How Much is Gap Insurance on a Car Loan: Essential Guide

Are you purchasing a car and wondering how much gap insurance will cost on your car loan? You’re not alone.

Many car buyers often overlook this crucial aspect of car financing, only to realize its importance later. But you’re already ahead by seeking this information now. Understanding the cost of gap insurance can save you from unexpected financial stress down the line.

Imagine driving off the lot with your new car, feeling the thrill of ownership. Now, picture how quickly that excitement could fade if an accident occurs and your car is totaled. Your car insurance might not cover the full amount you owe on your loan, leaving you with a hefty bill. This is where gap insurance becomes your financial hero, stepping in to cover the difference. We’ll delve into what gap insurance is, how much it typically costs, and why it might be a wise investment for you. By the end, you’ll have a clear understanding of how this small addition to your insurance plan can provide immense peace of mind. So, stick around, because this knowledge could save you a significant amount of money and stress in the future.

Credit: www.progressive.com

What Is Gap Insurance?

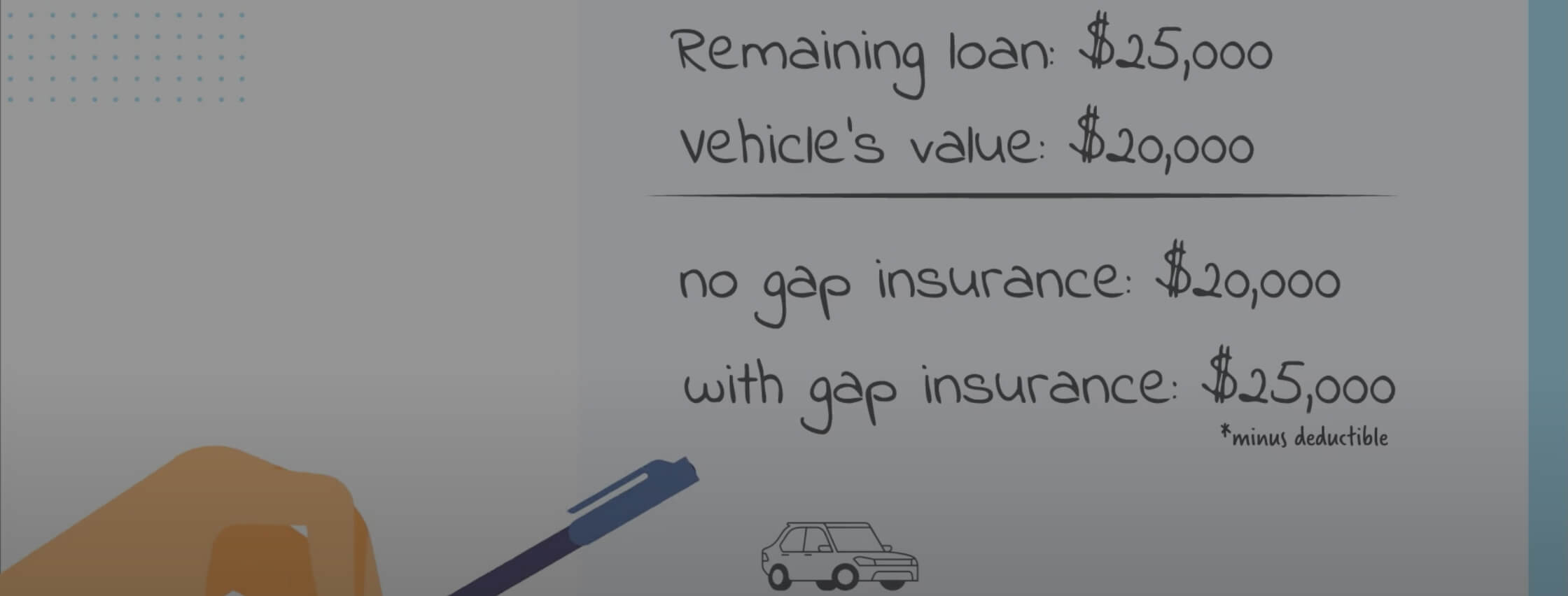

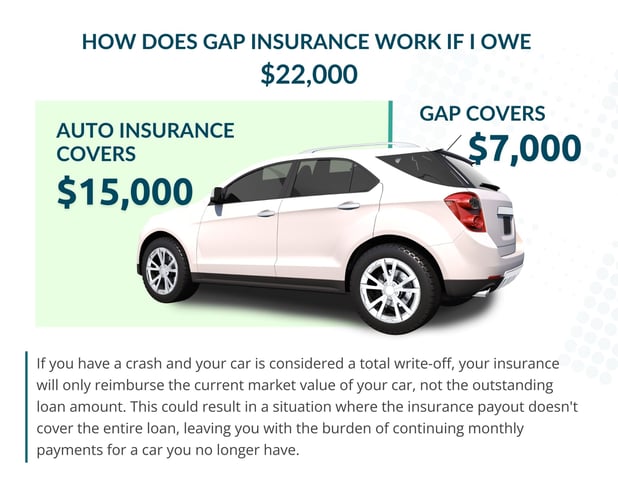

Gap insurance helps when a car is totaled or stolen. It covers the difference between the car’s value and the loan amount. This is important for new cars. New cars lose value quickly. Standard insurance might not cover the full loan amount. Gap insurance fills that gap. It ensures you aren’t stuck paying a loan for a car you no longer have.

