Do You Need Car Insurance for Doordash? Essential Facts

Yes, you need car insurance for DoorDash. Regular insurance may not cover delivery work.

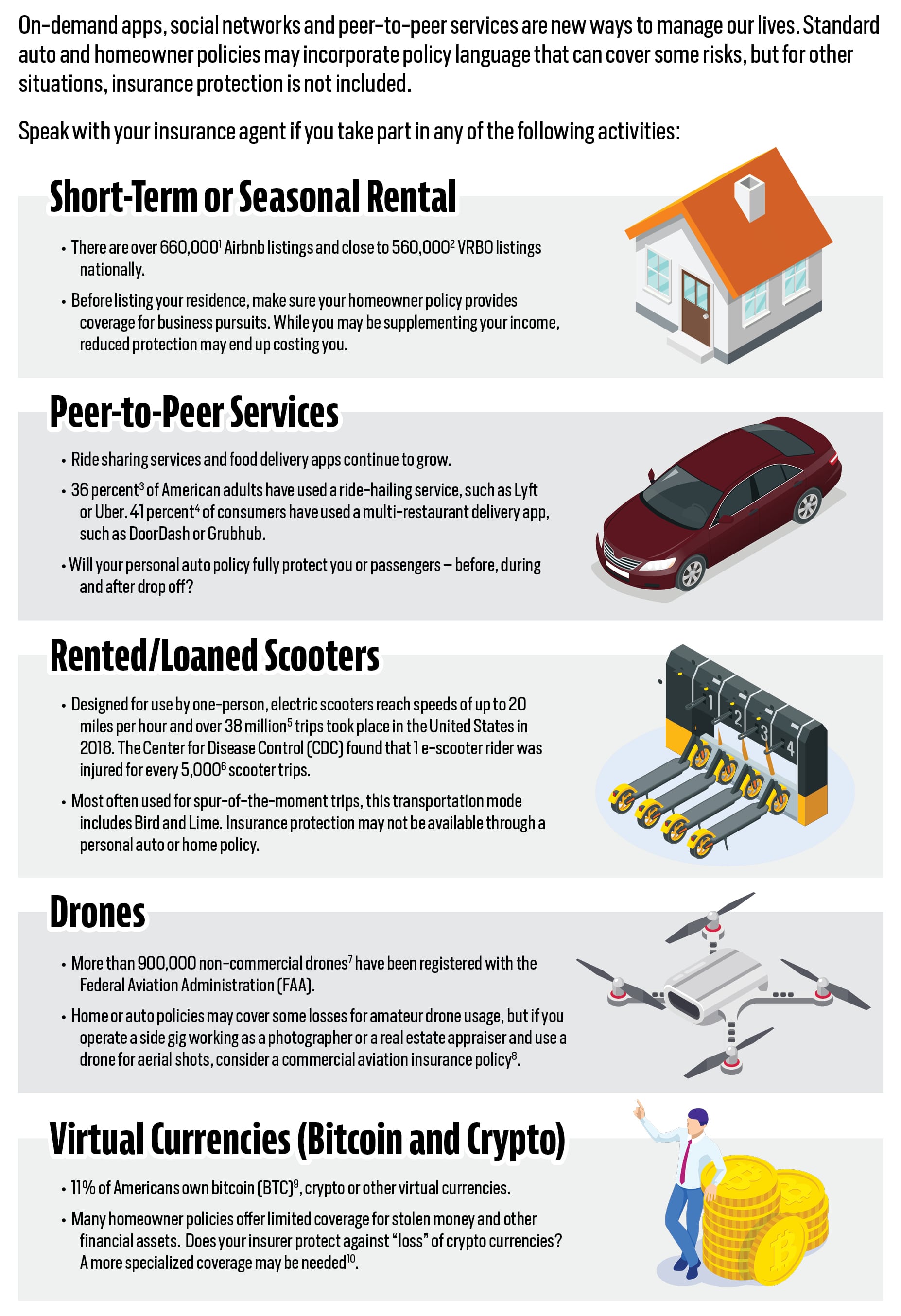

It’s important to understand the details. Driving for DoorDash involves using your car for business purposes. Regular car insurance usually covers personal use only. When you use your car for deliveries, it becomes a commercial activity. This change can impact your coverage.

If you get into an accident while delivering, your regular insurance might deny your claim. You may need special insurance called “rideshare” or “delivery” insurance. This type of insurance covers both personal and business use of your car. Understanding the right insurance can protect you from financial risks. It ensures you’re covered while making deliveries. This blog will help you understand car insurance needs for DoorDash drivers.

Legal Requirements

Each state has its own rules for car insurance. Some states need higher coverage. Others may have less strict rules. It is important to check your state laws.

Most states need at least basic liability insurance. This covers damages if you cause an accident. Understanding your state’s requirements is key. It helps you stay legal and safe.

