Is Car Insurance Mandatory in USA: Essential Facts You Need to Know

Yes, car insurance is mandatory in the USA. Each state has its own requirements, but all states require some form of auto insurance.

This ensures drivers can cover costs in case of accidents. Driving in the USA comes with responsibilities. One of the most important is having car insurance. Without it, you could face serious legal and financial consequences. Understanding the rules can be confusing, especially with each state having different requirements.

But knowing the basics can help you stay on the right side of the law. It also ensures you are protected in case of an accident. This blog will guide you through the essentials of car insurance in the USA. We’ll explain why it’s necessary and how it can protect you. Whether you’re a new driver or just need a refresher, read on to learn more.

Credit: 1800lionlaw.com

Introduction To Car Insurance

Car insurance in the USA is mandatory in most states. It helps cover costs if an accident happens. Always check state laws for specific requirements.

What Is Car Insurance?

Car insurance is a contract between you and an insurance company. It helps cover costs if you are in a car accident. The insurance company helps pay for damages. This can include repairs and medical bills. You pay a monthly fee called a premium. In return, the company helps you when something bad happens.

Importance Of Car Insurance

Car insurance is very important. It protects you and others on the road. If you cause an accident, it helps pay for damages. This includes fixing cars and medical care. Without insurance, you might have to pay a lot of money. Some states require car insurance by law. Even if it is not required, it is wise to have it. It helps you feel safe and secure.

Credit: smartfinancial.com

Legal Requirements

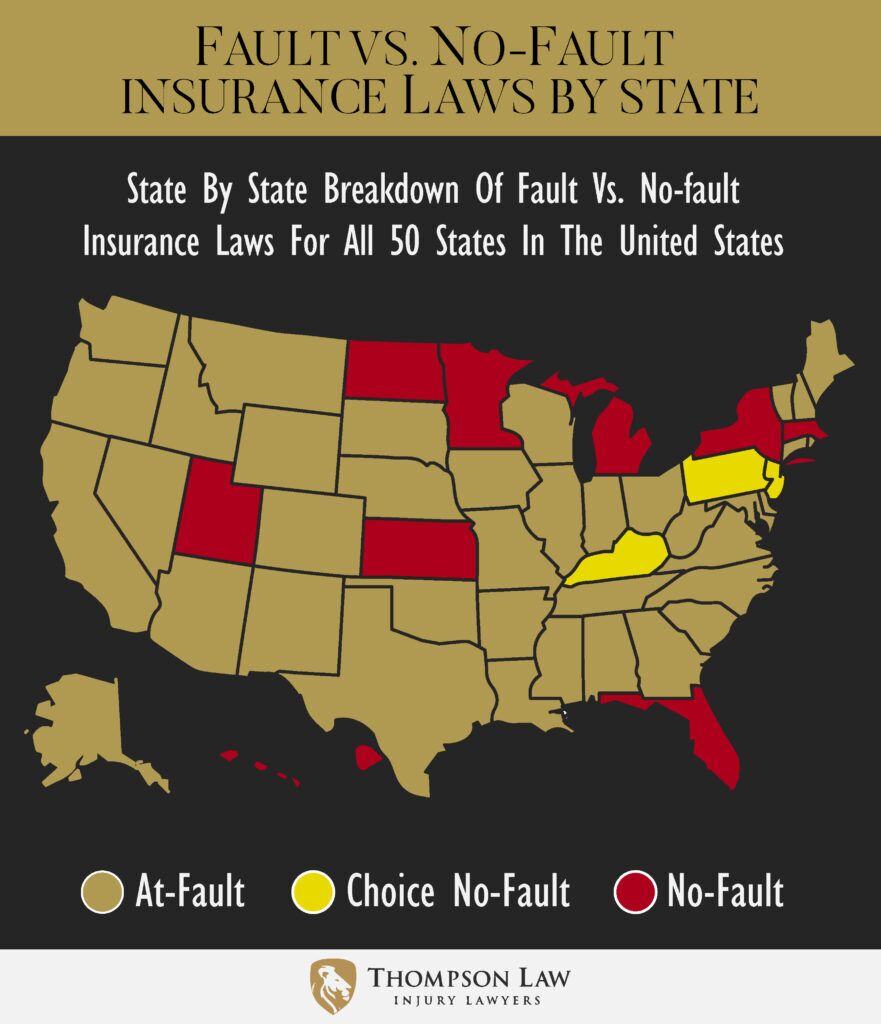

Car insurance laws differ between federal and state levels. The federal government does not mandate car insurance. State laws are the main authority. Each state has its own rules. Some states require more coverage than others. Understanding local laws is crucial.

Most states require liability insurance. This covers damage you cause to others. Some states also require uninsured motorist coverage. This protects you if the other driver has no insurance. Always check your state’s specific needs.

Types Of Car Insurance

Liability insurance covers damage to other people’s property. It also covers medical costs for others if you cause an accident. This is often required by law. Without it, you could face fines or jail time.

Comprehensive insurance covers damage not caused by a collision. This includes theft, fire, or natural disasters. It’s optional but very useful. It offers peace of mind for many drivers.

Collision insurance covers damage to your car from an accident. Whether you hit another car or an object, it helps fix your car. This insurance is optional. Yet, it’s often required by lenders.

Credit: www.drifted.com

Penalties For Uninsured Drivers

Driving without insurance can lead to large fines. These fines vary by state. You may pay hundreds of dollars. Some states add daily fees until you get insurance. It can become very expensive.

Uninsured drivers can lose their driver’s license. The suspension period varies. It can last several months. Getting your license back can be hard. You may need to pay more fees.

