How Do Deductibles Work for Car Insurance: Explained Clearly

Deductibles in car insurance are the amount you pay out-of-pocket before your insurance covers the rest. Understanding deductibles is crucial for managing your car insurance costs.

When you buy car insurance, you often see the term “deductible. ” This is the amount you agree to pay before your insurance kicks in to cover a claim. The deductible amount can affect your premium, which is the amount you pay for your insurance policy.

Higher deductibles usually mean lower premiums, and vice versa. Knowing how deductibles work helps you make informed decisions about your coverage. It ensures you are prepared financially if you need to file a claim. Keep reading to learn more about the role of deductibles in car insurance and how they impact your policy.

Credit: www.progressive.com

Introduction To Car Insurance Deductibles

Car insurance deductibles are the amount you pay out of pocket before your insurance covers the rest. They affect your premium costs and claim payouts.

What Is A Deductible?

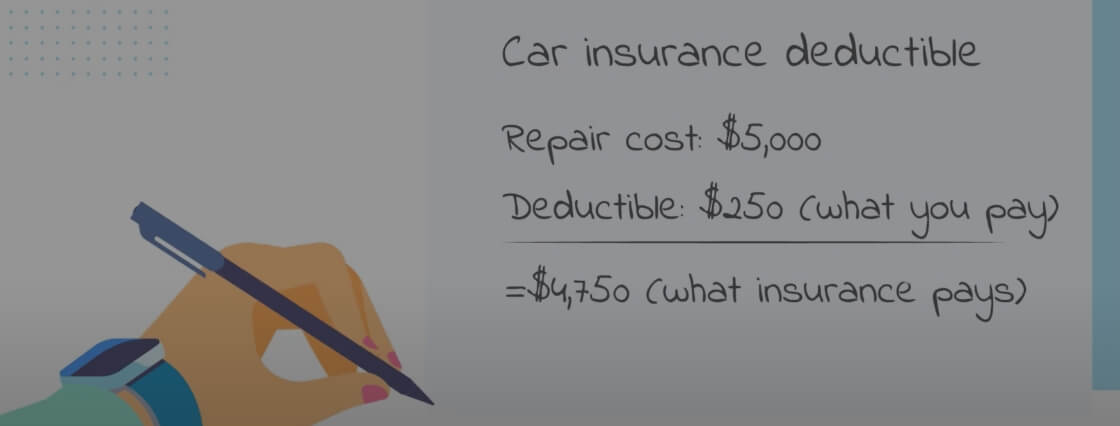

A deductible is the amount you pay out of pocket before your insurance covers the rest. For example, if you have a $500 deductible and your car repair costs $2000, you pay $500 first. Then, your insurance pays the remaining $1500. Deductibles can be different amounts, depending on your policy. Choosing a higher deductible can lower your monthly insurance payment. But you pay more out of pocket if there’s an accident.

Importance Of Deductibles

Deductibles help keep insurance costs manageable. They ensure you share some risk with the insurer. This encourages careful driving and reduces small, unnecessary claims. High deductibles lower your monthly premiums but require more upfront payment during a claim. Low deductibles mean higher premiums but less out-of-pocket expenses in case of an accident. Always balance your deductible with your financial situation.

Credit: www.progressive.com

Types Of Car Insurance Deductibles

Collision deductibles apply when your car hits another car or object. You must pay this amount before your insurance covers the rest. Higher deductibles can lower your premium. But you pay more out of pocket if an accident happens. Choose a deductible you can afford.

Comprehensive deductibles cover non-collision events. These include theft, fire, or natural disasters. You pay this amount first, then insurance handles the rest. Similar to collision, higher deductibles reduce premiums. But be ready to pay more if an event occurs. Balance your budget with potential risks.

How Deductibles Affect Premiums

A high deductible means you pay more out of pocket before insurance helps. Monthly payments, or premiums, are lower. You save money each month. But, in an accident, you will pay more. This can be tough if you don’t have savings.

