How to Calculate Car Payment With Interest: Simple Steps Explained

Calculating your car payment with interest is straightforward. You need to know the loan amount, interest rate, and loan term.

Understanding these components helps you budget better and make informed decisions. Buying a car is a significant financial commitment. Knowing how to calculate your car payment with interest is crucial. It ensures you can afford the monthly payments and manage your finances effectively.

This guide will break down the steps in simple terms, so you can easily follow along. Whether you are buying your first car or looking to refinance, mastering this skill will give you confidence. Let’s dive in and learn how to calculate car payments with interest.

Credit: www.calculatorsoup.com

Introduction To Car Payments

Buying a car is a big decision. It’s important to know your car payments. This helps you plan your budget. You need to know the monthly payment. You also need to know the total cost of the car. This includes the interest you will pay over time. Understanding this helps you make smart choices. You can avoid surprises.

Here are some terms you should know:

- Principal: The amount of money you borrow.

- Interest Rate: The percentage charged on the loan.

- Loan Term: The time period to repay the loan.

- Monthly Payment: The amount you pay every month.

- Total Cost: The full amount paid by the end of the loan.

Credit: www.youtube.com

Understanding Loan Terms

Principal Amount is the money you borrow from the bank. This amount does not include interest. You will pay back the principal amount over time. The principal affects your monthly payments. A higher principal means higher payments. It’s important to borrow only what you need.

The Interest Rate is the cost of borrowing money. It is shown as a percentage. A higher interest rate means you pay more. A lower rate saves you money. Always compare rates before choosing a loan. Even a small difference can add up over time.

The Loan Term Duration is the time you have to pay back the loan. It can be a few years or many years. Longer terms mean lower monthly payments. But, you pay more in interest over time. Shorter terms mean higher monthly payments. But, you pay less in interest. Choose a term that fits your budget.

Types Of Interest Rates

A fixed interest rate stays the same for the entire loan. This means your monthly payment will not change. It is easy to plan your budget. You know exactly how much to pay each month.

A variable interest rate can change over time. Your payment may go up or down. It depends on the market rates. This type of rate can be risky. You might pay more in the future. But sometimes, you could pay less.

Credit: www.calculatestuff.com

Calculating Monthly Payments

To calculate monthly car payments, use a simple formula. This formula involves the loan amount, interest rate, and loan term. You can use the formula: M = P[r(1+r)^n] / [(1+r)^n – 1].

Here, M is the monthly payment. P is the loan amount. r is the monthly interest rate. n is the number of payments.

Let’s say you borrow $20,000 for a car. The loan term is 5 years (60 months). The annual interest rate is 5%.

First, find the monthly interest rate. It is 5% divided by 12 months, which is 0.004167. Then, use the formula:

After calculating, the monthly payment is about $377.42.

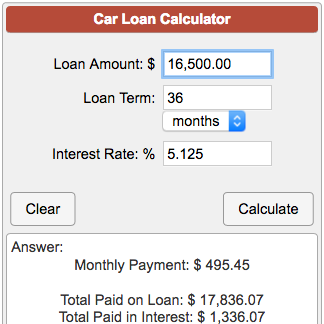

Using Online Calculators

Online calculators are very easy to use. They save time and effort. You enter a few details about your car loan. The tool then calculates your monthly payment. These tools are accurate and often free. They can be used anytime, anywhere. You do not need to be a math expert. Online calculators do all the hard work for you. Many websites offer these tools. You can find one with a quick search.

First, find a good online calculator. Enter the loan amount you need. Next, input the interest rate of the loan. Then, enter the loan term in months or years. Finally, click calculate. The tool will show your monthly payment. Some calculators also show a payment schedule. This helps you see how much you pay each month. You can adjust the details to see different results. This helps you plan your budget better.

Factors Affecting Car Payments

Your credit score plays a big role in car payments. A high score means lower interest rates. A low score means higher rates. This can change your monthly payment a lot.

The down payment is the money you pay upfront. Paying more upfront reduces the loan amount. This lowers your monthly payments. Paying less upfront increases your monthly payments.

The loan duration is the time you take to pay back the loan. A shorter loan means higher monthly payments. But, you pay less interest overall. A longer loan means smaller monthly payments. But, you pay more interest overall.

Tips For Lowering Car Payments

Refinancing can help reduce your monthly payments. It involves getting a new loan at a lower interest rate. This means you pay less in interest over time. Lower interest rates lead to smaller payments. A good credit score can also help you get better rates. Always compare different offers before deciding. This ensures you get the best deal.

Negotiating can significantly lower your interest rate. Start by researching current rates. This gives you an idea of what to expect. Show lenders that you know the market. Also, check your credit score before negotiating. A high score can help you get lower rates. Be confident and ask for the best rate possible. Sometimes, simply asking can save you money.

Common Mistakes To Avoid

Many people forget about extra fees. These can include loan origination fees and processing fees. These fees increase the total loan cost. Always ask about all possible fees. This helps you avoid surprises later. Check your loan agreement carefully. Make sure you understand every charge listed.

Some focus only on the monthly payment. This is a mistake. You should also look at the total interest paid over time. A lower monthly payment can mean more interest paid. Calculate the overall cost of the loan. This gives a true picture of what you will pay. Compare different loans to find the best deal.

Frequently Asked Questions

What Is The Formula To Calculate Car Payment?

The formula to calculate car payment involves the loan amount, interest rate, and loan term. Use the formula: \( P = \frac{rPV}{1 – (1 + r)^{-n}} \).

How Does Interest Affect Car Payments?

Interest increases the total amount you pay over the loan term. Higher interest rates result in higher monthly payments.

Can I Calculate Car Payment Without A Calculator?

Yes, you can use online car payment calculators. They simplify the process and provide accurate results quickly.

What Factors Influence My Car Payment?

Factors include loan amount, interest rate, loan term, and down payment. These elements determine your monthly payment.

Conclusion

Calculating car payments with interest is easy with the right steps. Use online calculators for quick results. Understand your loan terms and interest rates. This knowledge helps you budget better. Keep payments manageable to avoid stress. Stay informed to make smart financial decisions.

This guide simplifies the process for everyone. Happy car shopping!