How Long to Keep Car Insurance Records: Essential Guidelines

You should keep car insurance records for seven years. This helps in case of disputes or claims.

Car insurance records are vital documents. They include policy details, payments, and claim history. Keeping these records organized is essential. They can protect you in legal matters. They also help when switching insurance companies. This guide will explain why and how long to keep these records.

It will help you stay prepared and avoid issues. Understanding this topic can save you time and hassle. So, let’s dive in and learn more about managing your car insurance records efficiently.

Importance Of Keeping Car Insurance Records

Keeping car insurance records is very important. Some places have laws that say how long to keep them. These laws help protect you. They also help if you have to prove you had insurance.

Old records can help you. They show your payment history. They also show any claims you made. This can help if you switch insurance companies. They might give you a better deal. Keeping records is smart. It can save time and money later.

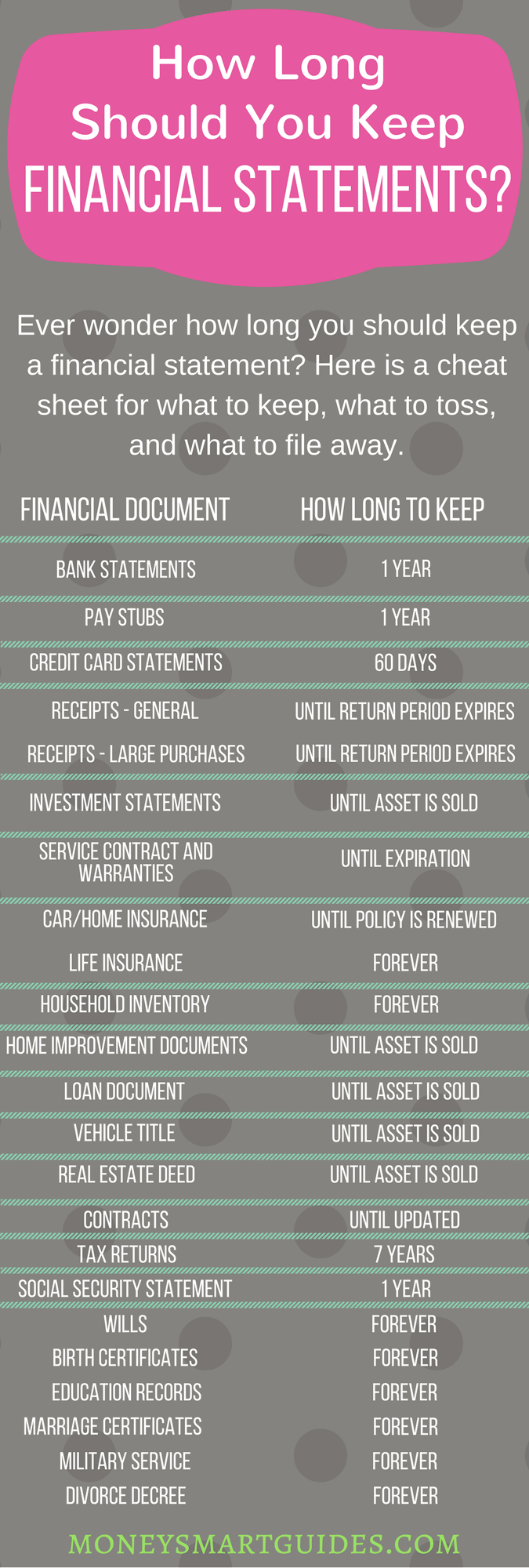

Credit: www.moneysmartguides.com

Types Of Car Insurance Records

Keep policies and coverage documents as long as they are active. These papers prove your coverage. They show what is covered and the limits. Store these safely. You might need them for renewals or claims. If you switch companies, keep the old ones for at least seven years.

Claims and correspondence are also important. They include letters, emails, and reports related to claims. Keep these for at least seven years. This helps if there are disputes later. You will have proof of what happened. Store them in a safe place.

Recommended Duration To Retain Records

Keep records of active car insurance policies for the duration of the coverage. These documents are essential for claims or disputes. Store them in a safe place. Ensure easy access whenever needed. Review them periodically.

