Do You Have to Pay Insurance on a Leased Car: Essential Guide

Yes, you have to pay insurance on a leased car. Leasing companies require it.

This ensures their investment is protected. Leasing a car comes with responsibilities. One major responsibility is maintaining insurance. Leasing companies need proof of insurance before you drive off the lot. This means you must have comprehensive and collision coverage. These coverages protect you and the leasing company in case of damage or theft.

In this blog, we will discuss why insurance is needed for leased cars. We will also cover the types of insurance required and the costs involved. Understanding these details will help you make informed decisions when leasing a car. Let’s dive in and explore the world of leased car insurance.

Credit: www.kryderlaw.com

Insurance Basics For Leased Cars

A lease agreement is a contract. You must follow its rules. These rules often include insurance requirements. It is important to read the lease agreement carefully. This helps you understand what insurance you need.

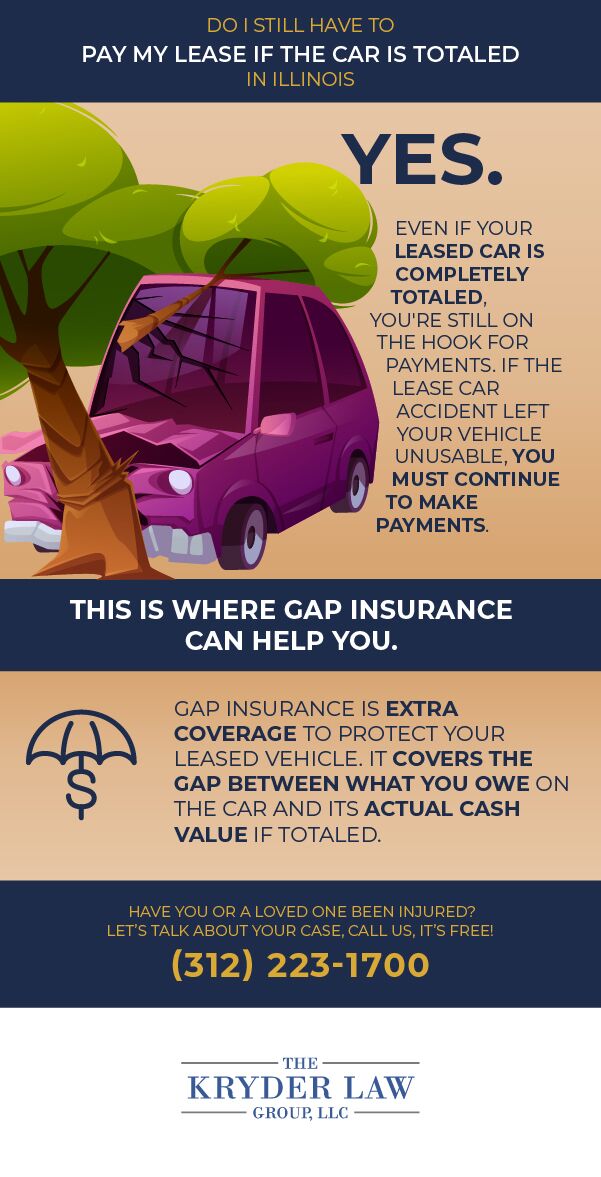

Leased cars often need full coverage insurance. This includes collision and comprehensive coverage. Collision covers damage from accidents. Comprehensive covers damage from theft, fire, and more. Leasing companies also require gap insurance. This covers the difference if the car is totaled and you owe more than its value.

Credit: www.eautolease.com

Why Insurance Is Mandatory

Insurance is necessary to protect the lessor’s investment. The lessor owns the car. They want to make sure it is safe. If an accident happens, repairs can be expensive. Insurance helps cover these costs.

Protecting The Lessor’s Investment

The lessor does not want to lose money. Insurance ensures they do not pay for damages. This helps maintain the car’s value. It also ensures the car is in good condition when returned.

Legal Requirements

Most states have laws about car insurance. These laws require all cars to be insured. Leased cars are not different. You must have insurance to drive legally. This protects everyone on the road. It also makes sure all damages are covered.

