What is the Average Interest Rate for a Car: 2026 Insights

The average interest rate for a car loan varies. It depends on several factors like credit score and loan term.

Buying a car is a big decision. It’s not just about choosing the right vehicle. You also need to think about financing options. Interest rates play a crucial role in this. Knowing the average car loan interest rate can help you make informed choices.

Whether you are buying a new car or a used one, understanding interest rates can save you money. This blog will guide you through what you need to know about car loan interest rates. We will break down the factors that influence these rates. Stay tuned to learn how to get the best deal on your car loan.

Credit: www.experian.com

Current Interest Rate Trends

Car loans are common. They help people buy cars. The interest rate is important. It affects the total cost. Right now, rates are changing. They can go up or down. Many factors influence this. It’s good to stay updated.

Many things affect car loan rates. Credit score is one. Better scores get lower rates. Another factor is the economy. Strong economy can mean higher rates. The loan term matters too. Longer terms may have higher rates. Car type also plays a role. New cars may have better rates.

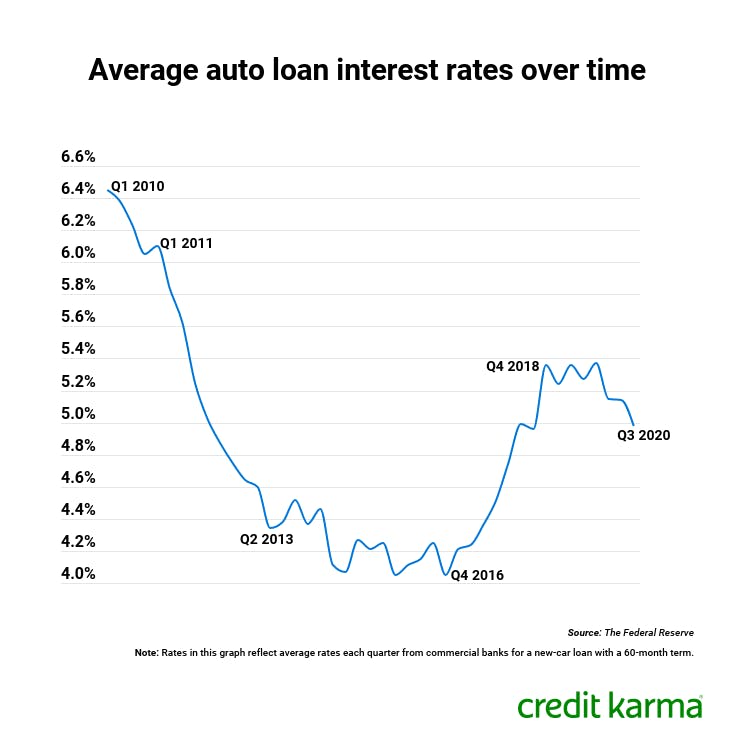

Historical Comparison

Over the past ten years, car loan interest rates have changed. Rates were lower in some years and higher in others. These changes affect how much people pay for car loans.

| Year | Average Interest Rate |

|---|---|

| 2013 | 4.5% |

| 2014 | 4.3% |

| 2015 | 4.2% |

| 2016 | 4.1% |

| 2017 | 4.4% |

| 2018 | 4.7% |

| 2019 | 4.6% |

| 2020 | 4.0% |

| 2021 | 3.9% |

| 2022 | 4.2% |

Regional Variations

Interest rates vary by country. In the USA, they may be around 4%. In Canada, rates can be 3.5% to 5%. European countries like Germany have rates close to 2%. In the UK, you might see rates of 3% to 4%. Japan often has lower rates, sometimes below 2%.

In the USA, interest rates can change by state. California rates might be higher than Texas rates. Cities also matter. New York City could have higher rates than smaller towns. Local banks and dealerships influence these rates. Always check local offers. It helps to compare different areas.