Driving without insurance can lead to legal problems. You might have to go to court. Judges can give harsh penalties. You could face community service. In serious cases, you might even go to jail.

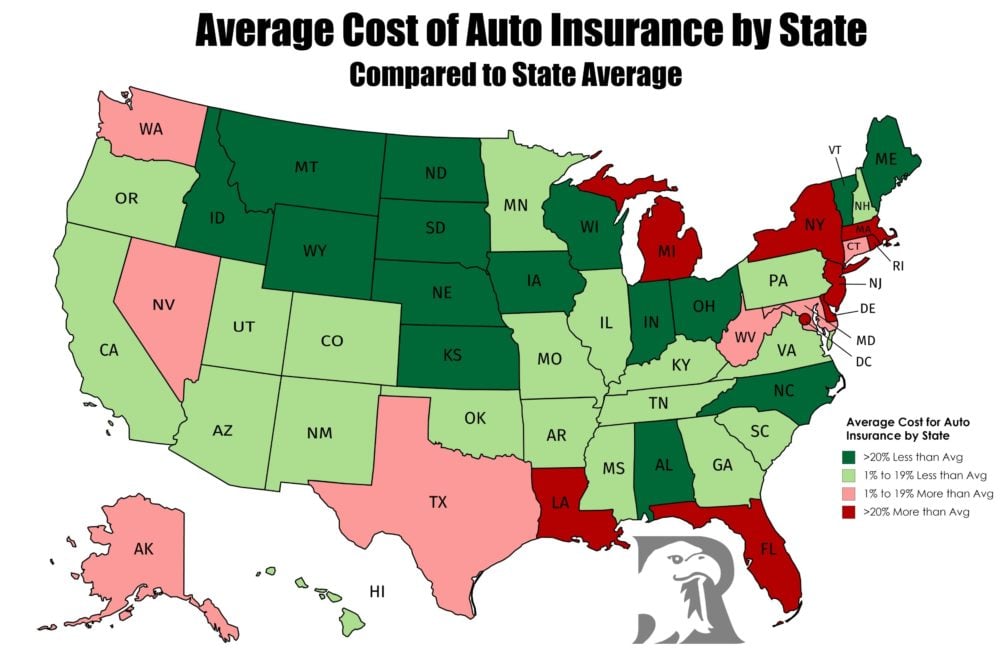

Factors Influencing Insurance Rates

Younger drivers often pay more for car insurance. Lack of experience increases risk. Older drivers with many years of driving pay less. Experienced drivers have lower rates. Insurance companies trust experienced drivers.

Expensive cars cost more to insure. Sports cars have higher rates. Insurance for family cars is cheaper. Safety features on cars can lower rates. Eco-friendly cars may also have discounts.

A clean driving record means lower rates. Accidents increase costs. Traffic tickets can also raise rates. Safe drivers save money on insurance. Insurance companies reward good driving habits.

How To Choose The Right Insurance

First, think about your car’s value. Older cars might need less coverage. New cars might need more. Also, consider your driving habits. Do you drive daily? Or just sometimes? Your lifestyle matters. Think about your budget too. How much can you spend? This helps in picking the right plan.

Collect quotes from different companies. Compare prices and coverage. Some might offer better deals. Look for discounts. Many companies give discounts for safe drivers. It’s good to compare at least three quotes. This way, you find the best price.

Read the policy details carefully. Know what’s included. Know what’s not. Look for hidden fees. Understand the terms. Ask questions if you are unsure. It’s important to know your coverage fully. This avoids surprises later.

Benefits Of Having Car Insurance

Car insurance provides financial protection if you have an accident. It covers repair costs and medical bills. Without it, you pay these costs yourself. This can be very expensive. Insurance helps you avoid large out-of-pocket expenses.

Having car insurance gives peace of mind. You feel safe knowing you are protected. If an accident happens, insurance helps. It reduces stress and worry. You can drive more confidently.

Car insurance is required by law in many states. Legal compliance means you follow the rules. Without it, you might get fined. You could also lose your license. Insurance helps you stay legal on the road.

Common Myths About Car Insurance

Many think full coverage means everything is covered. This is not true. Full coverage usually includes liability, collision, and comprehensive. But it may not cover all damages. It is important to read your policy. Ask questions if you are unsure.

Some believe red cars cost more to insure. This is a myth. Insurance companies do not charge more based on car color. They look at the car’s model, age, and safety features. Your driving record is also a big factor.

People often think older cars don’t need insurance. This is wrong. All cars need at least minimum coverage by law. Older cars might be cheaper to insure. But they still need coverage for accidents or theft.

Frequently Asked Questions

Is Car Insurance Required In The Usa?

Yes, car insurance is required in most states. Each state has its own minimum coverage requirements.

What Happens If I Drive Without Insurance?

Driving without insurance can result in fines, license suspension, and vehicle impoundment. Legal consequences vary by state.

What Types Of Car Insurance Are Mandatory?

Liability insurance is mandatory in most states. It covers bodily injury and property damage caused by you.

Are There States With No Car Insurance Requirement?

New Hampshire and Virginia have unique rules. New Hampshire doesn’t require insurance, but you must prove financial responsibility.

Conclusion

Car insurance is essential for driving legally in the USA. Different states have varying requirements, but most mandate it. Having insurance protects you from financial risks. It also ensures compliance with local laws. Driving without insurance can lead to fines and penalties.

Make sure to check your state’s specific regulations. Always stay informed and insured. This way, you drive with peace of mind.