Can I Add Someone to My Car Insurance: Simple Guide

Yes, you can add someone to your car insurance policy. This process is often simple and beneficial.

It ensures that the new driver is covered in case of an accident. Adding someone to your car insurance can provide peace of mind. Maybe it’s a family member, a partner, or a friend who will use your car regularly.

Including them on your policy helps avoid potential legal and financial issues. It’s important to understand how this works, what information is needed, and any potential changes in your premium. This blog post will guide you through the steps to add someone to your car insurance and explain why it might be a good idea. Let’s explore the details and see how you can make your car insurance more comprehensive.

Credit: clearsurance.com

Why Add Someone To Your Car Insurance

Adding someone to your car insurance can save money. Shared policies are often cheaper. New drivers can gain experience. Teen drivers can practice under your insurance. Family members can borrow the car. This can be very helpful. Emergencies happen. Having an extra driver can be useful.

There are risks involved. Adding a driver can increase premiums. If they have accidents, your rate may go up. Young drivers can be risky. They may have higher accident rates. This can affect your policy. There is also a risk of policy cancellation. If the added driver breaks rules, you may face problems.

Who Can Be Added To Your Policy

You can add family members or other drivers who live with you to your car insurance. This includes spouses, children, or roommates who use your vehicle. Ensure all drivers are listed to avoid issues with coverage.

Family Members

Adding family members to your car insurance is common. Parents often add their teens. Spouses usually share a policy. Siblings living together can be on the same plan. Make sure they live in your home. Immediate family members like parents, children, and siblings can be added. Everyone must have a valid driver’s license.

Friends And Roommates

Friends and roommates can also be added to your car insurance. They must live with you. They need to have a valid driver’s license. Adding them can save money. It can make things easier. Roommates often share cars. Friends may drive your car often. Be sure to list them on your policy. This can avoid problems later.

Eligibility Criteria

Most insurance companies prefer drivers who are at least 18 years old. Experience matters too. New drivers may face higher premiums. Insurance companies check if the person has been driving for a few years.

A clean driving record is crucial. Accidents or tickets can raise insurance costs. Insurance companies look for drivers with no recent violations. Safe drivers often get better rates.

