Do Men Pay More for Car Insurance?: Uncover the Truth

Yes, men often pay more for car insurance. This is due to various risk factors.

Car insurance rates can seem like a mystery. Many people wonder why men might pay higher premiums. Insurance companies base rates on statistics and risk analysis. Studies show that men, especially young men, are involved in more accidents. They also tend to engage in riskier driving behaviors.

This leads to higher claim rates. Therefore, insurers charge men more to cover these potential costs. Understanding these factors can help you see why rates differ. Let’s dive deeper into the reasons behind these insurance practices.

Credit: www.coveragecat.com

Gender And Car Insurance Rates

Men often pay higher car insurance rates due to higher accident statistics. Insurance companies base rates on risk factors.

Historical Trends

Historically, men often paid more for car insurance. This is because men were seen as more risky drivers. Insurance companies believed men had more accidents. They also thought men drove more miles. This led to higher premiums for men. Women were seen as safer drivers. They had fewer accidents and drove less. This resulted in lower premiums for women.

Current Statistics

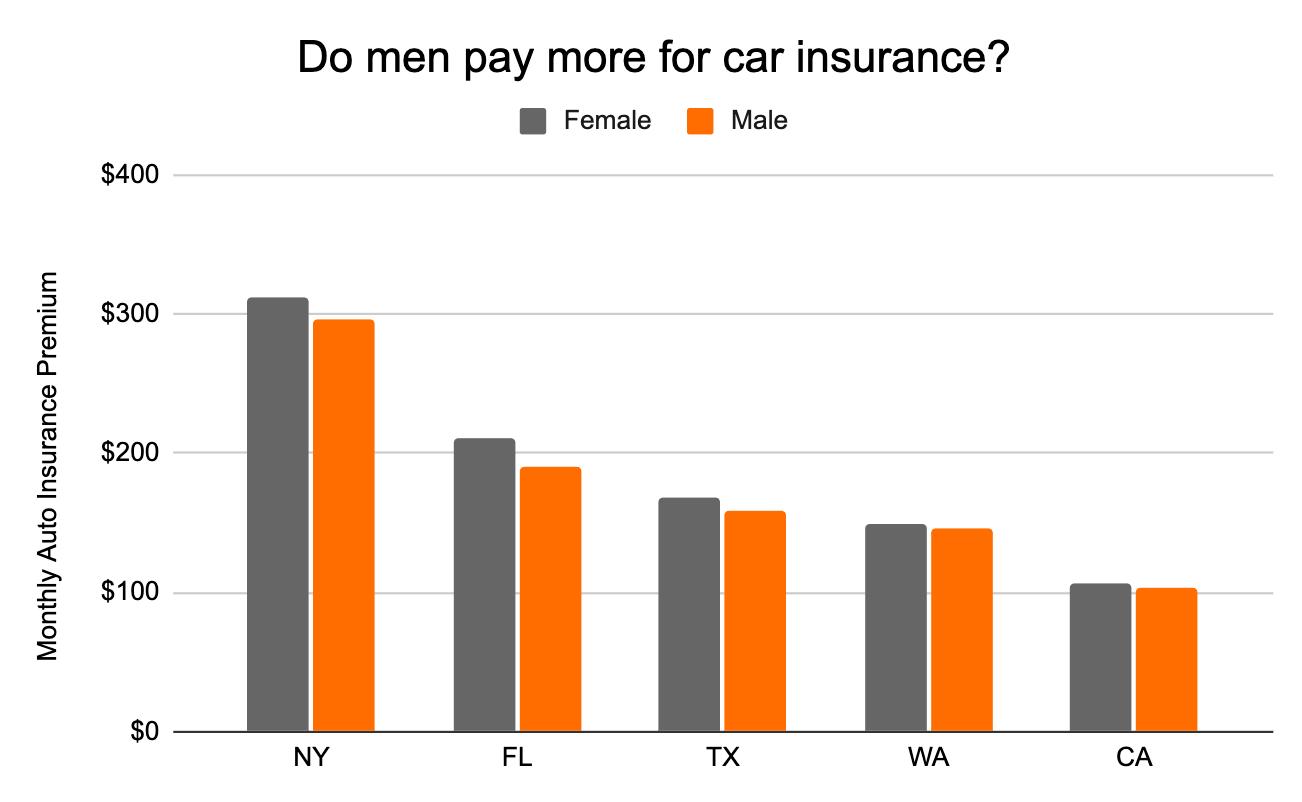

Today, the gap between men and women is smaller. Men still pay more in many cases. Current statistics show men have higher accident rates. They also tend to drive more expensive cars. These factors lead to higher rates. Women still pay less, but the difference is not as big as before. Insurance companies now use more data. This helps them set fair rates for everyone.

