What is Gap Insurance for Car: Essential Coverage Explained

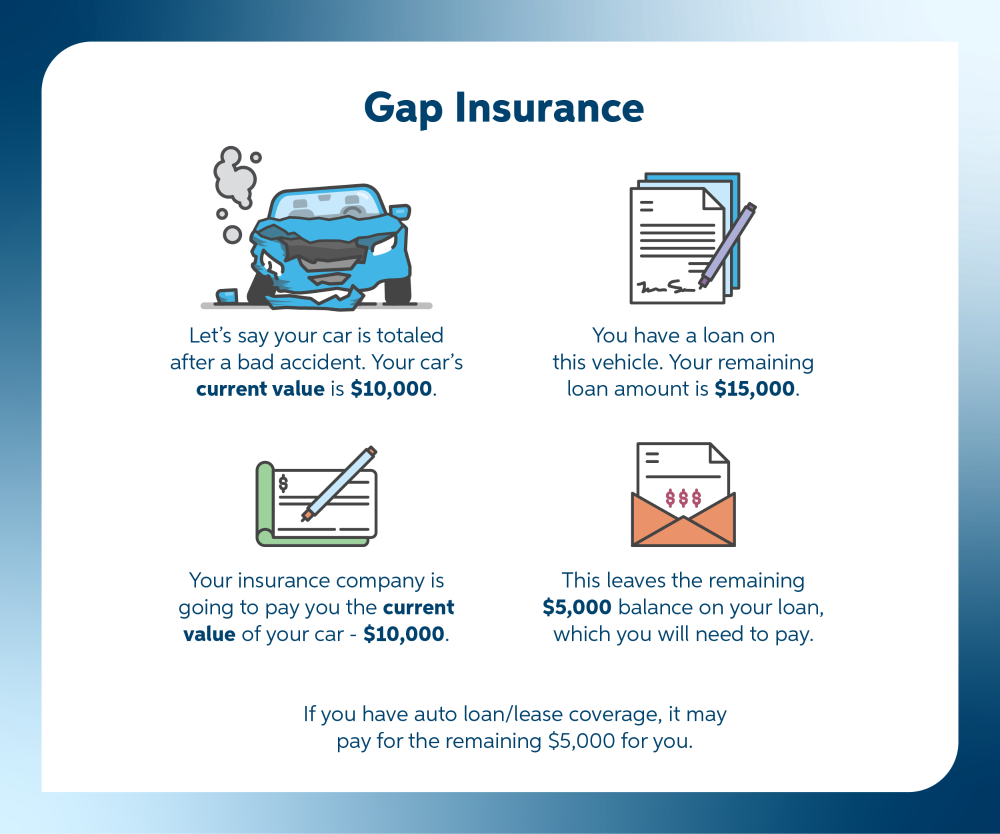

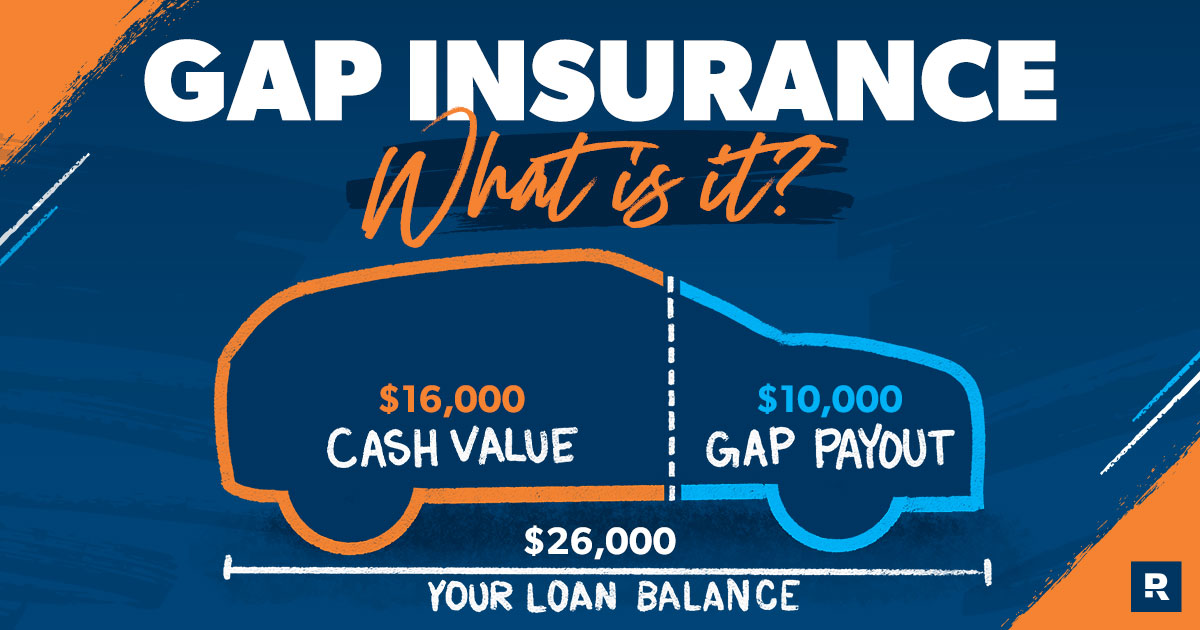

Gap insurance for a car helps cover the difference between what you owe on your car loan and the car’s actual cash value if it’s totaled or stolen. It’s important for those with a high loan balance or a lease.

If you’re financing or leasing a car, you might have heard about gap insurance. This type of insurance can be a lifesaver in specific situations. Imagine your new car gets totaled in an accident. Your regular auto insurance pays out the car’s current market value.

But what if you still owe more on your loan or lease than that amount? This is where gap insurance comes in. It covers the “gap” between what your car is worth and what you owe. Understanding gap insurance can help you decide if it’s a good option for you.

Introduction To Gap Insurance

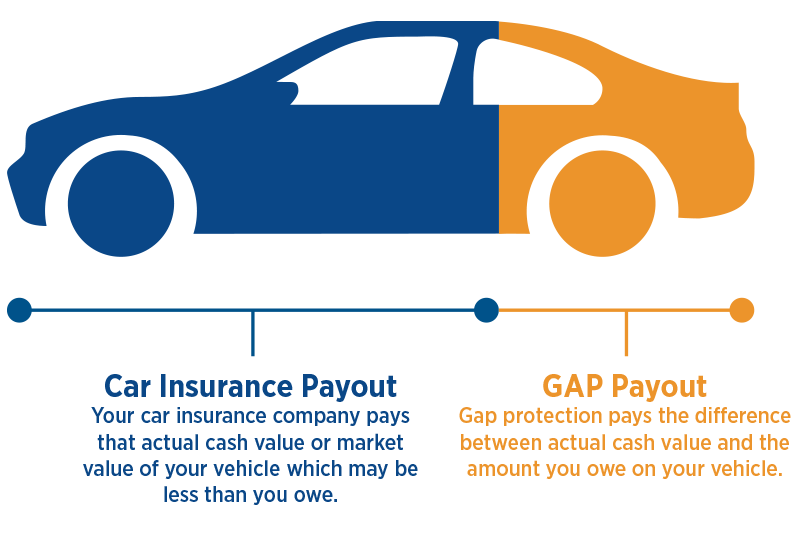

Gap insurance covers the difference between your car’s current value and the amount you owe on it. If your car gets totaled or stolen, your regular insurance pays the car’s value. But if you owe more than the car’s value, gap insurance pays the rest. It helps you avoid paying out of pocket.

Gap insurance is very important for new cars. Car values drop quickly after buying. If you have a loan, you might owe more than the car is worth. In case of an accident or theft, gap insurance protects you. It saves you from unexpected large bills. Without it, you might still owe money for a car you no longer have.

Credit: www.auto-owners.com

How Gap Insurance Works

Gap insurance covers the difference between the car’s value and the loan amount. If your car is stolen or totaled, this insurance helps pay off the loan. Regular insurance might not cover the full loan amount. That’s where gap insurance steps in. It is very useful for new cars. It protects your investment.

First, contact your gap insurance provider. They will guide you through the steps. Gather all necessary documents. This may include your loan agreement and insurance policy. Submit a claim form with all details. Wait for the claim to be processed. The provider will pay the difference. Always keep copies of all documents. This ensures a smooth process.

When To Consider Gap Insurance

Gap insurance for cars covers the difference between the car’s value and the loan balance if it’s totaled or stolen. Consider it when you have a high loan balance or lease a vehicle. This can help avoid financial loss.