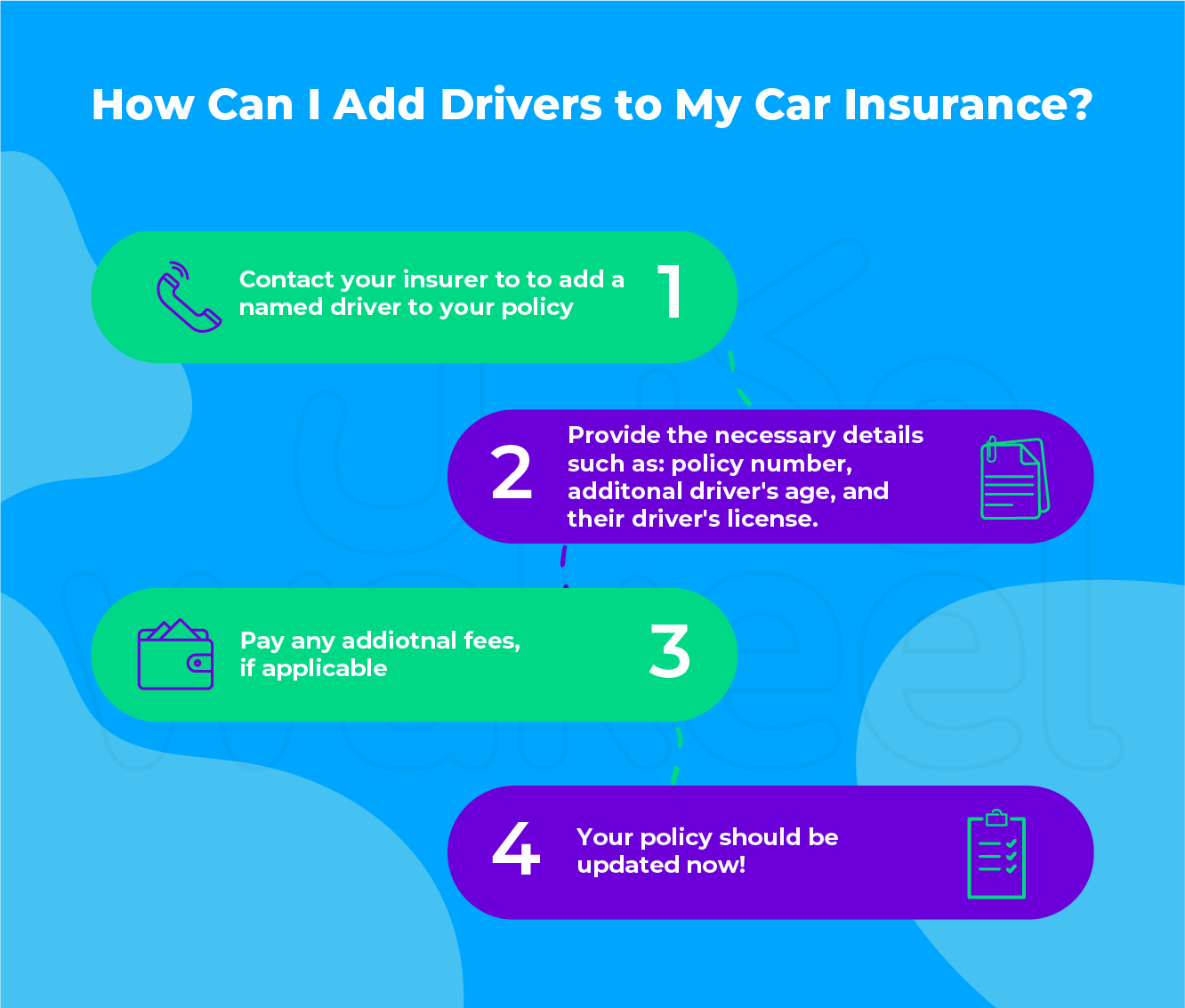

Steps To Add A Driver

First, call your insurance company. Tell them you want to add a driver. The new driver must meet certain criteria. The company will ask for details. Provide the driver’s full name and age. Also, give their driving license number. Mention their driving history too. This helps in calculating the premium.

Give the insurance company the new driver’s information. Include their address and how they use the car. The insurance provider needs to know if they drive often. This affects the insurance cost. Be honest with all details. Accuracy is crucial for the policy.

Impact On Premiums

Adding someone to your car insurance can change your premiums. Age of the added driver matters a lot. Young drivers often increase costs. Driving experience is another factor. More experienced drivers may keep costs lower. The driving record of the added person also impacts premiums. A clean record can help keep costs down. The type of car they drive can affect premiums too. High-performance cars might increase costs.

Choose drivers with clean records. This can help keep costs lower. Enroll in a defensive driving course. This could reduce premiums. Consider increasing your deductible. Higher deductibles can lower premiums. Shop around for better rates. Different insurers offer different prices. Bundle your insurance policies. This often results in discounts.

Credit: www.lemonade.com

Documentation Needed

To add someone to your car insurance, they must have a valid driver’s license. This proves they are legally allowed to drive. Make sure the license is not expired. The insurance company will need a copy of this document.

Proof of residence is another important document. This shows where the person lives. Utility bills or a lease agreement can be used. The address should match the one on the driver’s license.

Common Mistakes To Avoid

Many people forget to check their car insurance policy details before adding someone. Failing to inform your insurer can lead to complications. Ensure the added driver meets all requirements to avoid issues.

Not Informing Your Insurer

Always tell your insurer if you want to add someone to your car insurance. Failing to do so might lead to problems. They need to know who drives your car. This helps them update the policy. If they don’t know, your policy could be invalid. This can cause trouble if there’s an accident.

Failing To Update Policy Details

Make sure you update your policy details. This includes new drivers. Also, inform them of any changes in address. Even small details matter. Keeping your insurer informed helps avoid surprises. It ensures you are fully covered. Always check your policy documents. Confirm all details are correct.

Credit: www.wakeel.com

Frequently Asked Questions

Can I Add Someone To My Car Insurance?

Yes, you can add someone to your car insurance. Contact your insurance provider and provide the necessary information about the additional driver.

How Do I Add A Driver To My Policy?

To add a driver, contact your insurance company. Provide details such as the new driver’s name, age, and driving history.

Does Adding A Driver Increase My Premium?

Adding a driver can increase your premium. The cost depends on the new driver’s age, driving record, and other factors.

Can I Add A Temporary Driver To My Insurance?

Yes, you can add a temporary driver. Contact your insurance provider and specify the duration and details of the additional driver.

Conclusion

Adding someone to your car insurance is possible and often beneficial. It can provide extra coverage and peace of mind. Review your policy terms first. Contact your insurance provider for specific steps and requirements. Always ensure the added person meets the eligibility criteria.

This way, you can avoid any potential issues. Remember, clear communication with your insurer is key. Taking these steps can help you make an informed decision. By doing so, you maintain adequate coverage for all drivers.