Types Of Insurance Coverage

Liability insurance covers costs if you cause an accident. It pays for damage to others’ property. It also covers their medical bills. This insurance does not cover your car. Most states require it by law.

Comprehensive coverage pays for non-accident damage. This includes theft, fire, or natural events. Collision coverage pays for damage from a crash. Both types cover your car. Leasing companies often require these coverages. They protect the car and you.

Gap Insurance Explained

GAP Insurance covers the difference between the car’s value and what you owe on it. If your car gets totaled or stolen, the regular insurance pays for the car’s value. This amount might be less than what you owe. GAP Insurance pays the rest. This helps you avoid paying out of pocket.

GAP Insurance protects you from paying extra money. It saves you from big bills if your car is lost. It covers the gap between the car value and the loan. This keeps your finances safe. Having GAP Insurance means peace of mind. You know you are covered.

Costs Of Insuring A Leased Car

Insuring a leased car can be expensive. Many factors affect the cost. The car’s value is one factor. Expensive cars cost more to insure. The driver’s age and driving record also matter. Younger drivers often pay more. Drivers with accidents or tickets also pay more. Location is another factor. Some areas have higher rates. The coverage type you choose affects cost too. Full coverage costs more than basic coverage.

Compare quotes from different companies. This helps find the best rate. Ask about discounts. Many companies offer them. Keeping a clean driving record helps too. Avoid tickets and accidents. Consider raising your deductible. This can lower your premium. Drive less. Some companies offer discounts for low mileage. Finally, consider bundling insurance policies. This can save you money.

How To Choose The Right Insurance

Check different insurance providers. Look at their plans. Compare their prices. Some may offer better deals. Others may have more coverage. Read reviews. See what other people think. This can help you decide.

Look at what each plan covers. Some plans cover more. Others cover less. Think about your needs. Do you want full coverage? Or just basic? Consider the cost too. Sometimes, more coverage costs more. Make sure you get the best deal.

Steps To Insure Your Leased Car

First, collect all the required documents. This includes your driver’s license, the lease agreement, and the vehicle identification number (VIN). You also need details about your driving history. Make sure all information is correct. This will help speed up the process.

Next, get your current insurance policy details. This helps to compare rates. Gather information about any add-ons you might want. Always keep your contact information handy. This ensures smooth communication.

Contact an insurance provider to start the process. Provide them with the information you collected. They will ask for your personal details and vehicle information.

Choose the coverage options that suit your needs. Make sure to understand each option. Ask questions if you are unsure. Once you choose, complete the forms they provide. This can often be done online.

Pay the initial premium to activate the policy. Keep a copy of your insurance card in the car. Ensure you know the policy number and contact details of your insurer. You are now insured!

Credit: www.insurancebusinessmag.com

Consequences Of Not Insuring A Leased Car

Failing to insure a leased car can lead to serious issues. You may face penalties and fees. These can be quite high. The leasing company will not be happy. They might fine you a lot. Sometimes, they might cancel your lease. Then, you have to return the car. This is not good for your record. It can make leasing again hard.

Without insurance, you might break the lease terms. This is a big problem. The leasing company can take back the car. They may sue you for damages. Your credit score might drop. This makes it hard to get loans. Insurance is a must for a leased car. It keeps you and the car safe. Always have it to avoid trouble.

Frequently Asked Questions

Do You Need Insurance On A Leased Car?

Yes, insurance is required on a leased car. Leasing companies typically require full coverage insurance, including liability, collision, and comprehensive coverage.

What Type Of Insurance Is Required For A Leased Car?

Leased cars usually require full coverage insurance. This includes liability, collision, and comprehensive coverage, ensuring protection for both you and the leasing company.

Is Insurance More Expensive For A Leased Car?

Insurance for a leased car can be more expensive. This is because leasing companies require higher coverage limits and lower deductibles.

Can You Lease A Car Without Insurance?

No, you cannot lease a car without insurance. Leasing companies mandate full coverage insurance to protect their investment in the vehicle.

Conclusion

Paying insurance on a leased car is essential. It protects you financially. Leasing companies require it. Insurance provides peace of mind. It covers accidents and damages. Always check your lease agreement. Ensure you meet the insurance requirements. This will avoid penalties.

Stay informed and drive safely.