign up and save money by driving safely. You might also get a discount for taking a defensive driving course. Ask your agent about all the new discounts available.

Credit: www.statefarm.com

Frequently Asked Questions

Why Did My State Farm Car Insurance Increase?

Several factors can cause an increase, including accidents, traffic violations, and changes in your credit score.

Does My Driving Record Affect My Insurance Rate?

Yes, a poor driving record with accidents or tickets can lead to higher premiums.

Do Insurance Rates Change Based On Location?

Yes, moving to an area with higher accident rates or theft can increase your insurance costs.

Can My Credit Score Impact My Car Insurance?

Absolutely, a lower credit score can result in higher premiums as it indicates a higher risk to insurers.

Conclusion

Understanding why your car insurance increased is crucial. Many factors influence rates. Changes in your driving record, claims, or policy updates may impact costs. Compare policies and ask questions. Staying informed helps you manage expenses better. Seek advice from State Farm or other insurers.

This knowledge aids in making smart decisions. Keep your policy and driving record in good shape. It can help lower your premiums. Stay proactive and aware.