How Much is Carshield Insurance: Uncover the True Costs

Curious about the cost of Carshield insurance? You’re not alone.

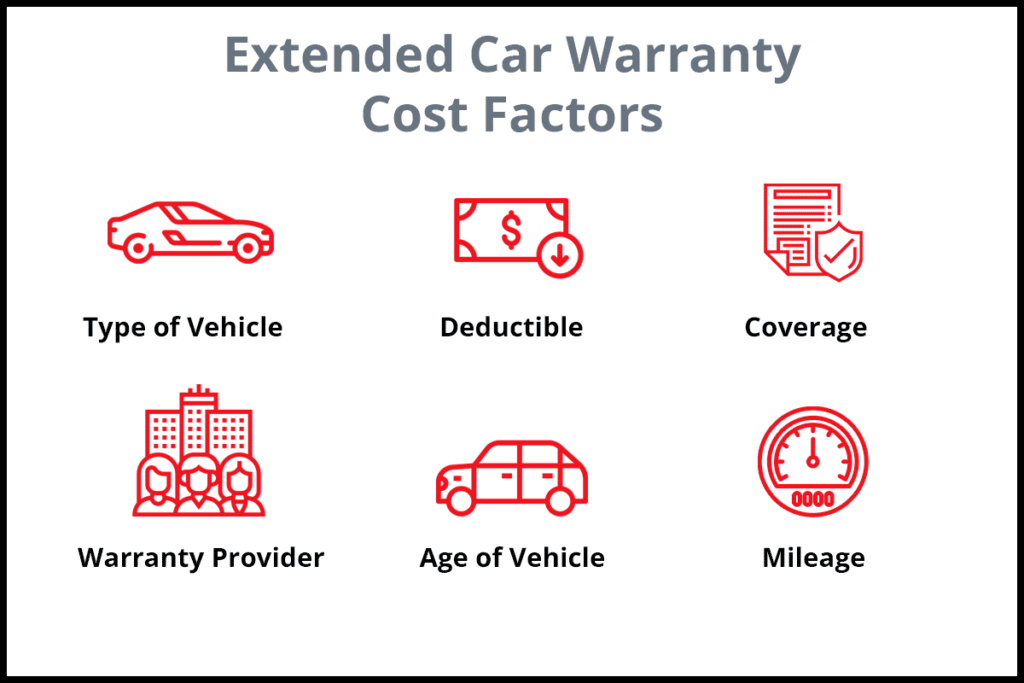

Many people want to know what they might pay for this service. Carshield offers extended vehicle warranties, but figuring out the exact cost can be tricky. Prices vary based on several factors, such as your car’s make, model, age, and mileage.

Additionally, the type of coverage you choose will affect your monthly or annual premiums. Understanding these elements can help you make an informed decision. This blog post will guide you through the various aspects that influence Carshield insurance costs, providing you with a clearer picture of what to expect. Stay tuned to learn more about how much you might pay for Carshield insurance and how to find the best plan for your needs.

Introduction To Carshield Insurance

Carshield offers vehicle service contracts. These help cover repair costs for your car. It can save you money on unexpected repairs. You pay a monthly fee for this service. Carshield works with many repair shops. So, you can get your car fixed almost anywhere. This gives you peace of mind. You don’t have to worry about big repair bills.

Having vehicle coverage is very important. It protects you from high repair costs. Cars can break down anytime. Repairs can be very expensive. With coverage, you pay less out of pocket. This helps you manage your budget better. Also, it keeps your car in good shape. Regular maintenance is easier with coverage. In short, it keeps your car running smoothly.

Credit: www.reddit.com

Types Of Carshield Plans

Basic plans cover important car parts. This includes the engine, transmission, and drive axle. These plans are great for older cars. They help keep your car running smoothly. Basic plans are also affordable for most people. You can choose the coverage that fits your needs.

Comprehensive plans offer more coverage. They include everything in basic plans. Plus, they cover electrical systems, air conditioning, and more. These plans are good for newer cars. They help protect your investment. Comprehensive plans can save you money on repairs. Choose the best plan for your car and budget.

