Does Car Insurance Affect Credit Score? Uncover the Truth

No, car insurance does not directly affect your credit score. However, your credit score can influence your car insurance rates.

Understanding this relationship is crucial. Car insurance companies often check your credit score to determine your premium. A good credit score can lead to lower rates, while a poor score may increase your costs. This practice is rooted in the belief that individuals with higher credit scores are less likely to file claims.

So, while your car insurance payments do not change your credit score, your credit history can impact how much you pay for coverage. This blog post will explore how your credit score interacts with car insurance and why it matters. Keep reading to learn more about the connection between your credit and your car insurance rates.

Introduction To Car Insurance And Credit Score

Car insurance helps cover costs from car accidents. It protects you and others. It can pay for damages and medical bills. Many states require it by law. There are different types of coverage. Some cover only damages to others. Others cover damages to your own car too. Choosing the right plan is important.

Credit scores show how well you handle money. They range from 300 to 850. Higher scores mean you are good with money. Lower scores can make loans more expensive. Paying bills on time helps your score. Missing payments can hurt it. Lenders use these scores to decide on loans. Even renting a home can depend on your score.

Credit: www.loqbox.com

How Car Insurance Works

There are different types of car insurance. Liability insurance covers damages to others. Collision insurance pays for your car repairs after an accident. Comprehensive insurance covers non-collision damages like theft. Personal injury protection helps with medical bills. Uninsured motorist coverage protects if the other driver has no insurance. Each type offers unique protection. Having the right insurance is important.

Car insurance rates depend on many factors. Age and driving experience play a big role. Location can affect rates too. Type of car matters; newer cars often cost more to insure. Driving history is important; more accidents usually mean higher rates. Credit score can also impact rates. A higher score often means lower costs. Coverage level chosen also influences the price. Each factor can change your final rate.

Credit Score Basics

A credit score has several parts. Payment history is the biggest part. It shows if you pay bills on time. Credit utilization is next. It looks at how much credit you use. Length of credit history matters too. It shows how long you have had credit. New credit is also a part. It counts how many new accounts you have. Credit mix is the last part. It shows the types of credit you have.

Credit scores are very important. They help lenders decide if you can get loans. A high credit score means you are good with money. It can get you better loan terms. A low credit score means you may be risky. It can make loans more costly. Good credit helps with more than loans. It can help with renting a home or getting a job.

Link Between Car Insurance And Credit Score

Insurers look at your credit score. They believe it shows how reliable you are. A good credit score means you are less risky. They think you will file fewer claims. A bad credit score means you are more risky. They think you will file more claims. So, they use it to set your rates.

