Do You Have to Have Car Insurance in Michigan: Essential Guide

Yes, you need car insurance in Michigan. It’s required by law.

Driving without it can lead to severe penalties. Understanding car insurance requirements can be confusing. Michigan has specific rules that every driver must follow. This blog post will explain what you need to know about car insurance in Michigan. We will cover the types of coverage required and why they are important.

Whether you are new to driving or just need a refresher, this guide will help you stay on the right side of the law. Let’s dive into the essentials of car insurance in Michigan and ensure you are fully covered.

Credit: www.michiganpublic.org

Michigan Car Insurance Requirements

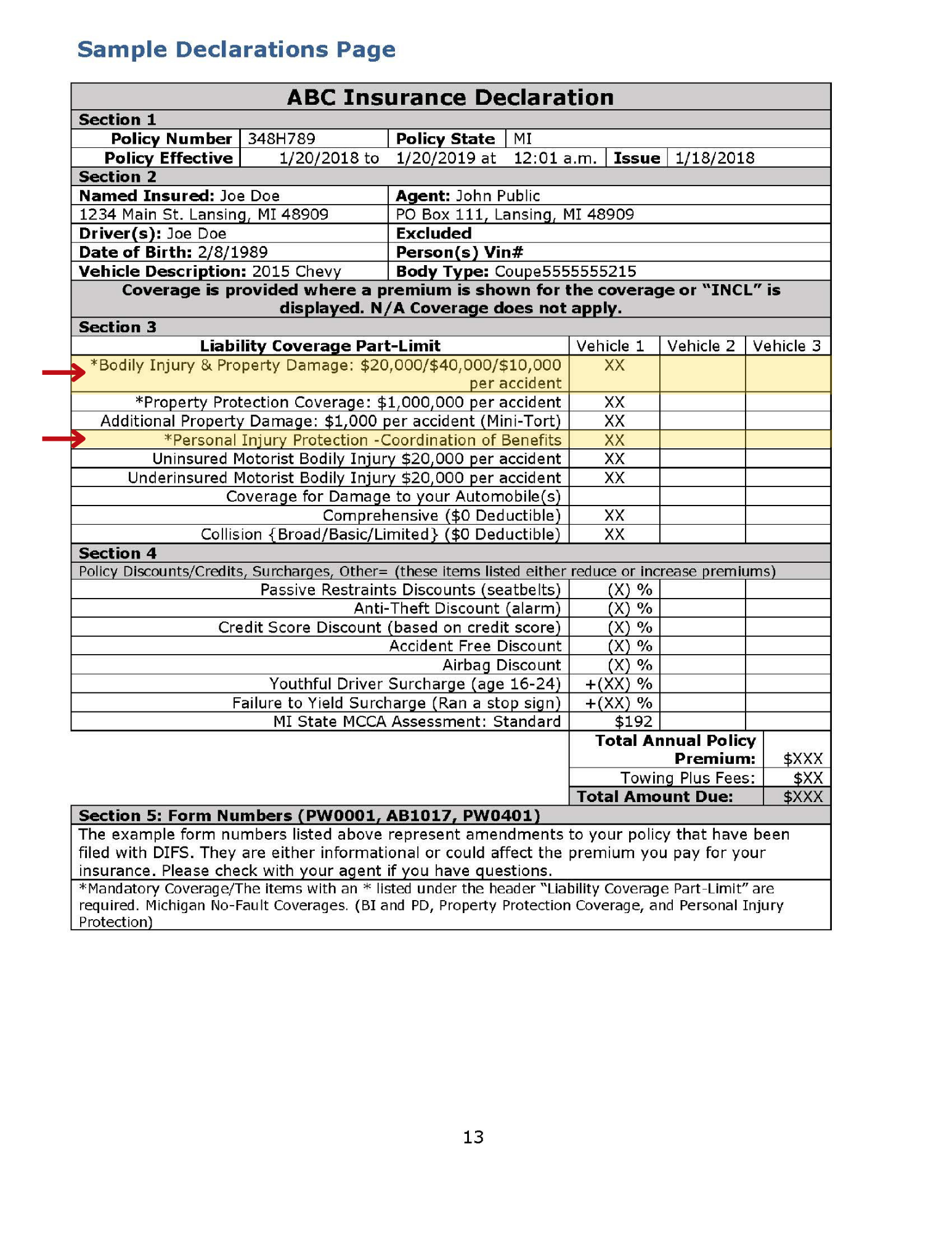

Car insurance is required in Michigan. Drivers must have three types of coverage. Personal Injury Protection (PIP) covers medical costs. Property Protection Insurance (PPI) pays for damage to others’ property. Residual Bodily Injury and Property Damage Liability (BI/PD) covers legal costs if you are sued.

Each type of coverage has a minimum limit. PIP must cover medical bills. PPI must be at least $1 million. BI/PD must include $250,000 per person and $500,000 per accident for injuries. For property damage, it must be $10,000. These limits ensure basic protection.

