Is It Better to Pay Cash Or Finance a Car: The Ultimate Guide

Are you standing at the crossroads of a major decision: whether to pay cash or finance your next car? You’re not alone.

This choice can feel like a heavy weight on your shoulders. It’s not just about how you get around; it’s about how you manage your money and your future financial health. What if I told you there’s a way to make this decision easier?

Imagine driving off in your new car, feeling confident and secure in your financial choice. You’ll discover the pros and cons of both paying cash and financing, giving you the clarity you need to make a smart decision. Ready to find out what’s best for you? Let’s dive in!

Credit: www.moneyunder30.com

Pros Of Paying Cash For A Car

Paying cash means no interest payments. You save money over time. Loans can add a lot of extra costs. Cash keeps it simple.

With cash, you own the car right away. No need to worry about monthly bills. The car is yours from day one.

Sellers may offer better deals for cash buyers. They like quick transactions. You might get a discount or a special price. Cash can make you a stronger negotiator.

Credit: greensafaris.com

Cons Of Paying Cash For A Car

Using cash means less money in your savings account. This can be risky if you face an emergency. You might not have enough money to cover unexpected costs. Savings are important for future needs. Spending all at once can leave you feeling stressed.

Paying in cash can limit your car options. You might not afford the car you really want. Financing allows for more flexible choices. Cash limits you to what you have saved. This can be frustrating if your dream car is more costly.

Cash payment affects your financial liquidity. Liquidity means how quickly you can use your money. Less cash means less flexibility. You might struggle with day-to-day expenses. Keeping some cash in hand is always smart.

Advantages Of Financing A Car

Preserving cash flowis important. Financing helps you keep more cash. Use that cash for emergencies or other needs. Paying monthly is easier than a big cash payment.

Building creditis essential. A car loan helps you improve your credit score. Timely payments show responsibility. This can lead to better loan offers in the future.

Access to higher-end modelsis possible with financing. You can buy a better car without full cash upfront. Choose a car that suits your taste and needs. Drive a car you love without waiting years to save.

Disadvantages Of Financing A Car

Interest and feescan make a car cost more. People pay extra money over time. This extra is called interest. Loans may also have other fees. These add to the total cost.

Taking a loan can cause debt accumulation. Each month there are payments. Missing one can increase debt. The debt can grow fast.

Car loans require a long-term financial commitment. Payments last for many years. This means less money for other things. Be ready for this long commitment.

Factors To Consider When Choosing

Your current financial situationmatters a lot. Do you have savings? Cash payment needs a good amount saved. Financing might be better if you lack funds. Make sure you can manage monthly payments. Avoid over-stretching your budget.

Think about your future financial goals. Would you prefer saving for a house or trip? Financing might help keep cash for other goals. Paying cash leaves no monthly car payments. Consider what matters most for your future.

Interest rateschange over time. They affect the total cost of financing. Lower interest rates mean smaller payments. Look at the loan termstoo. Shorter terms often mean higher payments. Longer terms might be easier to manage. Compare options carefully.

Impact On Personal Finances

Paying cash means no monthly payments. This can make budgeting simpler. Financing a car, on the other hand, involves regular payments. You need to plan for these monthly expenses. Missing payments can harm your credit score. Careful budgeting is essential.