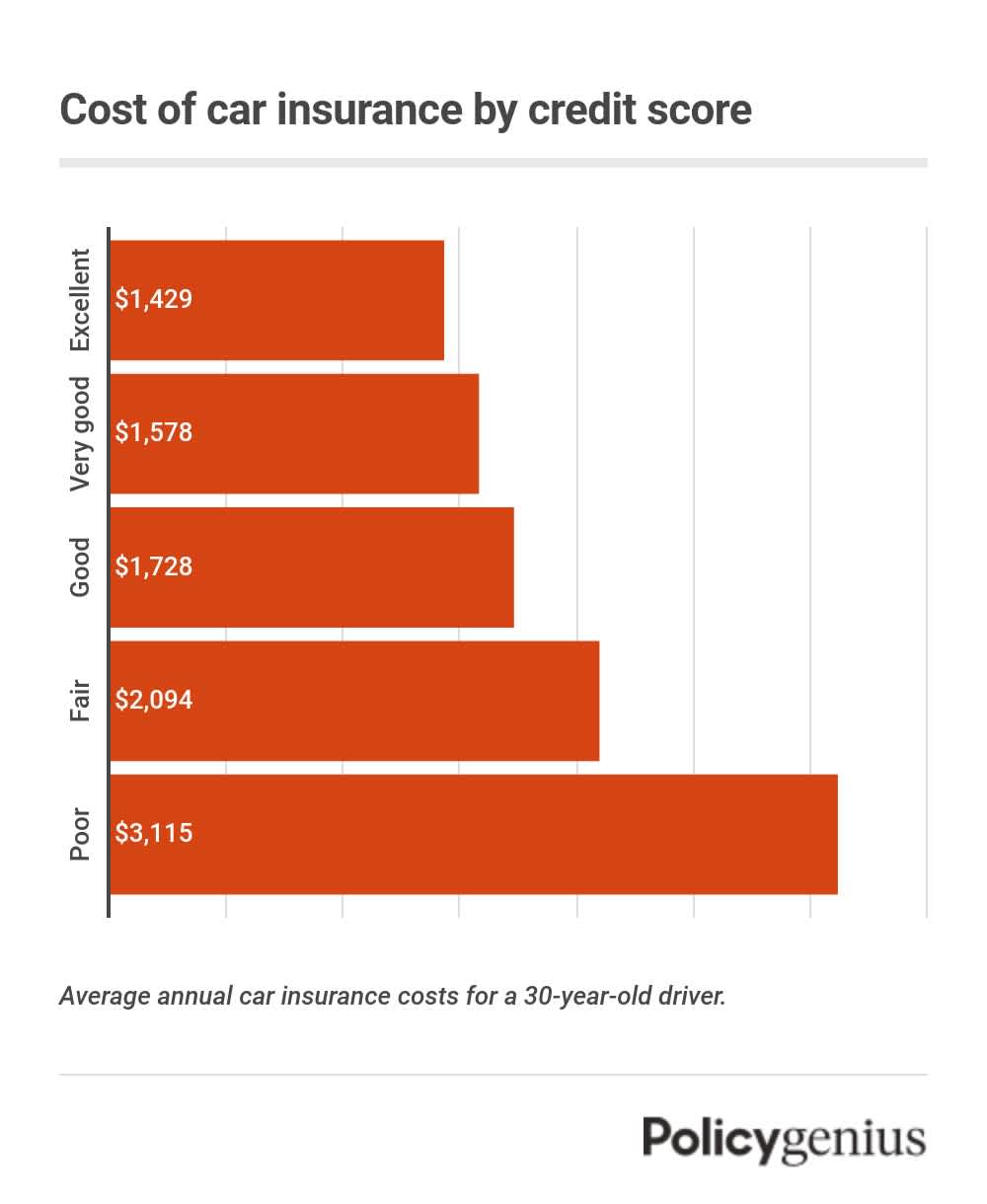

Higher credit scores often lead to lower insurance premiums. Insurers see you as a safe bet. Lower credit scores can raise your premiums. Insurers see you as a risk. They worry you will cost them money. So, your credit score can change what you pay.

Does Paying Car Insurance Affect Credit?

Paying car insurance on time does not directly affect your credit score. Insurance companies usually do not report payments to credit bureaus. Your credit score stays the same. But, paying on time shows you are responsible. This can help in other areas.

Missed payments on car insurance can cause issues. If you miss a payment, it might go to collections. Collection agencies can report this to credit bureaus. This will hurt your credit score. Always try to pay on time to avoid this problem.

Credit: www.allstate.com

Shopping For Car Insurance Without Hurting Credit

A soft credit check does not affect your credit score. It is often used for pre-approval or background checks. On the other hand, a hard credit check can impact your score. Lenders use it to make final decisions on loans.

- Ask the insurer if they use a soft or hard check.

- Limit the number of applications in a short time.

- Check your own credit report regularly.

- Maintain good credit habits like paying bills on time.

Improving Credit Score For Better Insurance Rates

Paying bills on time can help your credit score. It shows you are responsible. This responsibility can lead to lower car insurance rates. Insurers see you as less risky. Set reminders to pay bills. Use automatic payments if possible. This way, you won’t miss a payment.

Reducing debt improves your credit score. A lower debt means you handle money well. This can help lower car insurance costs. Pay off small debts first. Then focus on larger debts. Avoid new debt while paying off old debt. This keeps your credit score high.

Myths About Car Insurance And Credit Score

Many people think car insurance affects credit scores directly. This is a common myth. Car insurance rates may use credit scores, but your score won’t change because of your car insurance.

Common Misconceptions

Many people think that car insurance affects credit scores. This is not true. Credit scores are for loans and credit cards. Car insurance does not change them.

Some believe a low credit score means higher insurance rates. This can be true, but not always. Insurance companies look at many things. Credit score is just one part.

Another myth is that paying car insurance late will hurt credit. This is wrong. Late payments to insurance companies do not show on credit reports.

Clarifying The Truth

Car insurance companies may check credit scores. They use this to set rates. This check does not affect your score.

Good credit can help get better insurance rates. Keeping a good score is smart. It helps in many ways.

Insurance rates depend on many factors. These include driving record, age, and car type. Credit score is just one small part.

Credit: www.policygenius.com

Frequently Asked Questions

Does Car Insurance Affect Your Credit Score?

No, car insurance itself does not directly impact your credit score. However, insurers may check your credit during the application process.

Do Insurance Companies Check Your Credit Score?

Yes, many car insurance companies check your credit score. They use it to determine your insurance premium rates.

Can A Bad Credit Score Increase Car Insurance Rates?

Yes, a bad credit score can lead to higher car insurance rates. Insurers consider credit scores when assessing risk.

Does Paying Car Insurance On Time Help Your Credit Score?

No, paying car insurance on time does not directly improve your credit score. However, missed payments may lead to collection actions.

Conclusion

Understanding car insurance and credit score connections is crucial. Car insurance itself does not directly impact your credit score. Some insurers check your credit for pricing. Poor credit might lead to higher rates. Maintaining good credit can help. Regular monitoring of your credit is important.

Stay informed. Make timely payments. Protect your financial health. This ensures better rates and peace of mind.