Why Does Car Insurance Go Up?: Unveiling the Hidden Factors

Car insurance rates often rise unexpectedly. It can be frustrating and confusing.

Understanding why car insurance premiums increase is important. Many factors can cause these hikes. These include personal circumstances and wider industry changes. Knowing the reasons helps you stay informed and possibly find ways to save. In this blog post, we will explore the common reasons behind rising car insurance costs.

By the end, you’ll have a clearer picture of what impacts your rates and how you might manage them better. Let’s dive in and demystify this topic.

Introduction To Car Insurance Rate Increases

Many people think car insurance goes up only after an accident. This is not always true. Rates can increase for many reasons. Sometimes it can be due to changing personal factors. For example, moving to a new area can affect your rate. Other times, it is because of outside factors. Car theft rates in your area might have gone up. Knowing these facts helps avoid confusion.

Understanding why rates change helps you plan better. You can avoid unexpected costs. It also helps you choose the best policy. Sometimes, small changes in your life can affect your rate. For example, adding a new driver to your policy. By knowing what impacts your rate, you can make smarter choices. This knowledge can save you money in the long run.

Credit: darrschackowinsurance.com

Impact Of Driving Record

Accidents can cause car insurance to go up. Even small accidents. Insurance companies see accidents as risky. Claims made after accidents also affect rates. Each claim means higher chances of future claims. This makes insurance more expensive. Insurance companies may see you as a high-risk driver.

Traffic violations also impact insurance. Speeding tickets can raise rates. Running red lights or stop signs is risky. Each violation adds points to your driving record. More points mean higher insurance costs. Insurance companies track these points closely. Safe driving helps keep insurance costs down.

Influence Of Vehicle Type

Newer cars often cost more to insure. Older cars may have lower rates. Luxury cars usually have higher insurance costs. Sports cars also tend to be expensive. Family cars often have lower rates.

Cars with many safety features can lower your insurance. Airbags and anti-lock brakes help reduce costs. Repair costs also affect rates. Expensive repairs mean higher insurance. Some cars are cheaper to fix. These cars may have lower insurance costs.

Role Of Geographic Location

Car insurance often costs more in urban areas. More cars mean more accidents. City drivers face more traffic. Roads are busier. There are more chances to crash. Rural areas have less traffic. Fewer cars mean fewer accidents. Rural roads are less crowded.

High crime rates can increase car insurance. Urban areas often have more crime. Car theft is higher. Vandalism happens more. Insurers see this as a risk. Premiums go up. Rural areas have less crime. Lower risk means lower costs.

Effect Of Personal Factors

Young drivers often pay more for car insurance. They lack experience. Teenagers are more likely to have accidents. Men might pay more than women. They are seen as higher-risk drivers. Older drivers can also see higher rates. They might have slower reaction times.

Married people might pay less for car insurance. They are seen as more responsible. Your job can also affect your rates. High-risk jobs can lead to higher premiums. For example, delivery drivers pay more. Desk jobs might get lower rates. They are less likely to have accidents.

Credit: www.bolderinsurance.com

Changes In Coverage And Policy

Changes in Coverage and Policy often cause car insurance rates to rise. New coverage options or updates to existing policies can lead to higher premiums.

Adjustments In Coverage Limits

Increasing your coverage limits can increase your premium. Higher limits mean the insurance company pays more if you have an accident. Lowering your deductible can also raise your costs. A lower deductible means you pay less out of pocket when making a claim.

Additional Policy Features

Adding extra features to your policy can raise your premium. Features like rental car coverage or roadside assistance are useful but cost more. Adding a new driver to your policy can also increase your insurance cost. Each new feature or adjustment affects your overall premium.

