What Happens If Your Car Gets Repo: Your Next Steps

Your car getting repossessed can be a stressful event. It means your lender took back the vehicle.

Repossessions happen when you miss car loan payments. Lenders have the right to take your car if you fall behind. This process can leave you without transportation and hurt your credit score. It’s important to understand what happens during a repossession and the steps you can take afterward.

Knowing your rights and the consequences can help you manage this difficult situation. In this blog, we will explore the repossession process, its impact on your life, and how you can recover from it. Stay informed and take control of your financial future.

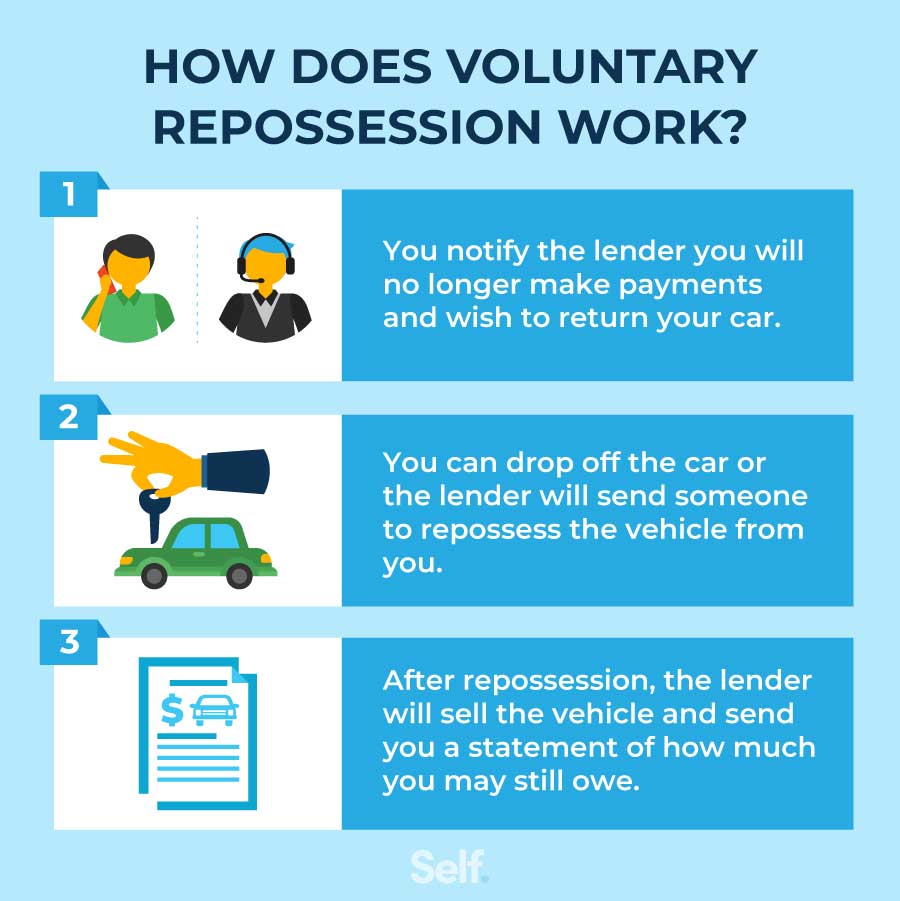

Credit: www.self.inc

Car Repossession Process

Missed car payments are a common reason. Not having insurance can also lead to it. Sometimes, other contract issues cause repossession. Always read your loan agreement carefully. Stay aware of your obligations. Avoid these issues to keep your car.

A repossession agent takes the car. They come without warning. Often, they come at night. They use a tow truck. They take your car to a storage lot. You must pay fees to get it back. It’s best to avoid this situation.

:max_bytes(150000):strip_icc()/does-hiding-a-car-to-avoid-repossession-actually-work-527154-final-5b64a4f546e0fb005076f503.png)

Credit: www.thebalancemoney.com

Immediate Actions To Take

Reach out to your lender right away. Explain the situation and ask for options. Lenders may offer solutions. You could set up a payment plan. Or, you might be able to negotiate a new agreement. Acting quickly can help you keep your car.