A low deductible means insurance helps sooner. Monthly premiums are higher. You pay more each month. But in an accident, you pay less out of pocket. This can be easier if you have less savings.

Choosing The Right Deductible

Choosing a car insurance deductible needs careful thought. Look at your budget. Can you pay a high deductible in an accident? Higher deductibles often mean lower monthly payments. But you pay more out-of-pocket if there’s a claim. Lower deductibles mean higher monthly costs. But less to pay if there’s an accident. Balance your savings with potential risks. Think about your comfort level. What feels right?

Consider your driving habits. Do you drive long distances often? Are you in high-traffic areas? High risks might mean a lower deductible is best. Check your car’s value. Older cars might not need a low deductible. Newer cars could benefit from it. Think about where you live. Is it a high-crime area? More risks mean you might want a lower deductible. Balance risks with what you can afford.

Filing A Claim With A Deductible

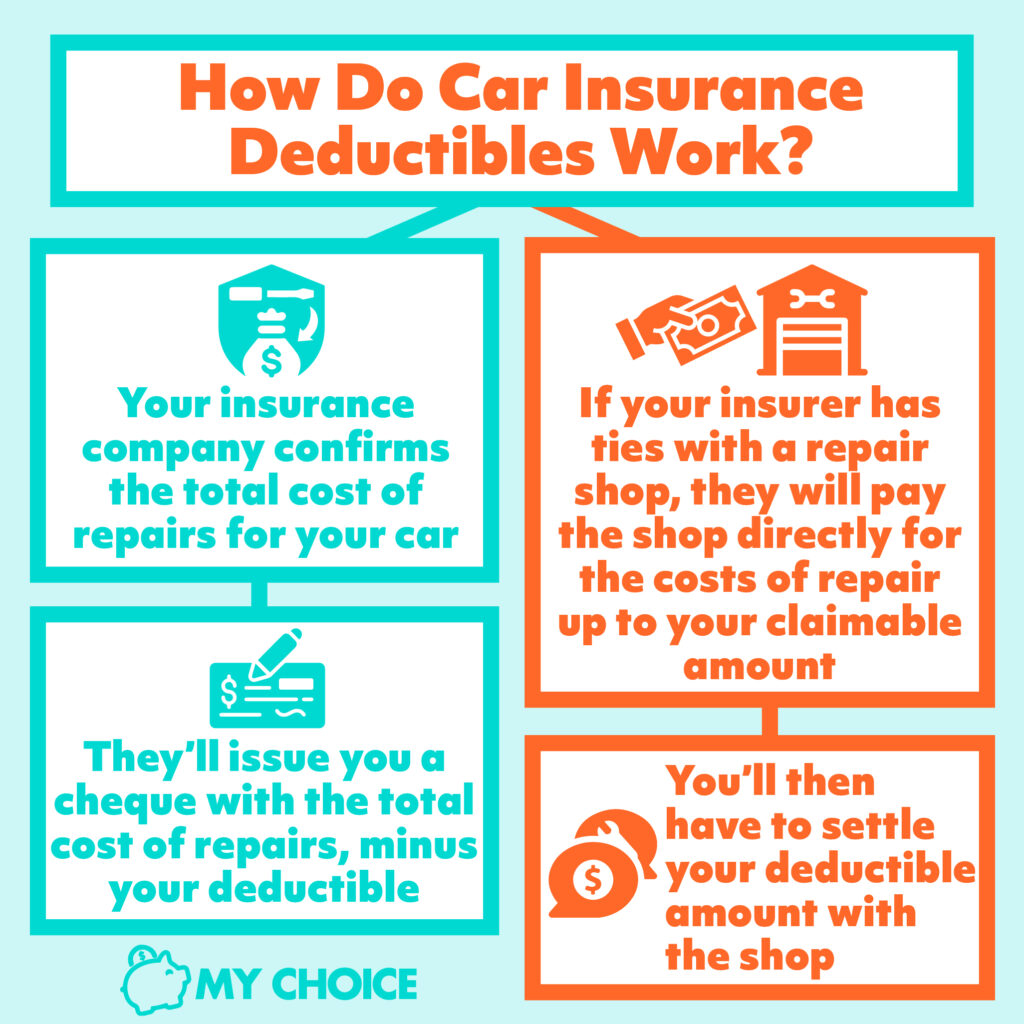

Filing a claim with a deductible means you pay a part of the damage cost. This part is the deductible amount. Your insurance company then covers the rest. The deductible amount is chosen when you buy the policy. Higher deductibles lower your monthly premium but increase your out-of-pocket costs during a claim.

If your car gets damaged in an accident, you file a claim. Suppose your deductible is $500. If the repair cost is $2,000, you pay $500. The insurance company pays the remaining $1,500. If the damage cost is less than your deductible, you pay the full amount. For example, with a $500 deductible and $300 damage, you pay the $300.

Factors Influencing Deductible Amounts

Several factors influence car insurance deductible amounts, including your budget, the value of your car, and your risk tolerance. Higher deductibles often lead to lower premiums but mean more out-of-pocket costs after an accident.

Vehicle Type

Different vehicle types can impact deductible amounts. Luxury cars often have higher deductibles. Older cars may have lower deductibles. Sports cars tend to have higher risks, leading to higher deductibles. Trucks and SUVs may have different deductible rates. Electric cars could also influence deductible amounts.

Driving History

Clean driving records often lead to lower deductibles. Accidents in the past may increase deductibles. Multiple traffic tickets can also raise deductible amounts. New drivers might face higher deductibles. Experienced drivers with good records may enjoy lower deductibles.