Economic And Market Conditions

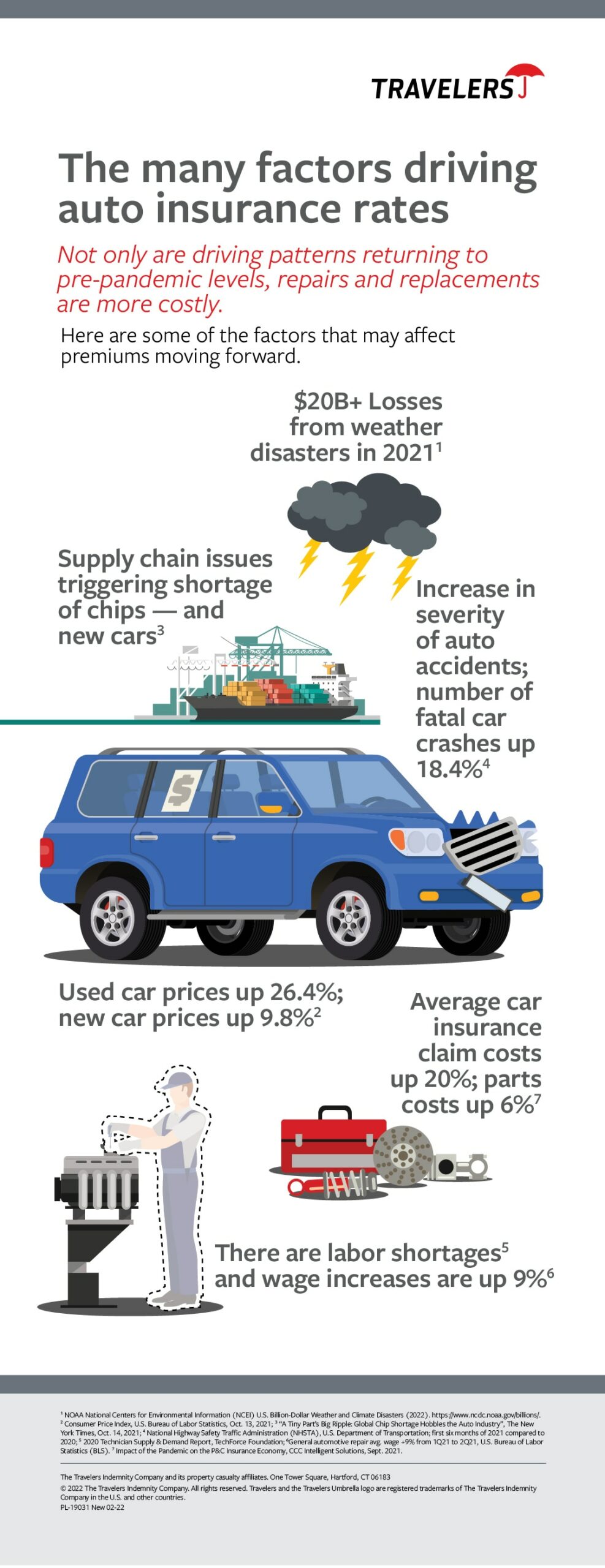

Inflation raises the price of everything. This includes car repairs. Higher repair costs mean higher insurance rates. This is because insurance companies pay more to fix cars. They pass these costs on to you. So, as prices rise, so do your premiums.

Insurance companies track trends. They look at how often claims are made. If there are many claims, rates go up. This is to cover their costs. Weather events, like storms, can cause many claims. This also affects your insurance rate.

Credit: msainsurance.com

Strategies To Lower Premiums

Car insurance premiums can rise due to accidents, traffic violations, or changes in your credit score. One strategy to lower premiums is to maintain a clean driving record. Another method includes increasing your deductible to reduce monthly costs.

Safe Driving Discounts

Safe driving can reduce your insurance costs. Many companies give discounts for clean driving records. Avoid accidents and traffic violations. Use a telematics device to track your driving habits. These devices monitor speed, braking, and distance. Safe drivers may get lower rates. Always follow traffic rules and drive safely.

Bundling Policies

Bundling can save you money. Combine your car and home insurance. Many companies offer discounts for multiple policies. This can make it easier to manage your insurance. You get one bill and one renewal date. Bundling can also offer better coverage options. Check with your insurer for bundling deals.

Conclusion And Future Trends

New technologies impact car insurance. Self-driving cars are a key example. They aim to reduce accidents. But they may also bring new risks. Electric cars are another factor. These vehicles require different maintenance. They might cost more to insure.

Climate change affects insurance too. More natural disasters mean higher claims. Insurers may raise prices to cover these costs.

Insurers must adapt to these trends. They will use more data to assess risks. This helps them set fair prices. Drivers can also adapt. Safe driving can reduce premiums. Using technology can help too. Devices that monitor driving habits can lower costs.

Staying informed is key. Understand new factors affecting your insurance. Make smart choices to keep costs down.

Frequently Asked Questions

Why Do Car Insurance Rates Increase?

Car insurance rates can increase due to factors like accidents, traffic violations, or claims. Changes in your credit score or moving to a higher-risk area can also impact rates. Additionally, insurance companies may raise premiums due to increased costs or broader economic conditions.

How Can I Lower My Car Insurance?

You can lower car insurance by maintaining a clean driving record, increasing your deductible, or bundling policies. Shopping around for better rates and taking advantage of discounts can also help reduce your premium.

Do Insurance Rates Go Up Every Year?

Insurance rates can increase annually due to inflation, rising repair costs, or changes in your driving record. Even if you have no claims, general market conditions and risk assessments may lead to higher premiums.

Will My Rate Increase After A Claim?

Yes, filing a claim may cause your insurance rate to increase. The amount of the increase depends on the claim’s severity and your insurance company’s policies. Maintaining a good driving record can help mitigate these increases over time.

Conclusion

Car insurance rates can increase for many reasons. Changes in your driving record matter. Accidents, tickets, or claims can raise costs. Also, insurance companies adjust for inflation and new technology. Age and location play a role too. Younger drivers and city dwellers may pay more.

Keeping a clean record helps. Comparing quotes from different insurers can save money. Stay informed about factors affecting your rates. This way, you can manage and possibly reduce your car insurance costs.