How Old Do You Have to Be for Car Insurance: Age Requirements Explained

You need to be at least 16 years old to get car insurance. The minimum age can vary by state and country.

Some places may require you to be 18 or older. Understanding the age requirements for car insurance is crucial. Each state has different rules and regulations. This can lead to confusion for young drivers and their parents. Car insurance is important for all drivers, but younger drivers face unique challenges.

Age restrictions are in place for a reason. They help ensure that drivers have enough experience. This reduces risk and accidents on the road. Learning about these rules will help you get insured properly. It will also prepare you for safe driving habits. Let’s explore the age requirements and what they mean for new drivers.

Credit: www.policygenius.com

Minimum Age For Car Insurance

In many places, you need to be at least 18 years old to get car insurance. Some states allow younger drivers to have insurance. This is often with a parent or guardian.

Different states have different rules. In some states, you can get insurance at 16. In others, you must wait until 18. Checking your state’s rules is important. Always know the law where you live.

Teen Drivers And Insurance

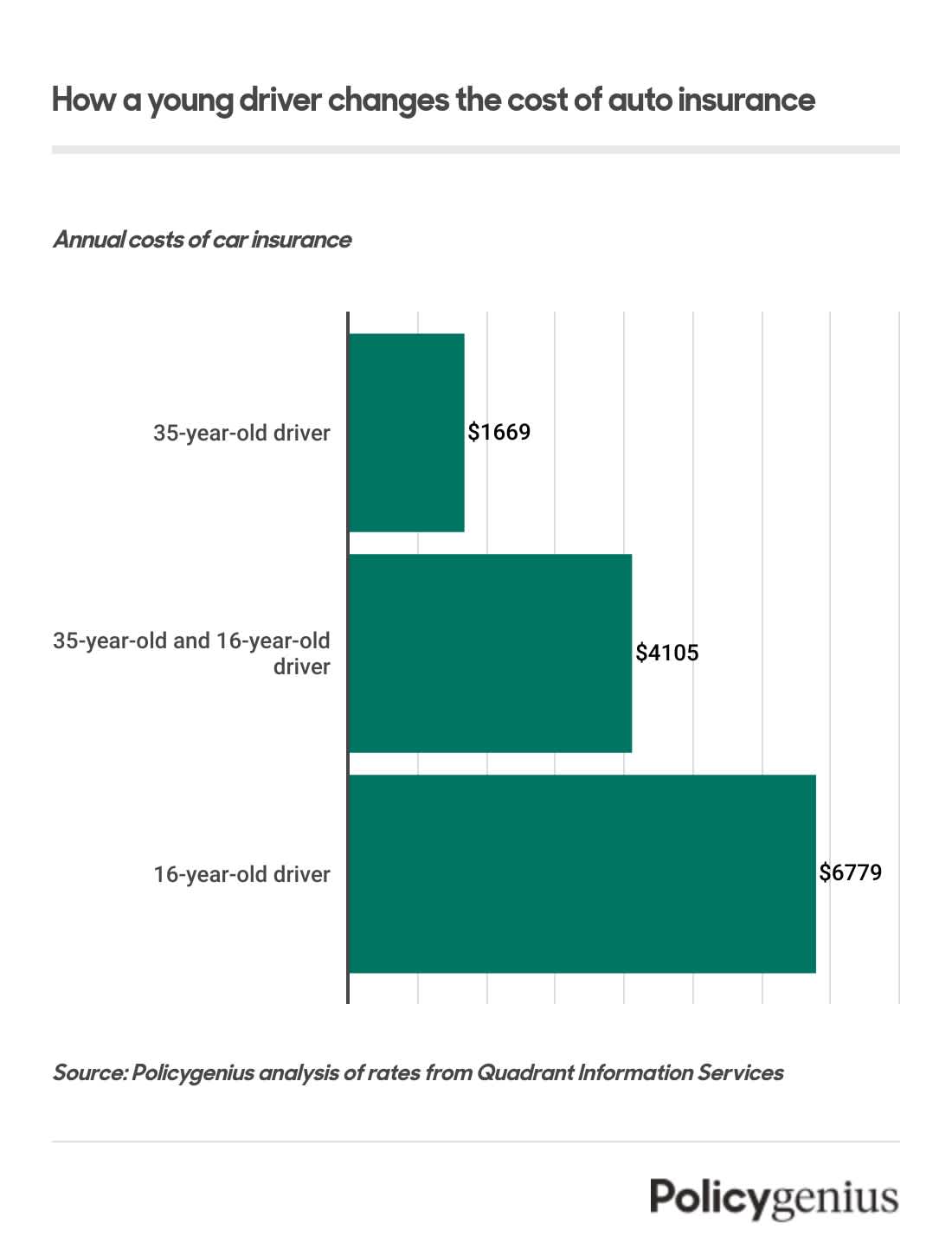

Parents play a big role in teen driving. They must guide and teach. They also need to add teens to their insurance. This can be costly. Insurance companies see young drivers as risky.

