Can I Insure a Car Without Registration? Essential Guide

You cannot insure an unregistered car directly. Insurance needs vehicle details.

Car insurance is crucial for safety and legal reasons. But what happens when your car isn’t registered yet? Many wonder if they can still get insurance. This topic is essential for new car owners or those transitioning vehicles. Understanding the link between registration and insurance is vital.

In this post, we’ll explore the process, exceptions, and solutions. You’ll learn if it’s possible to navigate this scenario and the steps to take. Stay informed and prepared for any situation regarding your car’s registration and insurance needs. Let’s dive into the details and answer your questions.

Credit: goodcar.com

Insuring An Unregistered Car

Insuring an unregistered car can be complicated. Some states do not allow it. Fines may occur if caught. Check local laws. Some places have strict rules. This ensures only registered cars are on the road. Following the law keeps everyone safe.

Insurance companies have different rules. Some may insure an unregistered car. Others will not. Temporary insurance might be an option. This is for short periods. It helps until the car is registered. Always ask your insurance provider. They will give you the best advice. Each company has unique policies.

Temporary Insurance Options

Short-term car insurance gives quick coverage. This is useful for a few days or weeks. No long-term commitment is needed. It can be great for rental cars. Or when borrowing a friend’s car.

Provisional insurance is easy to get. It offers flexibility. You can get it fast. Often within minutes. It is also affordable. Only pay for what you need. This type of insurance can be a good option for emergencies.

Requirements For Insuring Without Registration

Insuring a car without registration can be possible. You need proof of ownership. This can include a bill of sale. Title of the car also works. Proof shows you own the car.

Insurance companies may ask for more documents. A valid driver’s license is often required. They may also need inspection reports. Sometimes, a VIN verification is needed. Always check with your insurance company.

Risks Of Driving Without Registration

Driving without registration can lead to legal penalties. Police may stop you. You could face fines or even jail time. Your car might be impounded. This means you lose your car. It is against the law to drive without proper registration.

Insurance companies will not cover unregistered cars. If you have an accident, you pay for all damages. No coverage for you or others involved. Your policy becomes invalid. This can cost you a lot of money. Your rates might increase later. Always keep your car registered to avoid these issues.

