How Do I Avoid Paying Tax on a Company Car: Legal Strategies

To avoid paying tax on a company car, you need to understand tax rules. Certain strategies can help reduce or eliminate this tax.

Company cars are a common perk for employees. However, they come with tax implications. Understanding how to minimize or avoid these taxes can be beneficial. Whether you’re an employee or employer, knowing the rules can save money. In this blog post, we’ll explore legal methods to avoid paying tax on a company car.

From optimizing car use to leveraging tax exemptions, we’ll cover various strategies. These tips will help you make informed decisions and potentially reduce your tax burden. Stay tuned to learn more about managing company car taxes effectively.

Credit: www.patriotsoftware.com

Legal Tax Avoidance Strategies

Leasing a car can be cheaper. The payments for a leased car are lower. You may also claim lease payments as business expenses. Buying a car requires more money upfront. The value of the car will drop over time. You can’t claim the full cost as a business expense right away. Consider your budget and needs.

Giving a car allowance to employees can save money. The allowance is a fixed amount. Employees can use it for their car expenses. This way, you don’t have to buy or lease cars. Employees can choose the car they like. This method can also lower your tax bills.

Choosing The Right Company Car

Picking a car with low emissions helps reduce tax. These cars are better for the environment. They use less fuel and create less pollution. Many companies offer these cars as options.

Electric cars are great choices. They run on electricity, not gas. This means no emissions. They also have low running costs. Hybrid cars use both gas and electricity. They have lower emissions than regular cars. They save money on fuel too. Using these cars can lower your tax bill.

Maximizing Business Mileage

Tracking the miles driven for business is important. Always log your miles accurately. Use a notebook or an app. Record the date, purpose, and miles driven. This helps you distinguish between business and personal use. Keeping a detailed log can reduce taxes.

Logging mileage accurately is key to avoiding extra taxes. Make sure to write down each trip. Note the starting and ending miles. Include the reason for the trip. This ensures you can prove business use. Accurate logs can save you money.

Credit: www.pkfsmithcooper.com

Claiming Capital Allowances

Annual Investment Allowance (AIA) can help save on taxes. You can claim up to £1,000,000. This allows you to deduct the cost of the car. The car must be new. Used cars do not qualify. Claiming AIA reduces your tax bill. It is a big help for businesses.

First-Year Allowances (FYA) are another option. This lets you deduct 100% of the car’s cost. The car must be low-emission. It must meet specific criteria. Check the car’s emission rating. FYA helps save more money. It encourages eco-friendly choices.

Utilizing Salary Sacrifice Schemes

Salary sacrifice means giving up part of your salary. You get a company car instead. The sacrificed salary is not taxed. This can save you money. Both you and your employer benefit.

Using salary sacrifice can lower your taxable income. This means you pay less tax. Your company car is taxed at a lower rate. This is a smart way to save money.

Credit: www.financialsamurai.com

Benefits Of Pool Cars

Pool cars are shared company vehicles. These cars are used by different employees. No single person uses the car all the time. The car is not for private use. It stays at the office when not needed.

Using pool cars can save you from paying extra taxes. The car is only for work purposes. You do not need to pay tax for personal use. The car does not count as a benefit. This helps you save money. Many companies prefer pool cars for this reason.

Opting For Cash Alternatives

Choosing cash instead of a company car can be smart. Cash is often more flexible. You can use it however you like. A company car comes with tax implications. You may need to pay taxes on the car’s value. This can be expensive. Cash does not have this issue.

Using a company car can mean extra taxes. The car’s value is seen as a benefit. This means you could pay more taxes. Cash does not have this problem. You can also save money on insurance and maintenance. Cash is simpler and can save you money.

Understanding Employer Contributions

Employers may pay for your fuel. This can be a taxable benefit. Some employers reimburse fuel costs. This can reduce your tax burden. Keep fuel receipts. Submit them to your employer. Use a fuel card. This can simplify tracking. Ask your employer about fuel policies.

Company cars need regular maintenance. Employers often cover these costs. This can be tax-free. Use company-approved repair shops. Keep all repair receipts. Submit them to your employer. Schedule regular checks. This ensures the car is in good condition. Follow the maintenance schedule. This can help avoid extra taxes.

Frequently Asked Questions

How Do I Get Around My Company Car Tax?

Consult a tax advisor for legal ways to minimize your company car tax. Consider electric vehicles for lower tax rates.

Do I Have To Pay Taxes On A Company Vehicle?

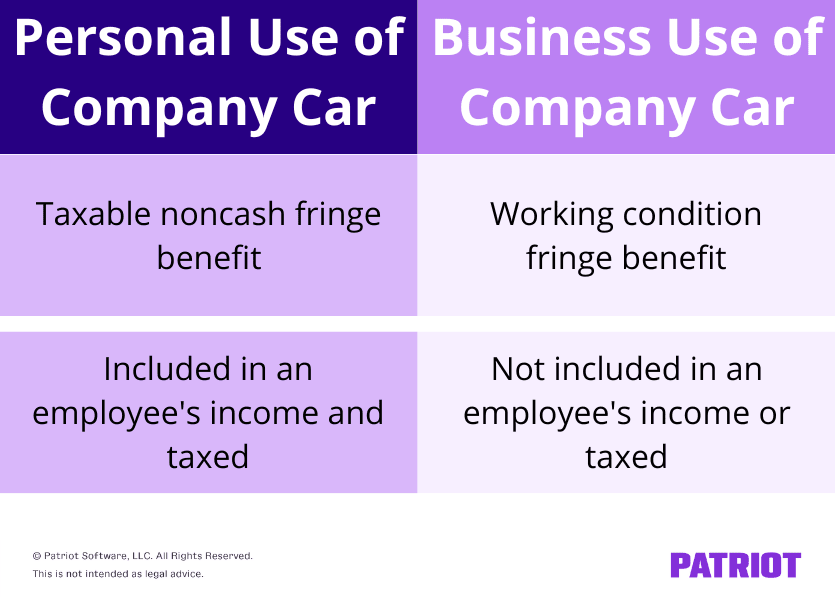

Yes, you may have to pay taxes on a company vehicle. Personal use of the vehicle is considered a taxable benefit.

Is A Company Car Worth It For An Employee?

A company car can be worth it for an employee due to savings on fuel, insurance, and maintenance costs. Evaluate personal needs to decide.

How To Avoid Paying Tax On Car Allowance?

Use a car allowance for business expenses. Keep detailed records and receipts. Consult a tax professional.

Conclusion

Understanding tax rules for company cars can save you money. Use tax-efficient strategies to reduce your burden. Consult a tax expert for personalized advice. Keep accurate records of your car usage. Review company policies regularly. Stay informed about tax law changes.

Make smart choices when selecting a company car. Remember, small steps can lead to big savings. Reduce stress by being proactive with tax planning. Enjoy your company car without unnecessary tax worries. Take control of your finances today.