What is the Average Car Payment: A Comprehensive Guide

The average car payment is around $600 per month in the U.S. This amount varies based on the car’s price, loan terms, and interest rates.

Understanding the typical car payment helps you plan your finances better. With car prices rising, it’s important to know what you might expect to pay each month. Factors like your credit score, loan duration, and the car model can affect your monthly payment.

By knowing the average car payment, you can make informed decisions when buying a car. This knowledge can also help you negotiate better terms with lenders. Let’s dive deeper into the factors that influence the average car payment and how you can manage these costs.

Introduction To Car Payments

A car payment is the amount of money you pay each month for your car. This payment is part of a loan agreement with a bank or lender. The payment usually includes the principal amount and interest. The principal is the money you borrowed. The interest is the fee the lender charges you for borrowing the money. Car payments can vary in size. They depend on the price of the car, the loan term, and the interest rate.

Understanding car payments is very important. It helps you manage your budget better. You know how much money you need each month. This can help you avoid debt. Knowing your car payment also helps you plan for other expenses. It ensures you are not overspending. Being aware of your car payment terms can save you money. It helps you choose the best loan option. This can lower your monthly payments.

Factors Influencing Car Payments

The loan amount greatly affects car payments. A higher loan means higher monthly payments. Borrowing less reduces payments. It’s that simple. Always consider how much you need to borrow.

Interest rates impact your monthly payments. Lower rates mean lower payments. Higher rates increase your payments. Check different lenders for the best rate. A good rate saves you money over time.

The loan term is how long you have to repay. A longer term means smaller payments each month. But you pay more interest overall. A shorter term has higher payments but less interest. Choose a term that fits your budget.

Types Of Car Loans

New car loans are for people buying a brand-new car. These loans often have lower interest rates. You may need a good credit score. Payments can be spread over many years. Longer loans mean lower monthly payments. Shorter loans cost less in total.

Used car loans are for buying a pre-owned car. Interest rates might be higher than new car loans. Cars lose value faster. Monthly payments can be lower if the car costs less. Loans may not be as long. Shorter loan terms mean higher monthly payments.

Leasing is like renting a car. You pay monthly but do not own the car. Lease payments are often lower than loan payments. You need good credit for leasing. At the end, you return the car. You can choose to buy the car after the lease ends. Leasing lets you drive new cars more often.

Credit: www.thelordlovesyou.com

Average Car Payment Statistics

The average car payment in the U.S. is $644 per month for new cars. For used cars, the average monthly payment is $488. Lease payments average around $531 per month. These figures change yearly.

Car payments differ across states. In California, the average payment is $700. Texas sees an average of $650. New York’s average car payment is $680. Southern states often have lower averages. Payments can vary widely.