It’s helpful for cars with low down payments. Or for long-term loans. Without it, you might owe more than the car’s worth. Gap insurance is a smart choice for many. It offers peace of mind. Knowing you’re protected is reassuring.

Purpose Of Gap Insurance

Gap insurance helps when a car is totaled or stolen. It covers the difference between the car’s value and the loan balance. This is important if the car’s value is less than the loan amount. Standard insurance only pays the car’s current value. Gap insurance steps in to fill this gap. It prevents financial stress for car owners.

This insurance safeguards your finances. It means you won’t pay out of pocket. This is crucial if you owe more than the car’s value. Gap insurance offers peace of mind. It ensures you aren’t stuck with a big loan. Without it, you might face debt even after losing the car. Financial security is a key benefit of having gap insurance.

Factors Influencing Gap Insurance Cost

The cost of gap insurance can vary based on the car type. Sports cars and luxury cars often have higher insurance costs. These cars are usually more expensive to repair or replace. Family cars or economy models might have lower costs. Insurers see these cars as less risky.

The amount of your car loanimpacts gap insurance cost. A larger loan means a higher insurance cost. This is because the insurer covers the gap between the car’s value and the loan amount. Smaller loans usually mean lower insurance costs. Insurers have less to cover, reducing the cost.

Credit: www.skylacu.com

Average Cost Of Gap Insurance

Gap insurance costs can vary widely. Most people pay between $20 to $40 a year. Some may pay up to $50 annually. Prices differ based on the car and the lender.

Monthly premiums might seem low at first. Annual premiums can save money over time. Paying once a year is often cheaper. Monthly payments might add up. Think about what fits your budget best.

Where To Purchase Gap Insurance

Many people buy gap insurance at the dealership. It’s easy and quick. The cost can be added to the car loan. This means you pay slowly over time. But it might be more expensivethan other places. Always check the price first. Compare it with other options. Ask questions if you don’t understand. A good deal can save money.

Big insurance companies also offer gap insurance. This option can be cheaper. You pay for it separately from the car loan. This makes the monthly car payment lower. But remember to read the terms carefully. Not all plans are the same. Some might cover more things. Others might have limits. Choose what is best for you and your car.

Is Gap Insurance Worth It?

Gap insurance costs vary, typically ranging from $20 to $40 annually added to your car loan. It covers the difference between your car’s value and what you owe, protecting against financial loss in case of theft or accident. This small investment offers peace of mind during uncertain times.

Pros And Cons

Gap insurancecovers the difference between what you owe and your car’s value. It can be helpful if your car is totaled or stolen. This insurance can save you money if you owe more than the car’s worth. It gives peace of mind. You won’t pay out-of-pocket in a bad situation.

But there are downsides. Gap insurance costs extra. Not everyone needs it. If you paid a large down payment, it may be unnecessary. Sometimes, your loan already includes gap coverage. Understand your loan terms. Check before buying extra insurance.

Situations Necessitating Gap Insurance

- Buying a car with a small down payment

- Financing for a long term

- Car value drops quickly

- High-interest loans

- Leasing a vehicle

These situations can make gap insurance valuable. It protects your finances. Avoid paying more than your car’s worth. Look at your needs. Decide if gap insurance is right for you.

How To Save On Gap Insurance

Bundling Discountscan help reduce costs. Many providers offer discounts when you combine services. You can bundle gap insurance with your car insurance. This means one bill and a lower price. Always ask your provider about these options. It’s an easy way to save money.

Comparing Quotesis also important. Different companies have different prices. Some might offer a better deal. Always get quotes from several places. Look for the best offer. This can help you find the cheapest gap insurance. Ask questions if something is not clear. Understanding the details can save you money.

Common Misconceptions

Many think that gap insurance covers everythingif a car is lost. This is not true. It only covers the difference between the car’s value and the loan balance. It does not pay for other costs like missed payments or extra fees. Knowing what is covered helps avoid surprises.

Not everyone can get gap insurance. Eligibility depends on the car’s ageand type. New cars often qualify, but old cars might not. Lenders might have their own rules too. Check with the insurer to see if your car qualifies.

Frequently Asked Questions

Is Gap Insurance Worth It On A Car Loan?

Gap insurance is worth it if your car loan exceeds the car’s value. It covers the difference if your car is totaled or stolen. New car buyers or those with low down payments benefit most. Evaluate your financial situation and car depreciation rate to decide its necessity.

What Is A Fair Price For Gap Insurance?

A fair price for gap insurance typically ranges from $20 to $40 annually. Prices vary based on coverage and provider. Always compare options for the best deal.

What Is The Average Price Of Gap?

The average price of Gap clothing varies by item and location. Prices typically range from $20 to $100. Sales and promotions can offer significant discounts. For the most accurate pricing, visit Gap’s official website or local store.

How Much Does It Cost To Get A Gap?

Getting a tooth gap can cost between $50 to $300. Prices vary based on location and dentist expertise.

Conclusion

Gap insurance can be a smart choice for car loans. It covers the difference if your car is totaled or stolen. Costs vary, so compare options. Check with your lender and insurance company. Sometimes it adds peace of mind. Other times, it might not be necessary.

Understand your car’s value and your loan details. Think about your budget and needs. This will help you decide. A little research can save money. Ensure you make an informed choice. Protect yourself from unexpected financial loss. Your car and wallet will thank you.