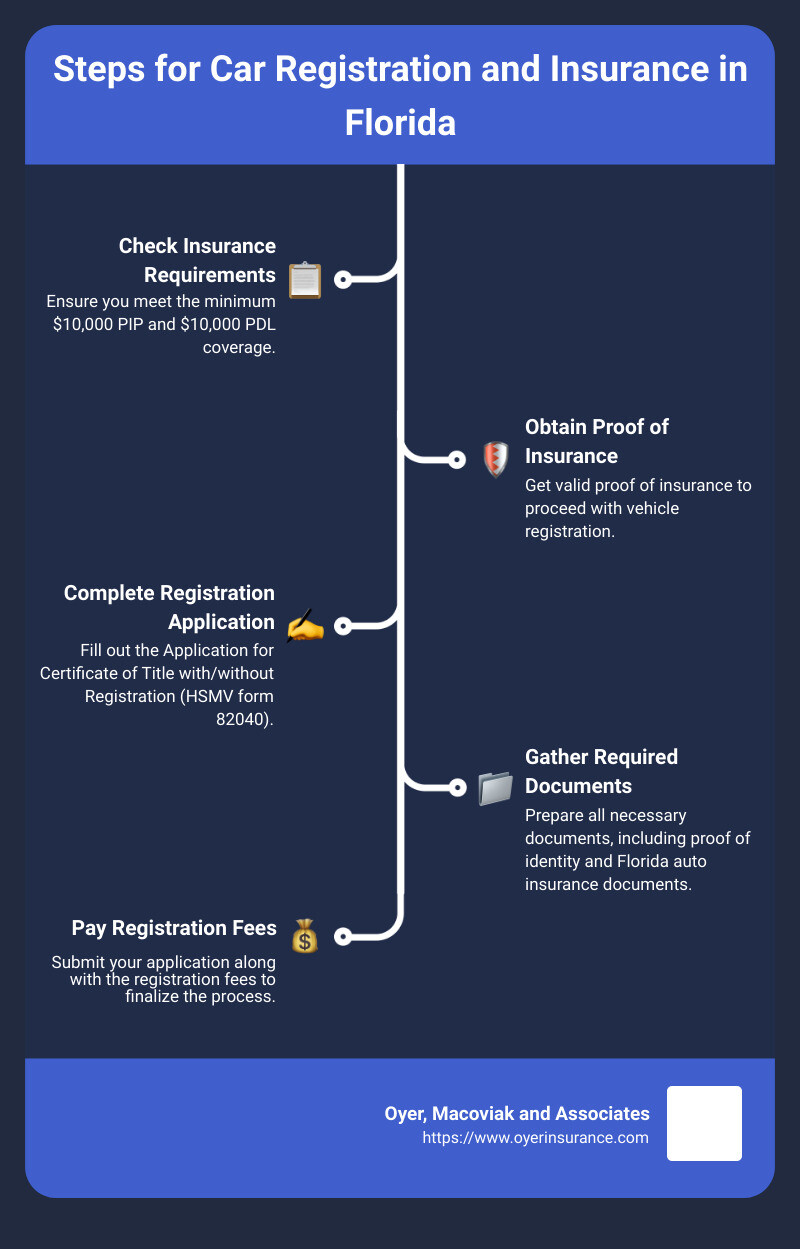

Steps To Register Your Car

First, collect all required papers. You need the car title. Also, bring your ID. Proof of insurance is important too. Check for extra papers needed in your state.

Next, go to the DMV office. Bring all your documents. Fill out the forms they provide. Pay the registration fee. Wait for your registration to be processed.

Credit: www.kbb.com

Alternatives To Traditional Insurance

Non-owner car insurance is for people who drive but do not own a car. It helps you if you need to borrow or rent a car. You get coverage for liability. This means if you cause an accident, it helps pay for damage. It also covers injuries to others.

Usage-based insurance tracks your driving habits. It uses a device or an app. Safe drivers can save money. It looks at things like mileage and speed. It is a good choice if you drive less often. It gives you more control over your insurance cost.

Consulting With Insurance Agents

Ask about temporary insurance options. This can be useful while waiting for car registration. Find out if the agent needs any proof of ownership. This might include a bill of sale or a title. Ask if there are any restrictions on the coverage. Knowing these can save you from surprises later.

Read the policy terms carefully. Look for details about the coverage period. Ask about any exclusions. These are things not covered by the policy. Make sure you understand the premium. This is the amount you pay for the insurance. Check if the policy can be canceled or changed easily.

Comparing Insurance Quotes

Insurance companies look at many factors. Car age and type matter a lot. Driver’s age and driving history also affect premiums. Location is important too. City drivers pay more. Car usage, like daily or occasional, changes the price. Safety features can lower your premium. Always compare these factors.

Start by gathering quotes. Compare them side by side. Look for the best value, not just the cheapest. Check for hidden fees. Read reviews from other customers. Choose a company with good customer service. Make sure coverage fits your needs. Always ask questions if unsure.

Credit: www.oyerinsurance.com

Frequently Asked Questions

Can I Insure A Car That Isn’t Registered?

Yes, you can insure a car that isn’t registered. However, some insurers may have specific requirements or limitations. Always check with your insurance provider for details.

What Are The Requirements For Auto Insurance In Texas?

Texas requires minimum liability coverage of 30/60/25. This means $30,000 per person, $60,000 per accident, and $25,000 for property damage.

Does An Unregistered Car Affect Insurance?

An unregistered car can affect your insurance coverage. Many insurers won’t cover unregistered vehicles. Ensure your car is registered to avoid issues.

Can You Get Car Insurance Without A Car Registration?

No, you cannot get car insurance without a car registration. Insurance companies require vehicle registration to provide coverage.

Conclusion

Insuring a car without registration is challenging but possible. Some insurers offer coverage. Temporary insurance can help in certain situations. Understand your local laws first. Talk to insurance agents for advice. They can guide you through the options. Always check the requirements and policies.

This ensures you get the right coverage. Remember, driving without insurance is risky. Protect yourself and others on the road. Safe driving starts with proper coverage. Don’t overlook the details. It’s crucial for peace of mind. Keep your vehicle and finances secure.