What is a Finance Charge on a Car Loan: Explained Simply

A finance charge on a car loan is the cost of borrowing money. It includes interest and fees.

Understanding finance charges can save you money. When you borrow for a car, lenders charge for the service. This charge is the finance charge. It varies based on the loan amount, interest rate, and loan term. Knowing how finance charges work helps you make better decisions.

You can compare loans and choose the most affordable one. In this blog, we’ll explain finance charges. We’ll also show how to calculate them. This knowledge will help you understand your car loan better. Let’s dive in and make car loans simple!

Introduction To Finance Charges

Finance charges are extra costs on a loan. These costs can include interest and fees. A car loan often has finance charges. They help the lender earn money.

Finance charges are what you pay to borrow money. They are not part of the loan amount. These charges are important to understand. Knowing them helps you plan your payments.

Car loans have finance charges. They make the loan more expensive. It is important to know how much they are. This helps you know the total cost of the car. Always check the loan agreement for these charges.

Components Of Finance Charges

Interest rates are a key part of finance charges. They show how much you pay to borrow money. Higher interest rates mean you pay more over time. Lenders set these rates based on different factors. Your credit score is one. Loan terms are another. A good credit score can help. It often means lower rates. Loan duration also affects interest. Longer loans may have more interest. Understanding interest rates helps in planning. You see the real cost of a loan.

Loan fees are another part of finance charges. These are extra costs you pay. Application fees are common. You pay them to start a loan. Origination fees are also typical. They cover the loan setup. Some loans have late payment fees. If you miss a payment, you pay extra. Prepayment penalties are possible too. They charge if you pay off early. Knowing about fees is important. It helps you avoid surprises. Always ask about fees before signing.

Calculation Methods

Finance charges on car loans include interest and fees. Lenders calculate them based on loan amount and term. Understanding these charges helps manage your budget effectively.

Simple Interest

Simple interest is easy to understand. Only the original amount, or principal, is used. Interest is calculated on this amount. It does not change over time. This means you pay the same interest each year. This makes planning easier. If you borrow $1,000 at 5% interest, you pay $50 each year. Simple, right?

Compound Interest

Compound interest is a bit more complex. Interest is calculated on the principal and any accumulated interest. This means the amount you owe grows faster. If you have $1,000 at 5% interest, you pay interest on $1,050 in the next period. It can make loans more expensive over time. Be careful with this method. It may cost you more money.

Credit: educounting.com

Factors Affecting Finance Charges

Interest rates, loan term, and loan amount play a key role in finance charges on a car loan. Understanding these factors helps borrowers manage their expenses effectively. Keeping track of these can lead to better financial decisions.

Credit Score Impact

Your credit score plays a key role in finance charges. A higher score leads to lower interest rates. Lower scores often result in higher charges. Lenders trust people with good scores more. Paying bills on time helps improve your score. Avoiding too much debt is also important. Regularly checking your score can help you stay aware.

Loan Term Duration

The length of your loan term affects finance charges. Shorter terms often mean higher monthly payments. Longer terms can result in more interest paid over time. It’s important to find a balance. Choosing the right term can save you money. Consider your budget before deciding. Look at total interest costs, not just monthly payments.

Finance Charge Vs. Apr

APR stands for Annual Percentage Rate. It shows the cost of borrowing. Both APR and finance charge add to the loan cost. APR includes fees and interest. It’s a yearly rate. Finance charge is the total cost. It includes all charges. Both terms affect loan costs. They help you compare loans. They seem different but are linked. APR helps in comparing loans easily. It shows the true cost of the loan. Knowing both helps in better planning. Borrowers should know these terms.

APR and finance charge have key differences. APR is a percentage, while finance charge is a total amount. Both show loan costs. Both are important for car loans. Understanding both helps in making good choices. APR can include other fees. Finance charge usually includes interest only. Knowing these can help save money. They guide on what to expect. Both terms are important in loan agreements.