No-fault Insurance System

In Michigan, all drivers must have no-fault car insurance. This insurance pays for your own medical bills. It does not matter who caused the accident. This is called the no-fault system.

You also get coverage for lost wages. Your insurance will also cover some damage to other people’s property. This system helps everyone get quick help after an accident.

One benefit is that you get fast medical help. You do not have to wait for the other driver to pay. Another benefit is that you are covered even if the accident is your fault. This system can help reduce court cases about car accidents.

One drawback is the cost. No-fault insurance can be expensive. Another drawback is that it may not cover all damages. Some people feel it is unfair to pay for their own mistakes. There are pros and cons, but no-fault insurance is the law in Michigan.

Penalties For Uninsured Drivers

Driving without car insurance in Michigan can lead to heavy fines. Uninsured drivers may face fines up to $500. They might also need to pay court fees. These costs can add up quickly. It’s best to avoid these expenses by having car insurance.

Uninsured drivers risk losing their license. Michigan can suspend your driver’s license if you don’t have insurance. This suspension can last up to 30 days. During this time, you cannot legally drive. To get your license back, you’ll need to show proof of insurance. You may also need to pay a reinstatement fee.

Credit: eveins.com

Optional Insurance Coverages

Comprehensive coverage helps you pay for damage from events not involving a collision. It covers theft, vandalism, and natural disasters. This includes things like fire or hail. Comprehensive coverage also protects against falling objects. Imagine a tree branch hitting your car. This coverage would help. Think of it as a safety net for unexpected events.

Collision coverage helps pay for damage to your car from a crash. This includes hitting another car or an object, like a fence. If you hit a pothole, this coverage helps too. It is important if you want to repair your car. Even if you are at fault, collision coverage helps. It can save you from large repair bills.

Shopping For Car Insurance

Getting car insurance in Michigan can be confusing. It is important to compare quotes from different providers. This helps you find the best deal. Make sure to look at the coverage options. Some may offer better protection than others. Check the deductibles and premiums. These can vary a lot. Look for discounts. Many companies offer them for safe driving or multiple policies. Comparing quotes can save you money.

Choosing the right car insurance provider is key. Look for a company with good customer service. You want help when you need it. Check the financial strength of the provider. This shows they can pay claims. Read reviews from other customers. This gives you an idea of their reputation. Make sure they offer the coverage you need. A good provider will have many options. Choose wisely to protect yourself and your car.

Credit: www.michiganautolaw.com

Factors Affecting Insurance Rates

Your driving record greatly impacts your insurance rates. A clean record with no accidents or tickets means lower rates. Any traffic violations or accidents will raise your rates. Insurers see you as a higher risk. They may charge you more.

The type of vehicle you drive also affects your insurance costs. Expensive cars cost more to insure. They are costly to repair or replace. Vehicles with high safety ratings may lower your rates. Insurers see them as safer. Sports cars usually have higher rates. They are often driven faster and are seen as riskier.

Steps To Take After An Accident

First, call your insurance company. Tell them about the accident. Provide all details. This includes the time and place of the accident. Also, share information about the other driver. An agent will guide you through the process. They will explain what documents are needed. Make sure to ask any questions you have.

Take many pictures of the accident scene. Capture all damages to the cars. Get close-up shots of any visible injuries. Write down names and contact info of witnesses. Also, note the weather and road conditions. This helps in proving what happened. Keep a copy of the police report. These steps are important for a smooth claims process.

Tips For Lowering Insurance Costs

Safe drivers can save money. Insurance companies reward good driving. Avoid accidents and traffic tickets. These actions may reduce your premiums. Some companies offer discounts for completing driving courses. Check with your insurer. See if you qualify. Every bit helps.

Combining insurance policies can lower costs. Bundle car and home insurance. It often leads to discounts. Ask your insurance company about bundle options. This way, you may save money on both policies. Always compare prices. Different companies offer different deals. Choose the best one for you.

Frequently Asked Questions

Do You Need Car Insurance In Michigan?

Yes, Michigan law requires all drivers to have car insurance. It is mandatory to maintain minimum coverage.

What Is The Minimum Car Insurance In Michigan?

Michigan’s minimum car insurance includes Personal Injury Protection (PIP), Property Protection Insurance (PPI), and Residual Liability Insurance.

Can You Drive Without Insurance In Michigan?

No, driving without insurance in Michigan is illegal. You can face fines and penalties if caught.

What Happens If You Don’t Have Car Insurance?

If you don’t have car insurance, you may face fines, license suspension, and vehicle impoundment.

Conclusion

Michigan law requires all drivers to have car insurance. It protects you and others in accidents. Fines and penalties apply for non-compliance. Understanding your coverage options is vital. Make informed decisions to ensure safety and legal compliance. Regularly review your policy.

Always drive with proper insurance. It’s not just a legal requirement; it’s peace of mind. Stay safe and insured on Michigan roads.