If You File Bankruptcy What Happens to Your Car Loan?: Essential Insights

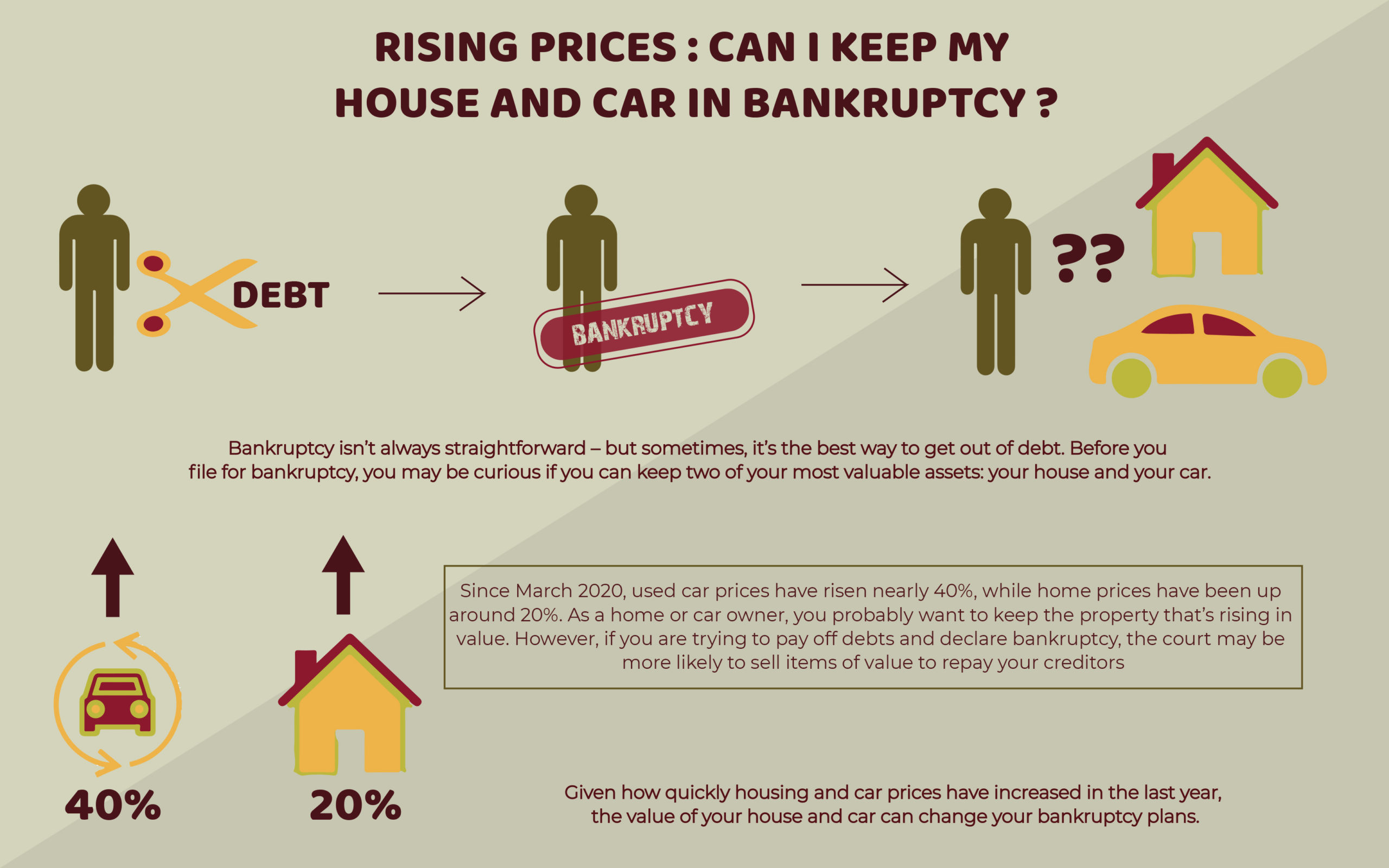

Filing for bankruptcy can be a tough decision. It impacts many parts of your life, including your car loan.

When you declare bankruptcy, your car loan can be affected in different ways. This depends on the type of bankruptcy you file. Understanding these effects can help you make better decisions. Bankruptcy can offer relief but also brings challenges. Knowing what to expect with your car loan is crucial.

This guide will explain how your car loan is handled during bankruptcy. You’ll learn the options available and the steps you can take. This way, you can move forward with confidence and clarity. Read on to find out what happens to your car loan if you file for bankruptcy.

Credit: www.therollinsfirm.com

Introduction To Bankruptcy And Car Loans

Bankruptcy can help clear debts. It is a legal process. People who cannot pay their bills may choose this. Different types of bankruptcy exist. Chapter 7 and Chapter 13 are common. Each type has different rules. Debt can be wiped out or a payment plan set up.

A car loan is a type of debt. You borrow money to buy a car. Then, you must repay it. Payments are usually monthly. Interest adds to the amount owed. If you miss payments, the car can be taken back. This is called repossession. Lenders want their money back.

Types Of Bankruptcy

Chapter 7 is also called “liquidation” bankruptcy. Your non-exempt assets are sold. Money from these sales pays your debts. Car loans are secured debts. This means the lender can take back your car. You must decide to keep or give up the car. If you keep it, you must continue payments. If you give it up, you owe nothing more.