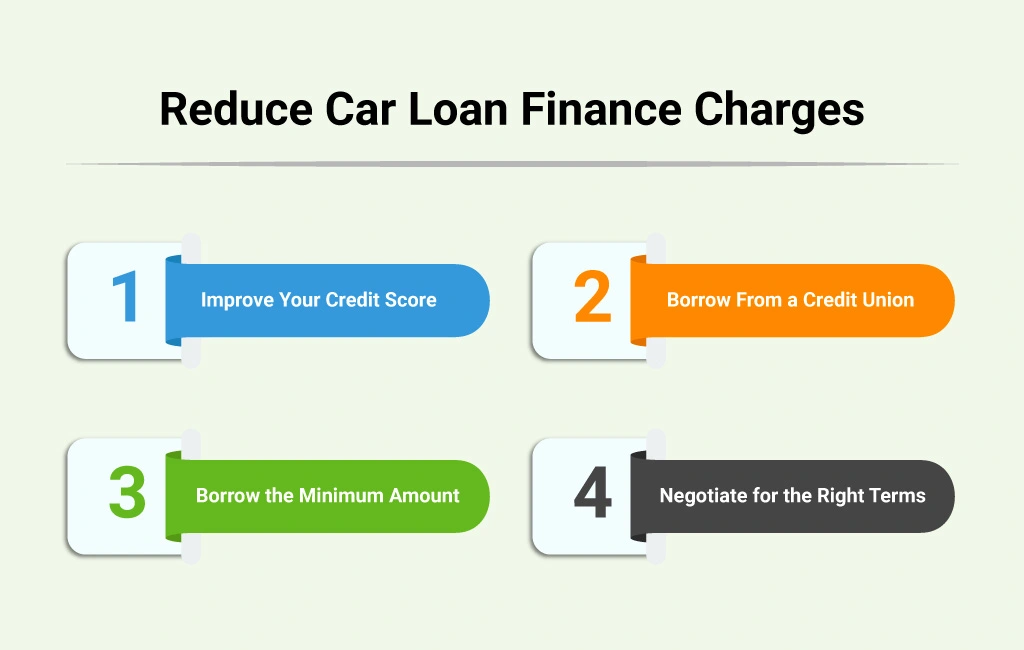

How To Minimize Finance Charges

Pay bills on time to boost your credit score. Lower scores mean higher finance charges. Use credit cards wisely. Keep balances low. Avoid new debt if possible. Check credit reports for errors. Fix any mistakes quickly. A better score helps in getting lower interest rates.

Ask the lender for better loan terms. A shorter loan term can mean lower interest. Compare rates from different lenders. Choose the one with the best offer. Negotiate fees and look for hidden charges. Read the loan contract carefully. Make sure you understand all terms before signing. Being informed can save money on finance charges.

Common Mistakes To Avoid

Ignoring hidden fees can cost you money. Many loans have extra fees. These may include service charges or processing fees. Always ask about these fees before signing. They can make your loan more expensive over time. Be sure to read all the details. Look for any extra costs.

Overlooking loan terms is another mistake. Loan terms tell you how long you will pay. They also show how much you pay each month. Don’t ignore these details. A longer loan term can mean more interest. A higher monthly payment might be better. It can save you money in the long run. Always understand the loan terms clearly. Ask questions if something is unclear.

Credit: www.wikihow.com

Conclusion And Summary

Understanding finance charges on car loans helps in managing costs effectively. These charges are the interest paid over the loan term. Knowing how they work can aid in budgeting and decision-making.

Key Takeaways

Understanding a finance charge on a car loan is important. It’s the total cost you pay to borrow money for the car. This charge includes interest and any other fees. The higher the charge, the more you pay over time.

A lower interest rate can save you money. Always compare rates before choosing a loan. Knowing these charges helps in making smart financial decisions.

Final Thoughts

Finance charges affect the total cost of buying a car. Always check the terms of the loan carefully. This knowledge helps in choosing the best car loan for you.

Credit: www.yourmechanic.com

Frequently Asked Questions

Is It Normal To Have A Finance Charge On A Car Loan?

Yes, a finance charge on a car loan is normal. It includes interest and fees for borrowing money. Lenders apply this charge to compensate for providing the loan. This is a standard practice in auto financing, helping lenders cover their costs and make a profit.

How Can I Avoid Paying Finance Charges On My Car Loan?

Pay extra towards the principal each month. Opt for a shorter loan term. Refinance for a lower interest rate. Make timely payments to avoid penalties. Consider bi-weekly payments for faster payoff.

Is A Finance Charge A Down Payment?

A finance charge is not a down payment. It refers to interest and fees on a loan or credit. A down payment is an upfront amount paid during a purchase. Both are distinct financial terms and serve different purposes in transactions.

Understanding these helps in managing finances effectively.

Is A Finance Charge Monthly?

A finance charge can be monthly, depending on the agreement. It often appears on credit card statements. Check your contract for details on payment schedules and amounts. Always review the terms to understand your obligations. Regularly monitoring your statements helps avoid unexpected charges.

Conclusion

Understanding finance charges on car loans is important. These charges affect the total loan cost. Knowing them helps you plan better. You can make informed decisions. Save money by comparing different loans. Choose the right lender. Always check the interest rates.

Read the loan agreement carefully. Ask questions if unsure. Make sure you understand all the fees. This knowledge empowers your car buying experience. You can budget wisely. Avoid unexpected costs. Stay informed and make the best choice for your financial situation.

Your car purchase should be smooth and stress-free.