Teen drivers face high premiums. This is due to their inexperience. They are more likely to have accidents. Insurance companies charge more to cover this risk. Parents should shop around for the best rates.

Young Adult Drivers

Car insurance for young adult drivers can be expensive. Insurance companies see drivers aged 18-25 as high-risk. This age group has less driving experience. They are more likely to be in accidents. But there are ways to lower costs. Discount opportunities can help.

There are several discounts available. Good student discounts can save money. A good GPA can help. Safe driver discounts reward those with clean records. Bundling insurance can also reduce costs. Combining car and home insurance often leads to savings.

Senior Drivers

Car insurance for senior drivers varies by location. Generally, drivers must be at least 18 years old to get insurance. Some insurers offer special rates for seniors over 65.

Premium Adjustments

Senior drivers often face higher premiums for car insurance. Age can impact reaction times and vision. These factors make insurers see more risk. Experience on the road can help. Long history with few claims may lower costs. Safety courses for seniors can also reduce rates. Some companies offer discounts for completing such courses.

Special Considerations

Many insurers have special policies for senior drivers. These policies may include roadside assistance. Coverage might include medical expenses from accidents. Some providers offer flexible payment plans. These plans help seniors manage costs. Review policy details carefully. Ensure it meets all needs and offers good protection.

Student Drivers

Student drivers can save money on car insurance. Good grades often lead to discounts. Insurance companies reward students who work hard. Grades matter. Better grades mean lower premiums. Parents can save too. Discounts apply to high school and college students. A GPA of 3.0 or higher usually qualifies. Report cards are important. Keep them handy. Share them with your insurance agent. Savings can be significant.

Driver’s education can reduce insurance costs. Courses teach safe driving. Insurance companies value these courses. They often offer discounts. Completion certificates are necessary. Show them to your agent. Teen drivers benefit the most. Schools and online programs offer classes. Learning safe driving is key. Knowledge and skills improve. Accidents may decrease. Safe drivers get better rates.

Temporary And Provisional Licenses

Insurance for drivers with temporary or provisional licenses can be more expensive. Young drivers are seen as high risk. Their inexperience leads to more accidents. Insurance companies charge higher rates.

Getting a full license can lower insurance costs. It shows more driving experience. Some insurers offer discounts. This helps to reduce premiums. Always check with your insurance provider.

Adding A Young Driver To An Existing Policy

Adding a young driver to your policy has benefits. It simplifies managing insurance. A family plan can lower the costs. Parents often get discounts when they add their child. This can save money on premiums. It makes things easier for everyone.

Family Plan Benefits

A family plan offers many benefits. It can be cheaper than separate policies. You can get multi-car discounts. This helps save more money. The young driver gains experience. This improves their driving over time. The whole family benefits.

Cost Implications

Adding a young driver can raise your premium. Insurance companies see young drivers as high-risk. This means higher costs. But, the benefits can outweigh the extra cost. You save more with family discounts. It’s a smart way to manage insurance costs.

Credit: www.policygenius.com

Tips For Lowering Premiums For Young Drivers

Young drivers can lower their premiums by taking safe driving courses. These courses teach good habits and help avoid accidents. Insurers often give discounts to those who complete them. It’s a great way to save money and stay safe on the road.

Bundling car insurance with other policies can reduce costs. For example, combine home and auto insurance. Many insurers offer discounts for this. It’s a simple way to lower premiums. Save money by keeping all insurance with one company.

Credit: www.progressive.com

Frequently Asked Questions

Can A 17 Year Old Get Their Own Car Insurance?

Yes, a 17-year-old can get their own car insurance. Some insurance companies require a parent or guardian to co-sign the policy.

What’s The Cheapest Car To Insure At 17?

The cheapest car to insure at 17 is often a used, smaller engine car like the Ford Fiesta.

How Much Is Insurance For A New Driver Under 18?

Insurance for a new driver under 18 typically costs between $2,000 and $5,000 annually. Rates vary by location and insurer.

Can I Get Insurance On My Own At 16?

No, you cannot get insurance on your own at 16. Most insurance providers require policyholders to be 18 or older.

Conclusion

Understanding the age requirements for car insurance is crucial. Young drivers face higher rates. Experience and age can lower costs. Teens should consult parents for advice. Compare different insurance providers for the best deal. Always review your policy details. Proper research helps save money.

Safe driving habits benefit all drivers. Stay informed about insurance changes. Make smart decisions for your car insurance needs.