Factors Influencing Carshield Costs

The make and model of your vehicle can greatly impact your Carshield costs. Luxury cars often have higher insurance rates. Older models might cost less to insure. Popular models may have lower costs due to available parts. Rare models could cost more due to expensive parts.

Age and mileage of your car are important. Newer cars usually cost more to insure. Older cars with low mileage can be cheaper. High mileage cars might have higher costs due to wear and tear. Maintaining your car well can help reduce costs.

Cost Breakdown Of Carshield Plans

Carshield plans have different monthly fees. Basic plans cost around $99 per month. Premium plans can cost up to $129 per month. The monthly fee depends on your car and the plan you choose. Some plans include more features. These features can increase the cost.

Deductibles are what you pay out of pocket. Carshield deductibles range from $100 to $500. The deductible amount affects your monthly fee. Lower deductibles mean higher monthly fees. Higher deductibles mean lower monthly fees. Choose the deductible that fits your budget.

Comparing Carshield With Competitors

Carshield is a popular choice for car insurance. Many providers offer similar services. Some well-known competitors include Endurance, American Auto Shield, and Protect My Car. Each has different plans and prices.

| Provider | Pros | Cons |

|---|---|---|

| Carshield | Flexible plans, 24/7 support | Higher cost for some plans |

| Endurance | Long-term plans, good reviews | Limited availability in some states |

| American Auto Shield | Wide range of coverage | Complicated claims process |

| Protect My Car | Maintenance plans included | Higher monthly payments |

Customer Reviews And Experiences

Many customers praise Carshield for its affordable prices. They find the coverage plans easy to understand. People like the helpful customer service. Claims are often handled quickly. Most users feel satisfied with the service. They appreciate the peace of mind it gives.

Some customers have issues with unexpected costs. Others report delays in processing claims. A few find the plans confusing. People sometimes feel misled by advertisements. There are complaints about poor communication. Not everyone feels valued as a customer.

Tips To Save On Carshield Insurance

Check for seasonal discounts. They can save you a lot. Many companies offer special deals during holidays. Always ask if there are any current promotions. Doing this can reduce your costs.

Referral programs are a great way to save money. Invite friends to join CarShield. You might get a discount for each person who signs up. It’s a simple way to lower your bill. Make sure to ask about any referral incentives.

Credit: www.automoblog.com

Final Thoughts On Carshield Costs

Carshield offers different plans. Each has different coverage. Costs vary based on coverage. Think about what you need.

Some may find it helpful. Others may not. Weigh the pros and cons. Check customer reviews. See if it fits your budget.

Research is key. Look for hidden fees. Ask questions. Compare with other companies. Make sure you know what you’re paying for.

Consider the benefits. Think about the long-term savings. Repairs can be costly. Carshield might save you money. Choose wisely.

Frequently Asked Questions

What Is The Average Cost Of Carshield Coverage?

The average cost of CarShield coverage ranges from $99 to $129 per month. Prices vary based on the plan and vehicle.

What Does Carshield Not Pay For?

CarShield doesn’t cover regular maintenance, pre-existing conditions, cosmetic damage, or aftermarket modifications. They also exclude non-mechanical issues and unauthorized repairs.

Is Carshield Worth The Money?

CarShield can be worth the money for those seeking extended vehicle protection. It covers repair costs, offering peace of mind. Compare plans and read reviews to decide.

How Much Is The Extended Car Warranty Per Month?

The cost of an extended car warranty varies. On average, you can expect to pay $100 to $150 per month.

Conclusion

Understanding Carshield insurance costs can help you make a smart choice. Pricing varies based on your car and coverage needs. Always get a quote for accurate pricing. Compare with other providers for the best deal. Make an informed decision to protect your vehicle.

Carshield offers peace of mind and budget-friendly options. Take your time and choose wisely. Your car’s future depends on it. Happy driving!