Factors Influencing Car Insurance Costs

Young drivers often pay more. They lack experience. Older, experienced drivers get lower rates. Insurance companies see them as safer. Age plays a big role in costs.

Accidents and tickets raise insurance costs. Clean records get discounts. Insurance companies check your record. Safe driving can save you money. A clean record is important.

Expensive cars cost more to insure. Sports cars have higher rates. Family cars are cheaper. Vehicle type affects insurance costs. Choose wisely.

The Role Of Gender In Risk Assessment

Men often pay more for car insurance due to statistical data showing higher accident rates. Insurance companies use this data to assess risk levels and set premiums accordingly. Understanding gender roles in risk assessment helps explain these pricing differences.

Accident Rates

Men are involved in more accidents than women. Statistics show men take more risks while driving. This often leads to higher accident rates. Insurance companies consider this when setting premiums. Men, especially young men, may pay more. Driving behavior affects accident rates and insurance costs.

Claim Frequency

Men file more claims compared to women. Higher claim frequency results in higher premiums. Insurance companies view men as higher risk. This is why men might pay more for car insurance. Fewer claims mean lower premiums for women. Gender impacts insurance rates significantly.

Credit: www.capitalone.com

Insurance Company Policies

Insurance companies use risk models to determine rates. Men often fall into higher-risk categories. They are seen as more likely to take driving risks. This can lead to higher premiums for men. These models look at accident rates and claims data. Men, especially young men, have more accidents. This data impacts the pricing.

Companies have different pricing strategies. They may charge men more due to risk factors. Age also affects the pricing. Younger men often have higher rates. As men get older, rates can decrease. But still, men might pay more than women. Companies use these strategies to cover potential losses. They analyze driving behavior and claim history. All these factors play a role in the final price.

Legal Regulations

Men often face higher car insurance rates due to statistical data showing they have more accidents. Insurance companies consider men riskier drivers. This leads to increased premiums.

State Laws

State laws can affect car insurance rates. Some states do not allow gender-based pricing. Other states have different rules. In these states, men might pay more. Insurance companies follow state rules strictly. This can lead to differences in rates. Understanding state laws helps in knowing your rates.

International Comparisons

Car insurance rates vary by country. In some countries, men pay more. In others, rates are equal. This depends on local laws. Insurance companies adjust rates based on risks. Different countries have different risks. This affects how much men pay.

Credit: www.valuepenguin.com

Case Studies

Male drivers often face higher car insurance costs. Studies show young males under 25 pay the most. This group is seen as high-risk by insurers. They often have more accidents. Premiums can go down with age. Safe driving records help too. Men in their 30s and 40s tend to pay less.

Female drivers generally pay less for car insurance. They are seen as lower risk. Statistics show they have fewer accidents. Women also receive fewer traffic tickets. This helps keep premiums low. Mature women often benefit from even lower rates. Safe driving is always rewarded.

Consumer Advocacy

Fair pricing campaigns aim to make car insurance costs equal. Men often pay more. These campaigns fight this unfair practice. They raise awareness about the issue. They also urge lawmakers to create fairer laws.

To challenge high rates, gather your data. Compare it with others. Contact your insurance company. Ask for explanations. Request a review of your rate. If needed, file a formal complaint. Seek help from consumer advocacy groups. They can offer advice and support. This process may lower your insurance costs.

Tips For Reducing Car Insurance Costs

Many insurance companies give discounts for safe driving. Avoiding accidents can lower your costs. Good driving records matter. Following traffic rules helps. Some insurers use tracking devices. These track your driving habits. Safe drivers save money.

Shop around before buying insurance. Different companies offer different prices. Compare quotes from multiple insurers. Look for best deals. Use online tools to compare. Always read customer reviews. Check the coverage each plan offers. This helps you find affordable insurance.

Frequently Asked Questions

Do Men Have Higher Car Insurance Rates?

Yes, men typically pay more for car insurance. Statistics show that men, especially young men, are involved in more accidents.

Why Do Men Pay More For Car Insurance?

Insurance companies consider men riskier drivers. Men, particularly younger ones, tend to have higher accident rates and more traffic violations.

Are Young Men Charged The Most For Car Insurance?

Young men generally face the highest car insurance rates. They are statistically more likely to be involved in accidents.

Does Age Affect Men’s Car Insurance Rates?

Yes, age significantly affects men’s car insurance rates. Younger men pay higher premiums, which typically decrease as they age.

Conclusion

Men often pay more for car insurance. This difference stems from various factors. Young men, especially, face higher rates. Driving habits and accident statistics play a role too. Understanding these factors helps in making informed decisions. Comparing rates from different insurers can save money.

Awareness of discounts and safe driving can also lower costs. Always stay informed and proactive. This way, you ensure the best possible rate.