Keep records of expired car insurance policies for at least five years. These documents may be needed for legal purposes. Some states require longer retention. Check your local laws. Keep them organized and secure.

Credit: www.youtube.com

Legal Timeframes For Record Retention

Car insurance records should be kept for at least seven years. This ensures you have documentation for any disputes. Always check local regulations for specific requirements.

State Regulations

Each state has its own rules for car insurance records. Some states may ask you to keep records for three years. Other states may ask for five years. Check the laws in your state to know the exact time. Keeping records can help if there are disputes or claims. Always keep your records organized and safe.

Federal Guidelines

Federal guidelines also play a part in keeping records. The IRS recommends keeping financial documents for seven years. This includes car insurance records. It helps with tax issues and audits. Keep your records in a secure place. This way, you can access them when needed.

Best Practices For Organizing Records

Keep car insurance records for at least three years. This helps with claims and verifying coverage history. Proper organization ensures easy access when needed.

Digital Vs. Physical Storage

Digital storage saves space and is easy to search. Use cloud services like Google Drive or Dropbox. This way, you can access records anytime. Make sure to back up your files. Physical storage involves keeping paper records. Use labeled folders and a filing cabinet. Store them in a safe, dry place.

Categorization Tips

Organize records by year and type. Create separate folders for claims, policy documents, and correspondence. Use color-coded labels for quick access. For digital files, create clear, named folders. Regularly update and sort your records. This makes finding documents easier. Dispose of old records safely. Shred paper documents to protect personal information.

Credit: www.youtube.com

Benefits Of Proper Record Keeping

Keeping car insurance records helps with claims. You can show proof of coverage quickly. This speeds up the claims process. You need dates and details of your coverage. This makes it easier for the insurance company.

Proof of coverage is important. It shows you have insurance. This is needed when renewing your policy. Keep records to show you were always covered. This can help you avoid gaps in coverage. Store your insurance cards and policy documents safely.

When To Dispose Of Records

It’s important to keep car insurance records for a few years. After this period, you should shred them. Shredding protects your personal information. Use a shredder for this task. If you don’t have one, find a local shredding service. They can help dispose of your documents safely. Never throw them in the trash without shredding.

Old digital files need to be deleted carefully. Ensure you use secure methods. First, delete the files from your device. Then, empty the recycle bin. Use software to permanently erase data. This ensures the files can’t be recovered. Be careful with personal information. Always keep your data safe.

Tools For Managing Insurance Records

Many people use software to manage records. Some software can store digital copies of documents. This makes it easy to find and access them. Popular software options include cloud storage and apps. Examples are Google Drive and Dropbox. These tools offer security and ease of access. Some apps also offer reminders for renewals. This helps in keeping track of important dates.

Some prefer manual filing systems. This involves physical files and folders. Each document gets a specific place. Use labels to organize files. This makes it easy to find them later. Keep files in a safe place. Ensure the area is dry and secure. Regularly check and update files. This helps in maintaining an organized system.

Frequently Asked Questions

Should I Shred Insurance Statements?

Yes, you should shred insurance statements. Shredding protects personal information and prevents identity theft. Keep records for a few years before shredding.

How Long Do You Keep Insurance Bills?

Keep insurance bills for at least 7 years. This helps with tax purposes, disputes, and claims. Store them securely.

Is There Any Reason To Keep Old Life Insurance Policies?

Yes, old life insurance policies can offer benefits like cash value accumulation and lower premiums compared to new policies.

How Long To Keep Documents Before Shredding?

Keep tax documents for seven years. Retain employment records for three years. Hold onto medical records indefinitely. Store utility bills and bank statements for one year. Shred sensitive documents once they are no longer needed. Always follow specific guidelines for your location and type of document.

Conclusion

Keeping car insurance records is crucial. Store them for at least five years. They help during claims and disputes. Old records may be useful for future reference. Organize them well for easy access. Digital copies are convenient and safe. Protect sensitive information to prevent identity theft.

Regularly review and update your files. Responsible record-keeping saves time and stress. Stay prepared and informed. Manage your car insurance records wisely.