New Car Purchases

Buying a new car can be exciting. But the value of a new car drops fast. This is called depreciation. If your new car gets totaled, regular insurance pays only the car’s value at the time of the accident. This is often less than what you owe on your loan. Gap insurance covers the difference. It helps you avoid paying out of pocket.

Leased Vehicles

Leasing a car is different from buying one. You do not own the car. You pay to use it. If the leased car is stolen or wrecked, you still owe money. Gap insurance helps cover what you owe. This is important because lease terms can be tricky. It keeps you from having to pay a lot of money unexpectedly.

Benefits Of Gap Insurance

Gap insurance gives you financial protection if your car is totaled or stolen. Standard car insurance pays only the car’s current value. This might not cover your loan amount. Gap insurance pays the difference. This way, you won’t owe money on a car you no longer have.

Driving a new car can be stressful. Gap insurance can offer peace of mind. You don’t need to worry about losing money if an accident happens. Knowing you are protected helps you enjoy your car more. Your finances stay safe even in tough situations.

Limitations Of Gap Insurance

Gap insurance does not cover everything. Regular wear and tear is not covered. Mechanical breakdowns are excluded. Intentional damage is not included. Past due payments on your car loan are not covered. Extended warranties are also not part of it. Check your policy details. Know what is excluded.

Gap insurance has limits. It covers the difference between your loan and the car’s value. There is a maximum amount it will pay. This amount varies by policy. Always read the fine print. Understand your policy limits. Know the maximum payout.

Credit: www.foothillcu.org

Cost Of Gap Insurance

The cost of gap insurance depends on several factors. The car’s value plays a big role. Newer and more expensive cars cost more to insure. The insurance company you choose also affects the price. Some companies charge more than others. Your driving history is important too. If you have a good driving record, you might pay less. The loan terms also matter. Longer loan periods can mean higher costs for gap insurance.

There are different ways to pay for gap insurance. One option is to pay monthly. This can make it easier on your budget. You can also choose to pay yearly. Paying yearly might save you money in the long run. Some people prefer to pay upfront when they buy the car. This way, you don’t have to worry about monthly or yearly payments. Always check with your insurance provider for the best payment option for you.

How To Purchase Gap Insurance

Buying gap insurance from a dealership is easy. They offer it when you buy a car. The cost can be added to your car loan. This makes it convenient. The dealership handles all the paperwork. You can get coverage right away. But it can be more expensive. Always compare prices before buying.

Insurance companies also offer gap insurance. You can add it to your existing policy. This can be cheaper than the dealership. Call your insurance agent for details. They can explain the coverage. Make sure to ask about discounts or bundling options. This can save you money. Always read the terms carefully before signing up.

Alternatives To Gap Insurance

Gap insurance for cars covers the difference between your car’s value and the amount you owe on it. Instead of gap insurance, consider new car replacement insurance or loan/lease payoff coverage.

New Car Replacement Insurance

New Car Replacement Insurance helps if your new car is totaled. It gives you a new car of the same make and model. This is better than getting the depreciated value. It helps you avoid losing money on a new car. This insurance is good for new car owners. It protects your investment.

Loan/lease Payoff Coverage

Loan/Lease Payoff Coverage helps if your car is totaled. It pays off the remaining loan or lease balance. This is useful if you owe more than the car’s value. It prevents you from paying for a car you no longer have. This coverage is also called “gap insurance lite.” It is cheaper than full gap insurance. Many people choose this as an alternative. It offers good protection at a lower cost.

Credit: www.ramseysolutions.com

Frequently Asked Questions

What Does Gap Insurance Cover?

Gap insurance covers the difference between your car’s actual cash value and the amount you owe on your car loan if your vehicle is totaled or stolen.

Is Gap Insurance Worth It?

Gap insurance is worth it if you owe more on your car loan than the car’s current value, providing financial protection.

How Much Does Gap Insurance Cost?

Gap insurance typically costs about $20 to $40 per year, but prices can vary depending on the provider and your car’s value.

Can I Add Gap Insurance Anytime?

You can usually add gap insurance anytime during your car loan term, though it’s best to get it sooner rather than later.

Conclusion

Gap insurance can save you money after a car accident. It covers the difference between your car’s value and loan balance. This protection helps prevent financial strain. Without it, you might owe money even after your car is totaled. Consider gap insurance if you have a new or financed car.

It provides peace of mind. Research your options and speak to your insurance provider. Making informed decisions ensures you’re well-protected. Understand your coverage needs. Stay safe on the road.