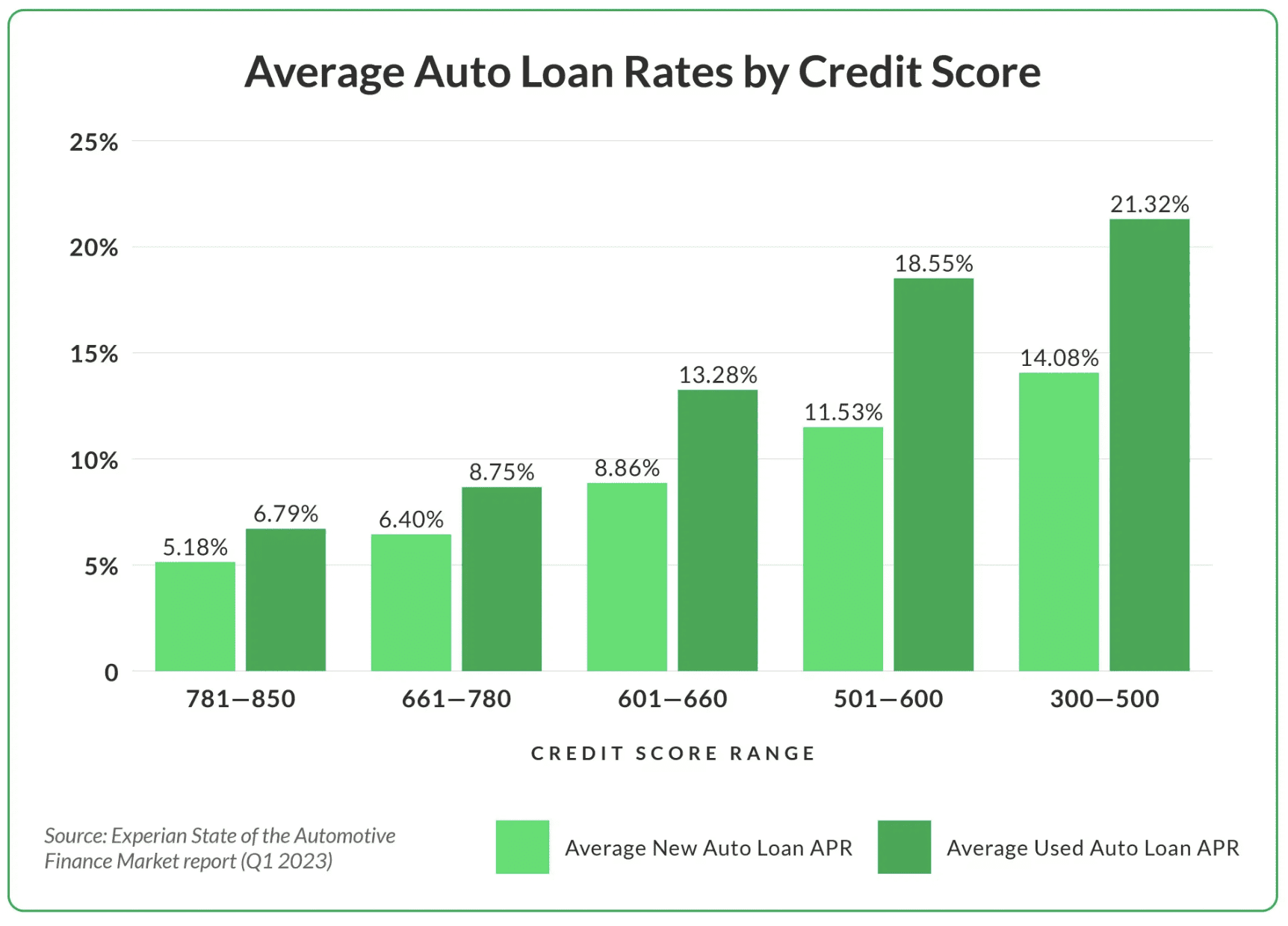

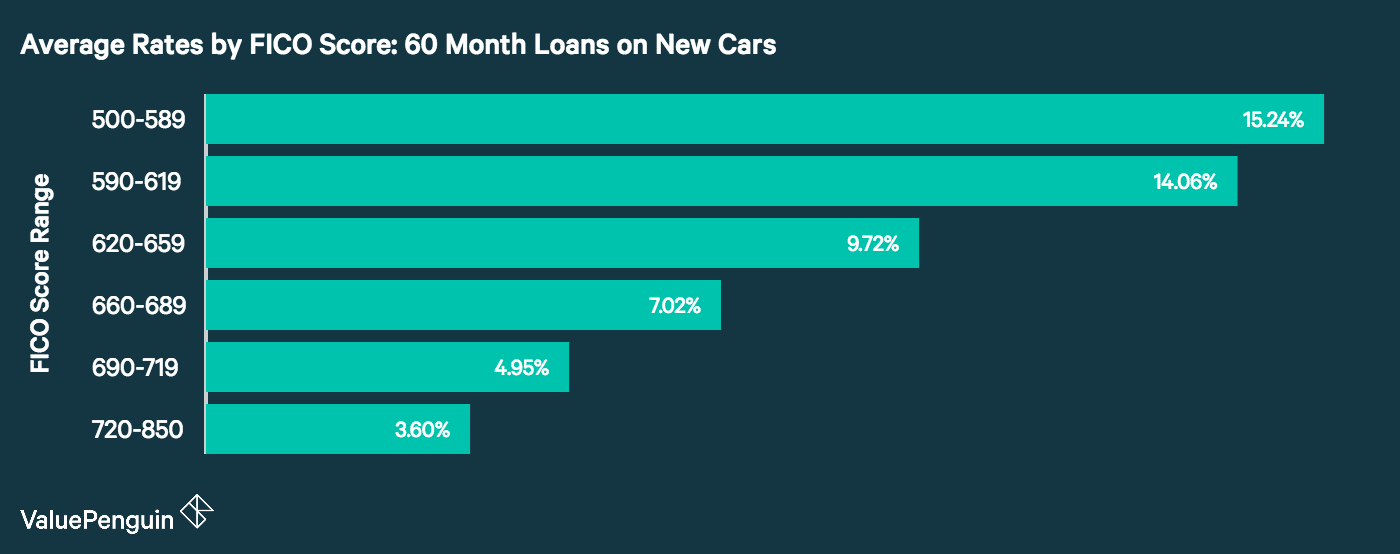

Credit Score Impact

A high credit score makes borrowing easier. Lenders trust you more. You get lower interest rates. Monthly payments are less. You save money in the long run. Better deals become available. More options for car loans open up.

A low credit score can make things hard. Lenders see more risk. Interest rates go up. Monthly payments increase. You pay more over time. Fewer loan options. Some lenders may say no. It can be stressful.

Loan Term Differences

Short-term loans usually have higher monthly payments. They often come with lower interest rates. You pay off the loan faster. This means less interest over time.

Long-term loans have lower monthly payments. They often come with higher interest rates. You pay more interest over the loan term. It takes longer to pay off the loan.

Credit: www.anpcorp.in

New Vs. Used Car Loans

New cars often have lower interest rates than used cars. This is because new cars have a higher value. They are seen as less risky by lenders. Used cars might have higher rates due to their lower value. Older cars can also be less reliable.

New car loans may have better rates. But they can be more expensive overall. Monthly payments can be higher. Used car loans might have higher rates. Yet, the total cost can be lower. Payments might be smaller. Consider both options carefully.

Economic Influences

Inflation can raise the cost of borrowing money. Car loans are no exception. When inflation is high, interest rates also go up. This means you pay more over time. Lower inflation often means lower rates. This can save you money. Always keep an eye on inflation trends. It helps you plan better.

Government policies can affect car loan rates. Regulations can make borrowing cheaper or more expensive. For example, a new tax can raise costs. Subsidies can lower them. Policies can change often. Stay informed. This helps you get the best deal.