Common Myths About Deductibles

Deductibles in car insurance can be confusing. Many think higher deductibles always mean higher premiums. In reality, higher deductibles usually lower your monthly payment.

Myth: Higher Deductibles Always Save Money

Many think higher deductibles always save money. This is not always true. Higher deductibles can lower monthly premiums. But, you pay more if an accident happens.

It is a gamble. Choose carefully. Understand your financial situation first. Can you afford high costs after an accident? If not, a lower deductible may be better.

Myth: Deductibles Must Be Paid Upfront

Many believe deductibles must be paid upfront. This is a myth. Deductibles are not paid before repairs. They are subtracted from claim payments.

For example, if your repair costs $1000 and your deductible is $200, the insurance pays $800. You cover the rest.

Tips For Managing Deductibles

Start by saving a small amount each month. This can build over time. A deductible fund helps cover unexpected costs. Keep this fund separate from other savings. It ensures you have money when needed. Review your budget to find savings. Even small changes can help. Aim to have the full deductible saved.

Check your deductible options once a year. Life changes can affect your needs. A higher deductible often means lower premiums. This saves money if you rarely file claims. A lower deductible means less out-of-pocket costs. This is good for frequent claims. Speak with your insurance agent. They can help find the best option for you.

Credit: www.mychoice.ca

Frequently Asked Questions

What Is A Car Insurance Deductible?

A car insurance deductible is the amount you pay out-of-pocket before your insurance covers the rest.

How Do Deductibles Affect Premiums?

Higher deductibles usually result in lower premiums, while lower deductibles lead to higher premiums.

When Do You Pay The Deductible?

You pay the deductible whenever you file a claim that is covered by your insurance policy.

Can You Choose Your Deductible Amount?

Yes, you can usually choose your deductible amount when purchasing your car insurance policy.

Conclusion

Understanding car insurance deductibles can save you money. Choose a deductible that fits your budget. Higher deductibles mean lower premiums but more out-of-pocket costs. Lower deductibles mean higher premiums but less to pay during a claim. Always review your policy details carefully.

Compare different options. Knowledge of deductibles helps you make better decisions. Protect your finances and your car. Remember, informed choices lead to better coverage. Stay informed and drive with peace of mind.