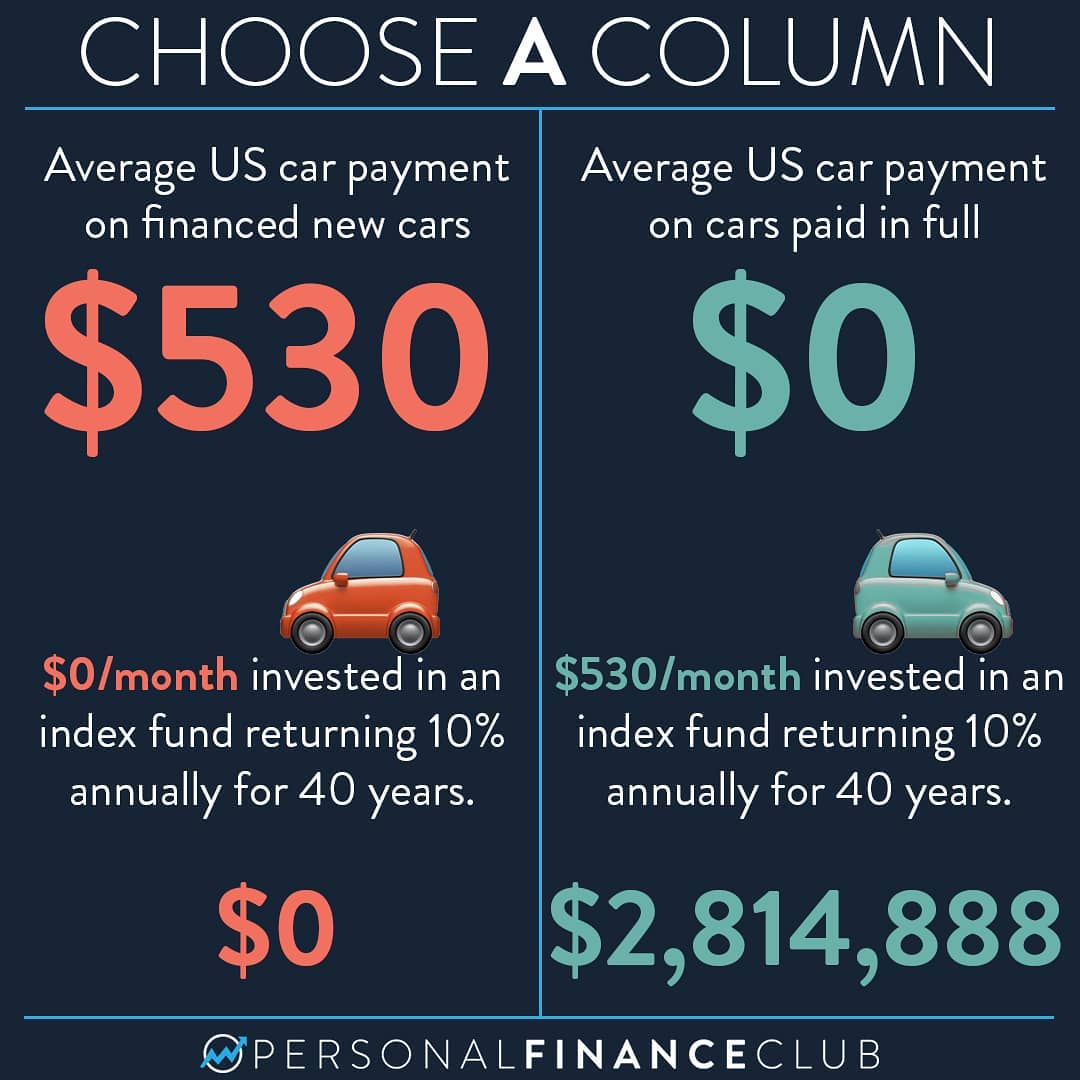

Using cash may reduce your savings. This can impact your future plans. Financing allows you to keep savings intact. You can invest your money elsewhere. This can grow your wealth over time. Consider the potential returns on investments.

An emergency fund is crucial. Paying cash might deplete this fund. Financing keeps your emergency money safe. You will have funds if something unexpected happens. Think about your financial safety net. It is important to be prepared.

Market Trends And Consumer Preferences

Car financing is popular. Many people choose it. They pay monthly. Car loans have lower interest rates now. This makes loans more attractive. Dealerships offer special deals on financing. More people are buying cars because of this.

Paying cash is less common. It requires saving money first. Few can afford this. Cash buyers avoid interest costs. They like owning the car right away. Some dealerships offer discounts for cash payments. This attracts cash buyers.

Consumers are careful. They compare prices. They look for the best deal. Many prefer financing. It’s easier to manage monthly payments. Cash buyers are usually older. They want no debts. Young buyers often choose loans. They have different priorities.

Credit: www.benimellalkhenifra.ma

Frequently Asked Questions

Should I Finance A Car Or Pay Cash?

Financing allows you to keep cash for emergencies and investments. Paying cash avoids interest and can lead to better deals. Consider your financial situation, interest rates, and car price. Paying cash is ideal for those who want to avoid debt.

Financing is suitable for those prioritizing liquidity.

What Are The Benefits Of Paying Cash For A Car?

Paying cash eliminates monthly payments and interest, saving money over time. It simplifies the buying process and may give you negotiation power. You own the car outright, reducing financial stress. Cash purchases avoid loan approval delays. It’s ideal for avoiding debt and enjoying long-term savings.

Why Do People Choose To Finance A Car?

Financing offers flexibility and allows you to buy a more expensive car. It helps maintain your savings for emergencies or other expenses. Monthly payments can be budget-friendly. It lets you build credit if payments are timely. Financing suits those valuing liquidity and managing monthly budgets.

Is Financing A Car More Expensive Than Paying Cash?

Financing typically incurs interest, making it more expensive than paying cash. Interest rates vary based on credit score and lender terms. Paying cash avoids these costs, saving money long-term. Financing may offer affordable monthly payments but adds to the total car cost.

Consider the interest rate before deciding.

Conclusion

Deciding to pay cash or finance a car depends on personal needs. Cash might save money in the long run. Financing offers flexibility with monthly payments. Each option has pros and cons. Consider your budget and future plans. Think about interest rates when financing.

Cash buys avoid monthly bills. Choose what’s best for your lifestyle. Evaluate financial priorities carefully. Make sure you understand loan terms. Both methods can work well. It’s all about what’s comfortable. Make informed choices for peace of mind. Your decision impacts your financial health.

Choose wisely for a stress-free experience.