What is the Average APR on a Car Loan: Key Insights

The average APR on a car loan can vary. Generally, it ranges from 3% to 10%.

But what exactly is APR? And why does it matter when financing a car? APR, or Annual Percentage Rate, is the yearly interest rate charged on a loan. It’s a key factor in determining how much you’ll pay over the life of a car loan.

Knowing the average APR helps you compare different loan offers and make informed decisions. This blog will explore what affects APR, current averages, and how to get the best rates. Understanding these details can save you money and help you navigate car financing with confidence. Let’s dive in and uncover the ins and outs of car loan APRs.

Factors Influencing Apr

Your credit score plays a huge role. A higher credit score means a lower APR. Lenders trust you more. They see you as less of a risk. A lower credit score means a higher APR. Lenders see you as a risk. They charge more to cover that risk. Always aim to improve your credit score.

The length of your loan term affects APR. Shorter terms often have lower APRs. Lenders get their money back faster. Longer terms usually have higher APRs. The lender’s risk is spread over a longer time. Choose a term that suits your budget.

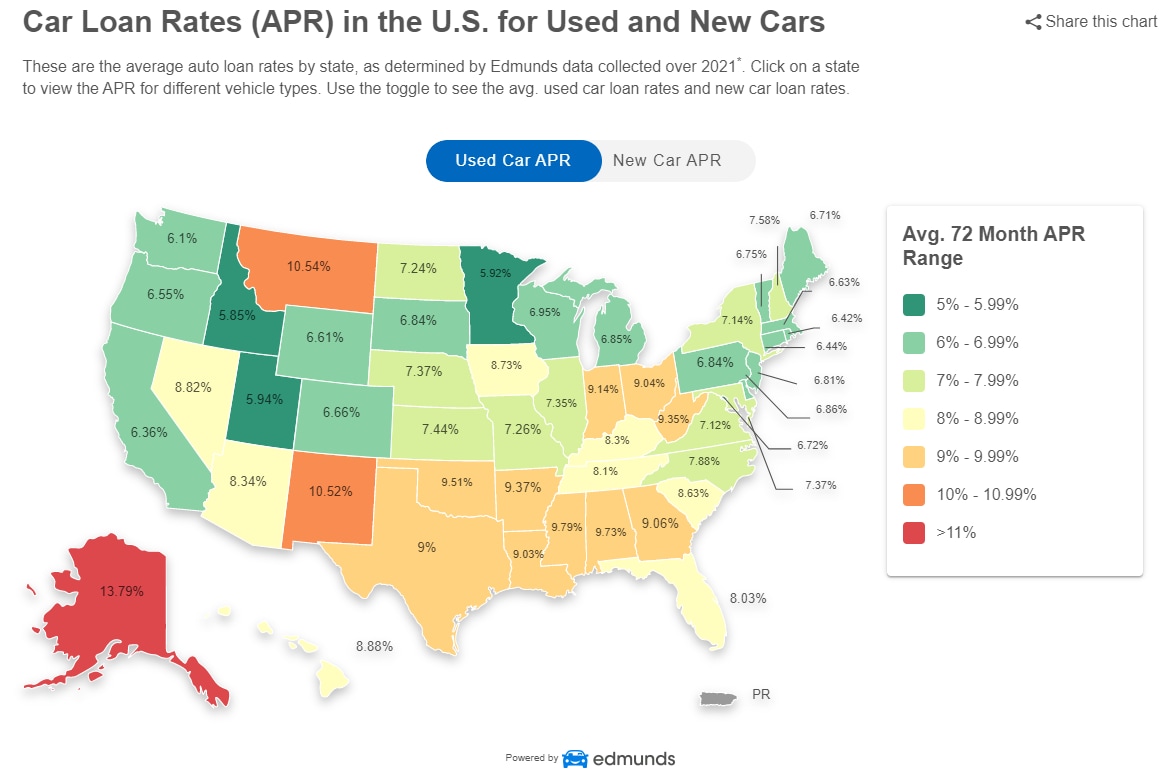

Credit: www.edmunds.com

Average Apr Rates

The average APR for a car loan in the US is around 4.21%. New cars usually have lower rates. Used cars often have higher rates. Rates can change based on many factors. Credit score is a big factor. Better credit scores get lower rates.

APR rates can vary by state. Some states have higher rates. Other states have lower rates. Here are some examples:

| State | Average APR |

|---|---|

| California | 3.9% |

| Texas | 4.5% |

| New York | 4.2% |

Types Of Car Loans

New car loans often have lower interest rates. This is because new cars are more valuable. Lenders see less risk with new cars. The average APR for new car loans is usually lower. It is often between 3% and 5%. This can change based on your credit score. Good credit can get you a lower APR. Poor credit can make it higher.

Used car loans tend to have higher APRs. This is due to the car’s lower value. Lenders see more risk in used cars. The average APR for used car loans is usually higher. It often ranges from 4% to 7%. Your credit score still matters. Better credit can reduce the APR. Worse credit can increase it.

Credit: www.valuepenguin.com

Impact Of Down Payment

Down payment size matters. A large down payment can lower the APR. This means less interest over time. Saving money.

Small down payments may raise the APR. Higher interest rates. More money paid over time. Loan costs increase.

Choose a big down payment if possible. Save money in the long run. Lower APR benefits you.

Apr Vs. Interest Rate

APR includes fees and other costs. The interest rate only includes the cost of borrowing. APR gives a clearer picture of the total cost.

Seeing the full cost helps to compare loans better. Interest rate alone can be misleading. It may seem lower, but other costs add up.

Understanding APR helps to save money. It shows the real loan cost. Choosing a loan with a lower APR means paying less over time.

APR is more honest. It includes all fees. A low interest rate may hide the true cost. Always check the APR before deciding on a loan.

Improving Your Apr

Pay bills on time. This helps your credit score. Lower credit card balances. This also helps. Check your credit report for mistakes. Fix any errors you find. Avoid opening new credit accounts often. This can drop your score. Improving your credit score can lower your car loan APR.

Shorter loan terms often have lower APRs. Long terms may look better. But you pay more in interest. Choose a term you can afford. But remember, a shorter term saves money on interest. Always read the loan details before you agree.

Credit: www.creditrepair.com

Frequently Asked Questions

What Is A Good Car Loan Apr?

A good car loan APR typically ranges from 3% to 6%. Rates vary based on credit score and loan term. Shop around and compare offers to find the best deal.

Is 7% A High Interest Rate For A Car?

A 7% interest rate for a car is considered moderate. Rates vary by credit score, loan term, and lender.

What Is A Good Apr For A 72 Month Car Loan?

A good APR for a 72-month car loan typically ranges from 3% to 5%. Rates may vary based on credit score.

What Apr Will I Get With A 700 Credit Score For A Car?

With a 700 credit score, expect an APR between 4% to 6% for a car loan. Rates vary by lender.

Conclusion

Understanding the average APR on a car loan helps you plan better. Always compare rates from different lenders. This ensures you get the best deal. A lower APR saves you money in the long run. Do thorough research before committing to a loan.

Being informed leads to smarter financial decisions. Remember, a good APR can make car ownership more affordable. Stay informed and secure the best rate possible.