How to Calculate Interest Rate on a Car: Simple Steps Explained

Calculating the interest rate on a car loan is simple. You need basic details like loan amount and terms.

Here’s how you can do it. Understanding how to calculate the interest rate on a car loan is crucial. It helps you know the true cost of the loan. Interest rates vary based on loan terms and your credit score.

Knowing your interest rate can save you money. In this guide, we’ll walk you through the steps. You’ll learn what factors influence your rate. We’ll also explain some common terms. By the end, you’ll be able to calculate the interest rate yourself. This knowledge will help you make better financial decisions. So, let’s get started!

Credit: www.yourmechanic.com

Introduction To Car Loan Interest Rates

Interest rates affect the total cost of your car loan. A higher interest rate means you will pay more over time. A lower interest rate saves you money. It’s crucial to understand how these rates impact your monthly payments.

Principal: The amount of money borrowed for the car. Annual Percentage Rate (APR): The yearly interest rate including fees. Term: The length of time you have to repay the loan. Monthly Payment: The amount you pay every month to the lender. Credit Score: A number that shows your creditworthiness. Better scores can lead to lower interest rates.

Types Of Interest Rates

Fixed interest rates stay the same over the loan period. You pay the same amount each month. These rates are easy to budget. No surprises. Fixed rates are best if you like stability. They can be higher than other rates. But they are predictable.

Variable interest rates change with the market. Your payment can go up or down. This makes them less predictable. They may start lower than fixed rates. But, they can rise. They can be risky. If rates go up, your payment goes up. Best for short-term loans.

Gathering Necessary Information

Start by gathering details like loan amount, interest rate type, and loan term. These details help in calculating accurate interest rates. Accurate information ensures better financial planning for your car purchase.

Loan Amount

The loan amount is the total money you borrow. This is the price of the car minus any down payment you make. Make sure you know this number exactly. This helps in getting accurate interest calculations.

Loan Term

Loan term is the time period you have to repay the loan. It is usually in months or years. Common terms are 36, 48, 60, or 72 months. Shorter terms often mean less interest paid.

Annual Percentage Rate (apr)

APR is the yearly interest rate charged on the loan. It includes fees and other costs. APR gives a clearer picture of the total cost of the loan. Always check the APR before agreeing to a loan.

Credit: www.calculatorsoup.com

Calculating Simple Interest

To find the simple interest, use this formula: Interest = Principal x Rate x Time. The principal is the loan amount. The rate is the interest percentage. Time is the loan period in years.

Imagine you borrow $10,000 to buy a car. The interest rate is 5% per year. You plan to repay in 3 years.

Using the formula: Interest = $10,000 x 0.05 x 3. The interest will be $1,500. So, you will pay $11,500 in total.

Calculating Compound Interest

The compound interest formula is easy. It is: A = P (1 + r/n)^(nt). Here, A is the amount of money. P is the principal amount. r is the annual interest rate. n is the number of times interest is compounded per year. t is the time in years.

Suppose you borrow $10,000. The annual interest rate is 5%. Interest is compounded monthly. You repay the loan in 3 years.

Then, P = 10000, r = 0.05, n = 12, and t = 3. Plug these values into the formula: A = 10000 (1 + 0.05/12)^(123).

Now, calculate (1 + 0.05/12). This is approximately 1.004167. Next, raise this to the power of 36. This gives approximately 1.1616. Multiply by 10000. So, A ≈ 11616. You will owe about $11,616 after 3 years.

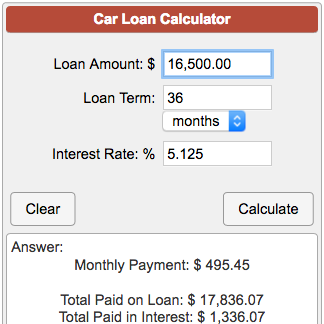

Using Online Calculators

Online calculators are easy to use. They save time. They provide quick results. Enter your loan amount. Add the interest rate. Choose the loan term. The calculator does the rest. It shows your monthly payment. You can see how different rates change the payment. This helps you plan better. It is simple and fast.

Some websites offer good car loan calculators. Try Bankrate or NerdWallet. They are popular and trusted. Another good site is Calculator.net. These tools give accurate results. They are also free to use. You can try different scenarios. This helps you find the best loan option.

Factors Affecting Car Loan Interest Rates

Your credit score plays a big role. A higher score means lower interest rates. Lenders see you as less risky. Pay bills on time to improve your score. Check your credit report for errors.

A larger down payment can lower your interest rate. It shows lenders you are serious. More money upfront means lower monthly payments. Aim for at least 20% down.

The length of your loan term affects your rate. Shorter terms usually have lower rates. Longer terms may cost more over time. Choose a term that fits your budget. Balance monthly payments and total cost.

Tips For Getting The Best Interest Rate

Your credit score affects your interest rate. Pay bills on time. Reduce your debt. Check your credit report for errors. Fix any mistakes quickly. A higher score means a lower interest rate.

Compare different lenders. Each lender offers different rates. Look at banks, credit unions, and online lenders. Get quotes from multiple places. This helps you find the best rate. Do not accept the first offer.

A co-signer can help you get a better rate. Choose someone with a good credit score. They agree to pay if you can’t. This reduces risk for the lender. They may offer you a lower interest rate.

Conclusion And Next Steps

Review and compare offers from different lenders. Look at the interest rates and terms. This helps you find the best deal. Lower interest rates save money. Long terms mean lower monthly payments. Always check the total cost. A lower interest rate might have higher fees.

Read the fine print before signing. Look for hidden charges. Check for prepayment penalties. Understand the terms. This helps avoid surprises later. Ask questions if unsure. A small detail can make a big difference.

Credit: www.wikihow.com

Frequently Asked Questions

What Is The Formula For Interest Rate On A Car?

The formula for interest rate on a car is: Interest = Principal x Rate x Time.

How To Calculate Interest Rate?

To calculate the interest rate, use this formula: Interest Rate = (Interest / Principal) x 100. Divide the interest earned by the principal amount, then multiply by 100 to get the percentage.

What Is The Payment On A 60 Month 2.99% Car Loan For $40,000?

The monthly payment for a 60-month car loan at 2. 99% interest on $40,000 is $718.

What Is A Good Interest Rate For A Car For 72 Months?

A good interest rate for a 72-month car loan is typically between 3% and 5% for borrowers with excellent credit. Rates can vary.

Conclusion

Calculating interest rates on a car loan can be simple. Understand the terms, use online calculators, and compare offers. Doing this ensures you get the best deal. Remember, lower interest rates save money. Take your time and choose wisely. Your financial decisions matter.

Happy car shopping!