Used Car Vs New Car Interest Rates: Which Saves You More?

Buying a car is a significant investment. Interest rates play a crucial role in your decision.

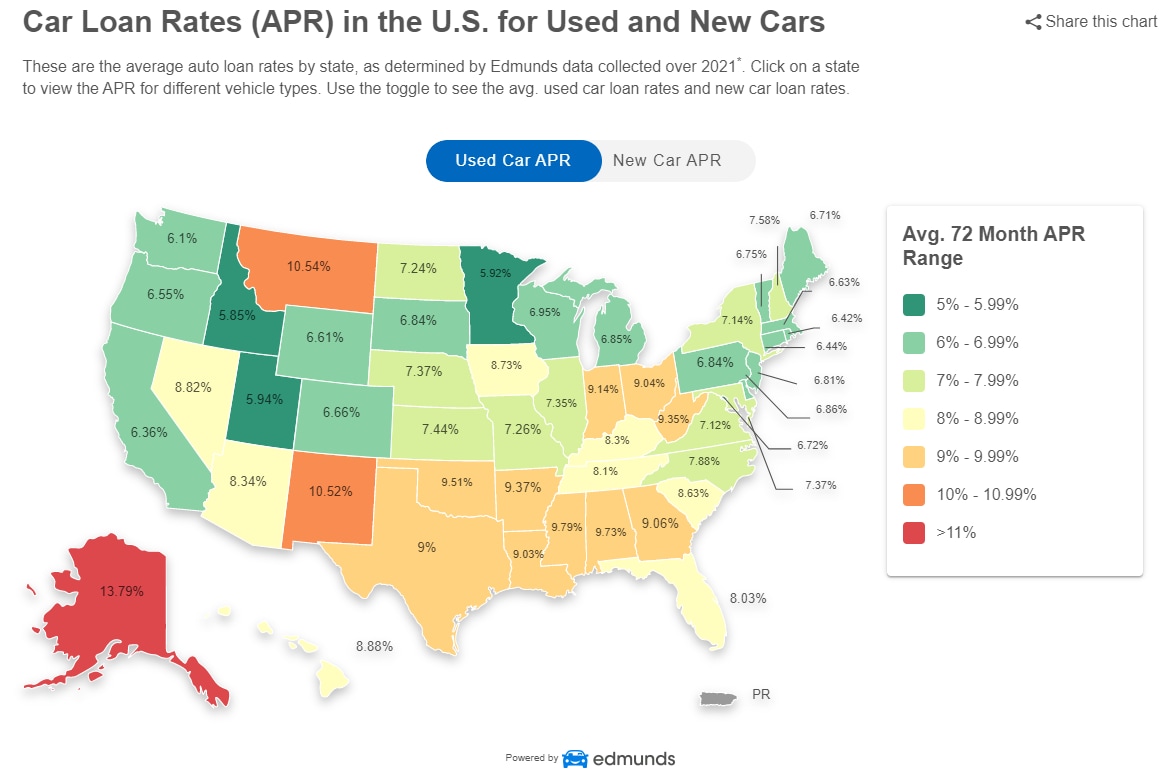

Understanding the difference in interest rates between used and new cars can save you money. New car interest rates are generally lower due to the reduced risk for lenders. Used car interest rates tend to be higher because of the vehicle’s depreciation and potential maintenance issues.

Knowing these differences helps you make an informed choice. In this blog, we will explore how these interest rates vary, and what factors influence them. This knowledge will empower you to make the best financial decision for your situation. Let’s dive in and compare used car vs new car interest rates.

Credit: www.edmunds.com

Interest Rates Overview

Interest rates can vary a lot between new and used cars. New cars often have lower rates. This is because new cars are less risky for banks. Used cars might have higher rates due to their age and condition. Understanding these differences helps in making a smart choice.

Factors Influencing Rates

Several factors affect car loan interest rates. The car’s age is a big one. New cars usually get better rates. Credit score matters too. Good credit can get you lower rates. Loan term length affects rates as well. Shorter terms often have lower rates.

Market Trends

Current market trends show a rise in interest rates. Economic changes can impact these rates. Used cars may see higher rates due to market demands. Keeping an eye on trends can help you choose the best time to buy.

Credit: www.debt.org

New Car Interest Rates

New car loans often come with lower interest rates. These rates are generally between 3% to 5%. Banks and lenders see new cars as less risky. Lenders offer better rates for less risk. Better rates can save you money over time. Always check different lenders for the best rate. Rates can vary.