Basic coverage is often not enough for delivery jobs. You may need extra coverage. This ensures you are fully protected. Comprehensive and collision coverage can help.

These coverages can protect your car from damage. They also cover theft and other risks. Always check your policy details. Make sure you have the right coverage for your needs.

Credit: www.agilerates.com

Personal Vs. Commercial Insurance

Personal insurance covers your car for everyday use. This includes driving to the store or visiting friends. Commercial insurance covers your car when you use it for work. This includes delivering food or packages.

If you deliver for Doordash, you need commercial insurance. Personal insurance may not cover accidents while working. Check with your insurance company. They can help you understand your coverage. Make sure you are fully protected on the road.

Doordash’s Insurance Policy

Doordash offers coverage for its drivers. This insurance helps protect you. It includes auto liability coverage. It covers damage to other vehicles. It covers injuries to others. It is active during deliveries. It is a backup to your personal insurance.

Coverage Details

The policy covers up to $1 million. It covers property damage. It covers bodily injury. It is active while delivering orders. It does not cover your car. Your own car insurance must cover your car.

Limitations And Exclusions

Doordash’s insurance has limits. It does not cover accidents when not delivering. It does not cover damage to your car. It does not cover theft. It does not cover personal belongings. It does not cover injuries to you. Your personal insurance must cover these.

Supplemental Insurance Options

Gap coverage fills the gap between personal and commercial use. It’s useful for drivers who work with Doordash. Some policies cover accidents during deliveries. Others cover theft and damage. It’s important to read the policy details. Understand what is covered and what is not.

Several companies offer gap coverage. Popular ones include Allstate, State Farm, and Progressive. Each provider has different plans. Compare their options. Look for affordable rates and good coverage. Check customer reviews. Make sure the provider has a good reputation.

Cost Of Insurance

Several factors can affect your insurance premiums. Your driving record is very important. If you have accidents, expect higher costs. The car’s make and model also matter. Expensive cars cost more to insure. Your age and gender can influence rates. Younger drivers often pay more. Where you live is another factor. Cities have higher premiums due to traffic. The coverage level you choose affects the price too. More coverage means higher costs.

There are several ways to save on car insurance. Shop around for the best rates. Compare different companies. Increase your deductible to lower premiums. Drive safely to avoid accidents. This helps keep costs down. Look for discounts from your insurer. Some offer savings for good drivers. Bundle your car insurance with other policies. This can reduce costs.

Credit: www.reddit.com

Claims Process

Driving for DoorDash requires car insurance to cover potential accidents. Standard policies may not cover delivery activities, so additional coverage is crucial.

Steps To File A Claim

First, call your insurance company. Give them details about the accident. They will ask for information. This includes the time, place, and what happened. Take pictures of the damage. Write down everything you remember. This helps your case. Then, file a police report. It is important. The insurance company will look at it. They may send someone to check your car. This is called an “adjuster.” They will decide how much the insurance will pay. Finally, stay in touch with your insurance. They will let you know what to do next.

What To Expect

The claims process may take some time. Be patient. Your insurance will guide you. They will explain what is covered. Repairs might be fast or slow. It depends on the damage. You might need a rental car. Ask your insurance if they cover it. Keep all your receipts. They are important. You will need them for reimbursement. Stay calm and follow the steps. Your car will be fixed soon.

Tips For Doordash Drivers

It’s key to keep your car insurance up to date. Driving for Doordash means extra wear and tear. Ensure your policy covers delivery driving. Personal insurance might not be enough. Check with your insurer. See if you need a commercial policy.

Don’t assume you have coverage. Always read your policy details. Many drivers miss this step. It can save you trouble later. Keep records of all your deliveries. You may need this if you make a claim. Stay safe and covered on the road.

Credit: www.mapfreinsurance.com

Frequently Asked Questions

What Disqualifies You From Doing Doordash?

Felony convictions, DUIs, violent crimes, or multiple driving violations can disqualify you from DoorDash. Incomplete background checks also disqualify.

What Kind Of Insurance Do You Need For Doordash?

You need auto insurance with delivery coverage to drive for DoorDash. Personal liability insurance is also recommended.

How Many Hours To Make $500 A Week With Doordash?

On average, making $500 a week with DoorDash requires around 20-25 hours of work, assuming $20-$25 per hour earnings.

What Are The Requirements To Drive For Doordash?

To drive for DoorDash, you need to be at least 18 years old, have a valid driver’s license, own a car or scooter, have insurance, and pass a background check.

Conclusion

Car insurance is crucial for Doordash drivers. It protects you from accidents and damages. Without it, you could face high costs. Insurance also ensures peace of mind while working. Check your policy’s coverage. Some policies may not cover delivery driving.

Consider commercial auto insurance if needed. Protect yourself and your vehicle. It’s better to be safe than sorry. Ensure you’re covered before accepting deliveries. This small step can save you from big troubles. Stay safe and drive responsibly.