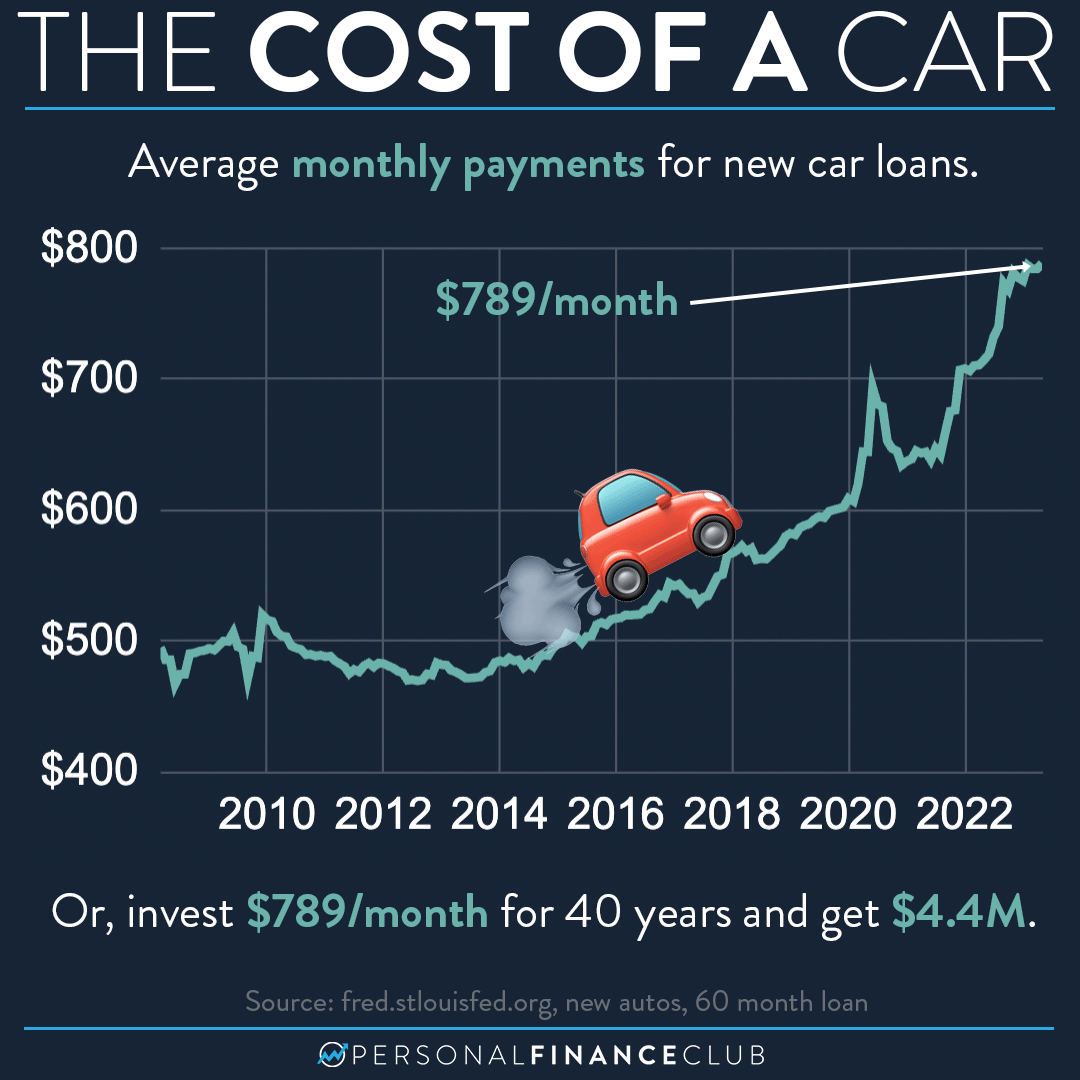

Car payments have risen over the years. Ten years ago, the average payment was much lower. Economic factors influence these trends. Interest rates play a big role. New technology in cars also impacts costs. Payments tend to increase each year.

Impact Of Credit Score On Car Payments

Credit scores usually range from 300 to 850. A higher score means better credit. A lower score means poor credit. Most people have scores between 600 and 750. A score above 700 is considered good. Scores below 600 are seen as risky by lenders. Regularly check your score. It can change over time.

Your credit score affects your loan’s interest rate. Higher scores get lower rates. Lower scores get higher rates. This means a higher monthly payment. A good score can save you money. Always aim for a better score. Pay your bills on time. Keep debts low. This helps improve your score.

Credit: www.reddit.com

Tips For Lowering Your Car Payment

Average car payments vary, but many pay around $500 monthly. Check interest rates and loan terms to reduce costs. Refinance options can also lower your monthly payments.

Improving Your Credit Score

A good credit score can help you get a lower interest rate. Pay all your bills on time. Reduce your credit card debt. Check your credit report for mistakes. Fix any errors quickly. These actions can make a big difference.

Choosing A Shorter Loan Term

A shorter loan term can save you money. You pay less interest. Monthly payments may be higher, but you save in the long run. Consider your budget carefully. Make sure you can handle the higher payments.

Making A Larger Down Payment

A larger down payment means you borrow less. This can lower your monthly payments. Save money before buying a car. A bigger down payment can also get you a better interest rate. Start saving early to make this possible.

Understanding Additional Costs

Car payments are not just the loan amount. Insurance premiums add to the monthly cost. They protect you in case of an accident. Costs vary by car type, age, and driver’s history.

Every car needs regular maintenance. Oil changes, tire rotations, and brake checks are common. Repairs can be expensive. Engine issues or transmission problems cost more. Plan for these expenses.

Buying a car involves taxes and fees. Sales tax varies by location. Other fees include registration and title costs. Some states have yearly fees. Add these to your budget.

Credit: www.personalfinanceclub.com

Frequently Asked Questions

What Is A Good Monthly Payment For A Car?

A good monthly payment for a car is typically 10-15% of your monthly income. Aim for affordability and budget balance.

How Much Is A $30,000 Car Payment For 60 Months?

A $30,000 car loan for 60 months, with an interest rate of 5%, results in a monthly payment of about $566.

What Is The Average Car Payment In The Us?

The average car payment in the US is about $570 per month for new cars and $430 for used cars.

Is $350 A Lot For A Car Payment?

A $350 car payment is moderate for most buyers. Affordability depends on your budget, income, and other expenses.

Conclusion

Understanding the average car payment can help you plan better. Monthly costs vary widely. Factors include credit score, loan term, and vehicle price. Research thoroughly before committing. Consider your budget carefully. Make informed decisions to avoid financial stress. Knowing these details can save you money.

Prioritize what fits your financial situation. Always check multiple financing options. By doing so, you’ll secure the best deal. Stay informed and drive smart.