Future Predictions

Future predictions suggest the average interest rate for a car loan might hover around 4-6%. Rates can vary based on credit scores and loan terms.

Expert Forecasts

Experts predict changes in car interest rates soon. Rates might go up or down. Economic shifts affect these rates. Inflation can cause rates to rise. Lower demand might make rates drop. Experts study many factors to predict these changes.

Potential Market Shifts

Market shifts impact interest rates too. New policies can change rates. Global events also play a role. Technology advancements may influence rates. Experts watch these trends closely. They provide updates to keep us informed. Stay aware of these shifts to plan better.

Credit: www.valuepenguin.com

Frequently Asked Questions

What Is The Current Car Loan Interest Rate?

The current car loan interest rate varies. On average, it ranges from 3% to 12%. Your credit score, loan term, and the lender will determine the exact rate.

How Can I Get A Low Car Loan Rate?

To secure a low car loan rate, maintain a good credit score. Shop around, compare offers, and consider a shorter loan term.

Does The Interest Rate Depend On The Car’s Age?

Yes, the interest rate often depends on the car’s age. New cars generally have lower rates compared to used cars.

How Does My Credit Score Affect Car Loan Rates?

Your credit score significantly impacts car loan rates. Higher scores typically receive lower interest rates, reflecting lower risk to lenders.

Conclusion

Understanding average car loan interest rates helps make informed decisions. Rates vary widely. Factors include credit score, loan term, and market trends. Always shop around for the best deal. Compare offers from different lenders. Consider your financial situation. Lower rates save money over time.

Educate yourself about loan options. Make a smart choice. Ensure your car loan fits your budget. Happy car shopping!