Check your loan documents. Understand your rights and duties. The agreement will explain what happens next. Look for any grace period details. You need to know the rules. It helps in planning your next steps.

Recovering Your Vehicle

Reinstatement means paying the missed payments and fees. This lets you get your car back. Redemption is different. You pay the full loan amount plus fees. It costs more, but you own the car outright. Choose the best option for your situation.

Talk to your lender. Be honest about your financial issues. They might offer a payment plan. Sometimes they lower the interest rate. Keep the communication clear. This can help you get your car back.

Legal Rights And Protections

Every state has different rules for car repossession. Some states need lenders to give you notice before taking your car. Others let them take it without warning. You might also have a right to get your car back by paying all missed payments. Some states even allow you to sue if the lender breaks the rules. Check your state’s laws to know your rights.

Repossession must follow fair debt collection laws. Lenders cannot harass you or use threats. They must be honest about the amount you owe. If they break these rules, you can report them. You may also be able to get money for damages. Knowing these laws can help protect you.

Financial Impact

Losing your car to repossession can hurt your credit score. It also adds fees to your financial burden. This affects future loan approvals.

Credit Score Consequences

A car repossession can hurt your credit score. Late payments and the repossession itself show up on your credit report. This can stay there for seven years. Your score can drop by 100 points or more. It can be tough to get new loans or credit cards. Lenders see you as a high risk.

Deficiency Balance

After repossession, the lender sells your car. If the sale price is less than what you owe, you must pay the deficiency balance. For example, if you owe $10,000 and the car sells for $7,000, you still owe $3,000. The lender can sue you for this amount. It adds to your financial stress.

Alternatives To Repossession

Voluntary surrender means you give the car back to the lender. This can be less stressful. You avoid the surprise of a repo. You still owe money if the car’s value is less than your loan. This option may hurt your credit score less. Plan this step carefully. Talk to your lender first.

Loan modification changes the terms of your loan. This can make payments easier. You might get a lower interest rate. Or a longer time to pay. Contact your lender to discuss options. They may help if you show you can’t pay now. Always ask about fees or extra costs.

Preventing Future Repossession

Track your monthly income and expenses. Make a list of all bills. Identify areas where you can cut costs. Save this extra money for car payments. Create a monthly budget and stick to it. Avoid unnecessary spending. Set aside an emergency fund.

Contact your lender if you face trouble. Explain your situation clearly. Ask for payment options. Lenders may offer solutions. Negotiate a new payment plan. Keep records of all communication. This helps in case of future disputes. Stay proactive to avoid problems.

Seeking Professional Help

Credit counseling services can help you manage your debt. They will work with you to create a budget. This can prevent future financial issues. These services often offer free or low-cost advice. They can teach you how to improve your credit score. Some even negotiate with lenders to lower your payments. This can make it easier to regain control of your finances.

A lawyer can explain your rights if your car gets repo. They might find errors in the repo process. This could help you get your car back. Legal help can also guide you through bankruptcy. This could stop the repo process. Some lawyers offer free consultations. This can help you decide if hiring them is right for you.

Credit: bankruptcy-az.com

Frequently Asked Questions

How Long Does A Car Repo Affect You?

A car repossession typically affects your credit for seven years. It can lower your credit score significantly.

Do I Still Owe Money After Repossession?

Yes, you may still owe money after repossession. This amount is called a deficiency balance. It is the difference between the loan balance and the sale price of the repossessed item.

When Your Car Gets Repossessed, Where Does It Go?

After repossession, your car typically goes to a storage facility or impound lot. The lender then decides to sell it at an auction.

What Happens If My Car Gets Repossessed And I Don’t Want It Back?

If your car gets repossessed and you don’t want it back, the lender will sell it. Any remaining balance after the sale, you must pay. This may impact your credit score negatively.

Conclusion

Losing your car to repossession can be stressful. It’s important to understand your rights. Contact your lender immediately to explore options. This might help you avoid further financial trouble. Also, consider speaking with a credit counselor. They can offer advice and support.

Remember, repossession affects your credit score. Take steps to rebuild it over time. Learn from this experience and plan better. It’s crucial to manage finances wisely. Stay informed and proactive to prevent future issues.