Low interest rates mean lower monthly payments. This can make new cars more affordable. New cars often have the latest safety features. They also come with a warranty. This can reduce repair costs. A new car is also more reliable. Fewer repairs mean fewer extra costs. Consider all these points when deciding.

Used Car Interest Rates

Used car interest rates are usually higher than new car rates. Banks see used cars as a bigger risk. Typical rates for used cars can range from 5% to 10%. This depends on your credit score. Higher scores get lower rates. Lower scores get higher rates. Also, the car’s age affects the rate. Older cars may have higher rates. Always compare rates from different lenders.

Buying a used car can save money. Lower purchase price is a big benefit. You avoid big depreciation hits. New cars lose value fast in the first year. Used cars have already gone through this. Insurance costs can be lower for used cars. You might get a better deal on a good car. Always check the car’s history before buying. Make sure it’s in good shape.

Credit Score Impact

Your credit score matters a lot. It affects your car loan rate. A higher score means a lower interest rate. This saves you money over time. A low score leads to high interest rates. It can cost you much more. Lenders trust people with good credit scores. They see them as less risky. So, always aim for a good credit score.

Pay your bills on time. This boosts your credit score. Reduce your debt. A low debt amount helps your score. Check your credit report. Fix any errors you find. Keep old credit accounts open. They show a long credit history. Avoid applying for new credit often. Too many inquiries can lower your score. Follow these steps to improve your credit score.

Loan Terms Comparison

New car loans often have longer terms. Used car loans typically have shorter terms. Longer terms mean lower monthly payments. But, you may pay more interest over time.

Payment plans for new cars are usually more flexible. Used car payment plans can be less flexible. New cars may offer special promotions. Used cars often have higher interest rates.

Down Payment Considerations

New cars often need a higher down payment. This is because they are more expensive. A larger down payment can lower monthly payments. It can also reduce the interest rate. Sometimes, dealers offer special deals. These deals might include low down payment options.

Used cars usually need a smaller down payment. They are cheaper than new cars. This means less money upfront. But, interest rates on used cars can be higher. It’s important to compare different offers. This helps in finding the best deal. A good down payment can still lower overall costs.

Total Cost Analysis

Interest rates for new cars are often lower. This means you pay less interest. Used cars usually have higher interest rates. Over time, this can add up. A lower rate on a new car can save money. Always check the interest rate before buying. Even a small difference matters. Comparing rates helps make a better choice. Understanding interest rates is important.

New cars lose value quickly. This is called depreciation. In the first year, they lose the most value. Used cars have already depreciated. This means they lose value more slowly. The slower depreciation of used cars can save money. Depreciation affects the total cost of owning a car. Always consider how much value a car will lose. This helps in making a smart choice.

Credit: www.ramseysolutions.com

Choosing The Best Option

Buying a car is a big decision. Interest rates play a key role. New cars often have lower interest rates. But they cost more. Used cars are cheaper. Yet, their rates can be higher. Think about your monthly budget. Can you afford a higher monthly payment? Or do you need a lower one? Consider your credit score too. It affects the interest rate you get. A higher score means a lower rate. Plan your purchase wisely. Choose what fits your budget best.

Think about how long you will keep the car. New cars lose value fast. Used cars do not lose value as quickly. Are you planning to sell the car soon? A new car may lose more money when sold. But, new cars often need fewer repairs. Used cars may need more repairs over time. This can cost more. Think about your future plans. Choose a car that fits your goals.

Frequently Asked Questions

What Are The Typical Interest Rates For Used Cars?

Used car interest rates vary, typically ranging from 4% to 10%. Rates depend on the borrower’s credit score, loan term, and the car’s age.

Are New Car Interest Rates Usually Lower?

Yes, new car interest rates are usually lower. They range from 0% to 6%, often influenced by promotional deals.

How Does Credit Score Affect Car Loan Interest Rates?

A higher credit score usually secures lower interest rates. Lenders view borrowers with high scores as less risky.

Do Used Car Loans Have Shorter Terms?

Yes, used car loans often have shorter terms, typically 36 to 60 months. This is due to the car’s depreciating value.

Conclusion

Choosing between used and new car interest rates depends on your needs. New cars often have lower interest rates but higher prices. Used cars might have higher rates but lower overall costs. Consider your budget and financial goals. Research and compare different loan offers.

Ensure you understand the terms before committing. Making an informed decision can save you money. Evaluate your priorities and choose wisely. Happy car shopping!