When Can You Refinance a Car Loan: Ultimate Timing Guide

Refinancing a car loan can save you money. But when is the right time?

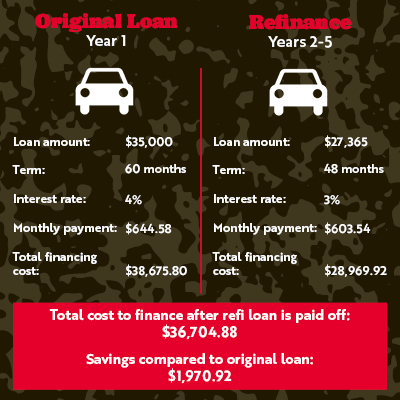

Refinancing a car loan can reduce your monthly payments or lower interest rates. Timing is key to making the most of this financial move. If your credit score has improved, or market interest rates have dropped, it might be a good moment to refinance.

Also, if you need to adjust your loan term for better flexibility, refinancing could help. Understanding the right time to refinance will ensure you maximize the benefits and avoid unnecessary costs. This guide will explain the best times to consider refinancing your car loan and how to identify the ideal moment to do so. Keep reading to make informed decisions about your car loan refinancing options.

Credit: www.gillelandchevrolet.com

Introduction To Car Loan Refinancing

Car loan refinancing means getting a new loan to replace your old one. This new loan usually has better terms. It could have a lower interest rate. It might also have a different loan length. People refinance to save money or to change their monthly payments.

Refinancing a car loan can have many benefits. You might get a lower interest rate. This can save you money over time. Monthly payments might become smaller. This can help with your budget. You could also pay off your loan faster. This means you will own your car sooner.

Credit: www.frontwavecu.com

Ideal Times To Refinance

Refinance your car loan at the end of a promotional period. Promotional rates often increase after a set time. You might save money by refinancing before the rate goes up.

If your credit score has improved, refinancing can help. A better credit score can get you a lower interest rate. This means you pay less each month. It’s a smart move to check your credit score often.

Economic Factors

Lower interest rates can save you money. Refinancing during this time might be smart. You could get a better deal. Monthly payments might be lower. This can help your budget. Keep an eye on rates. Act fast when they drop.

Sometimes, the market changes. These changes can affect your loan. It’s good to be aware of these shifts. If the market is favorable, refinancing might be wise. Always stay informed. This can help you make the best choice.

Credit: www.dixieautoloans.com

Personal Financial Changes

Refinancing a car loan can be considered after six months of payments. Improved credit scores and lower interest rates are key factors. Always assess your financial situation before making any decisions.

Increased Income

More income can help refinance a car loan. A higher salary means you might get better terms. Lenders see you as less risky. This could lead to lower interest rates. Your monthly payments could also be less. Overall, it can save you money.

Reduced Debt Levels

Less debt makes refinancing easier. Lower debt means you manage money well. Lenders trust you more. This can get you a better interest rate. Paying off debts can improve your credit score. This can also help with refinancing.

Vehicle-related Considerations

The age of your car matters. Most lenders prefer cars less than seven years old. Older cars may have less value. This can make refinancing harder. Check your car’s age before applying.

Your current loan balance also plays a role. Lenders want to know the amount you still owe. A high balance can be risky for them. It’s easier to refinance if you owe less.

Refinancing Process

Collect all important papers before starting. You’ll need your current loan details, proof of income, and your credit report. Also, have your car’s title ready. This helps speed up the process.

Compare different lenders to get the best rate. Look at interest rates, fees, and terms. Check reviews of each lender. Choose one that meets your needs. This can save you money in the long run.

Potential Risks

Some loans come with prepayment penalties. These fees apply if you pay off the loan early. It can make refinancing costly. Always check your loan agreement. Know if these penalties exist.

Refinancing may lead to extended loan terms. This means you pay for a longer time. While monthly payments might drop, total interest can rise. Be cautious. Understand the full cost of the loan.

Tips For Successful Refinancing

Get multiple refinance offers from different lenders. Look at the interest rates. Compare the loan terms. Check the monthly payments. Some lenders offer better terms. Others might have hidden fees. Choose the best offer for your needs.

Read all the loan documents carefully. Look for hidden fees. Understand the prepayment penalties. Some loans have special conditions. Make sure you know them all. This helps avoid surprises later.

Frequently Asked Questions

How Soon Can I Refinance My Car Loan?

You can typically refinance your car loan after 6 months. This allows time to build payment history. Check with your lender for specific requirements.

Does Refinancing A Car Hurt Your Credit?

Refinancing a car can temporarily lower your credit score. The hard inquiry and new loan impact your credit. Over time, timely payments on the new loan can improve your credit score.

How Hard Is It To Refinance A Car?

Refinancing a car is generally straightforward. Gather necessary documents, check your credit score, and compare offers from lenders.

What Disqualifies You From Refinancing A Car?

Poor credit score, insufficient income, negative equity, missed payments, and current loan terms can disqualify you from refinancing a car.

Conclusion

Refinancing a car loan can save money and reduce monthly payments. Evaluate your credit score and loan terms before deciding. Timing is crucial for refinancing; act when rates drop. Shop around for the best deals. Consider all costs involved. Make sure refinancing aligns with your financial goals.

Lower rates can lead to significant savings. Always read the fine print. A well-timed refinance can benefit your budget. Research thoroughly and choose wisely.