Chapter 13 is known as “reorganization” bankruptcy. You create a plan to repay your debts. This plan usually lasts 3-5 years. Car loans can be part of this plan. You may lower your car payments. You might even reduce the loan balance. You keep your car if you follow the plan.

Impact Of Chapter 7 On Car Loans

Filing for Chapter 7 bankruptcy can lead to car repossession. This happens if you can’t keep up with payments. The lender has the right to take your car. They sell it to recover the loan amount. You might lose the vehicle quickly. Make sure you understand the terms. Discuss with your lawyer for the best options.

A reaffirmation agreement lets you keep your car. You agree to continue paying the car loan. This agreement is made with the lender. It must be approved by the court. Ensure you can afford the payments. Missing payments can still lead to repossession. Think carefully before signing. Talk to your lawyer for advice.

Credit: www.capitalone.com

Impact Of Chapter 13 On Car Loans

Filing for Chapter 13 bankruptcy can affect your car loan. You may keep your car and adjust the loan terms. This helps in managing payments and avoiding repossession.

Repayment Plan

Under Chapter 13, you create a repayment plan to pay your debts. This plan lasts three to five years. You can keep your car if you follow the plan. Payments may be lower than before. The court needs to approve your plan. This makes car payments more manageable.

Cramdown Provision

The cramdown provision can reduce your car loan balance. This only applies if you bought the car more than 910 days before filing. The loan is reduced to the car’s current value. This can lower monthly payments. Interest rates may also be lowered. This makes it easier to keep your car.

Options For Keeping Your Car

You can reaffirm the car loan to keep the car. This means you agree to keep paying the loan. The lender will continue to accept your payments. But, you will still owe the loan amount. If you miss payments, the lender can take the car back. So, be sure you can afford the payments before reaffirming.

Redeeming the car is another option. You pay the current value of the car in one lump sum. This means you pay what the car is worth now, not what you owe on the loan. This can help if the car’s value is less than the loan amount. But, you need to have the cash ready to redeem the car. It can be tough to gather a large sum quickly. Consider this option if you have enough savings.

Surrendering Your Car

Filing for bankruptcy impacts your car loan. Surrendering your car might discharge the loan, but you lose the vehicle. Alternatively, you could keep the car by reaffirming or redeeming the loan.

Voluntary Surrender

Voluntary surrender means you give your car back to the lender. You stop making payments. The lender sells the car. They use the money to pay off your loan. This is a choice some people make. It can help avoid more debt. But it will hurt your credit score. It will stay on your report for seven years.

Deficiency Balance

After the car is sold, you might still owe money. This is called a deficiency balance. If the car sells for less than you owe, you must pay the difference. This can be a big problem. The lender can take you to court. They can get a judgment against you. This means they can take your money from your bank account. Or they can garnish your wages.

Effects On Credit Score

Filing for bankruptcy can heavily impact your credit score and car loan. Your car may be repossessed or the loan could be renegotiated.

Short-term Impact

Filing for bankruptcy lowers your credit score. It stays on your credit report for years. Your credit score drops fast. This makes getting new loans harder. Lenders see you as a high-risk borrower. You may get higher interest rates. Some lenders might not give you a loan at all. It can feel stressful and tough.

Rebuilding Credit

Rebuilding credit takes time and patience. Start by paying bills on time. Use a secured credit card. Keep your balances low. Check your credit report often. Look for mistakes and fix them. Over time, your score will improve. It’s a slow process, but it works. Stay positive and keep working at it.

Seeking Professional Advice

Filing for bankruptcy can impact your car loan. Your car might be repossessed, or you could negotiate new terms. Seek professional advice to understand your options.

Bankruptcy Attorney

A bankruptcy attorney helps you understand your options. They can guide you through the process. They will explain how bankruptcy affects your car loan. An attorney can offer advice on keeping or surrendering your car. They can also negotiate with lenders for better terms. It’s important to have legal support. It makes the process less stressful.

Financial Counselor

A financial counselor gives advice on your finances. They help you create a budget. They also offer tips on managing your debts. A counselor helps you plan for the future. They can show you how to avoid financial trouble. Working with a counselor can make things clearer. It helps you make better choices.

Credit: bononiandbononi.com

Frequently Asked Questions

What Happens To My Car Loan In Bankruptcy?

When you file for bankruptcy, your car loan can be affected. If you keep paying, you may retain your car.

Can I Keep My Car After Filing Bankruptcy?

Yes, you can keep your car if you continue making payments. Reaffirmation agreements might be required.

How Does Chapter 7 Affect Car Loans?

In Chapter 7 bankruptcy, you can surrender the car or keep it by reaffirming the loan.

What Is Reaffirmation In Car Loans?

Reaffirmation is an agreement to continue paying your car loan despite filing bankruptcy. It allows you to keep the car.

Conclusion

Filing bankruptcy impacts your car loan significantly. You might keep the car. Or not. It depends on your bankruptcy type and payment status. Always consult a bankruptcy attorney. They help you understand your options. Make informed decisions. Protect your assets.

Stay informed and prepared. Bankruptcy can be complex. Take steps to safeguard your financial future. Keep learning. Stay proactive. Your financial health matters.