Are New Cars More Expensive to Insure? Uncover the Truth

Yes, new cars are often more expensive to insure. This is due to several factors related to the car’s value and repair costs.

When buying a new car, insurance costs might surprise you. New cars usually have higher insurance premiums. Why? They are expensive to repair and replace. Advanced technology and safety features can also add to the cost. Insurers consider these factors when setting your premium.

Understanding why new cars can be more costly to insure helps you plan better. In this blog, we will explore the reasons behind this and provide tips to manage your insurance costs. Stay with us to learn more about insuring your new ride without breaking the bank.

Factors Influencing Car Insurance Costs

New cars cost more to replace. So, insurance costs rise. A high-value car needs more coverage. Old cars are cheaper to fix. So, their insurance is usually lower.

Modern cars have many safety features. These can include airbags, lane assist, and anti-lock brakes. These features lower accident risks. Less risk means lower insurance. But, some new technology can be costly to repair. This can make insurance higher.

Credit: get.goautoinsurance.com

Comparing New And Used Car Insurance

New cars often cost more to insure. They have higher value. This means higher replacement costs. They also may have more features. These features can be expensive to repair. Used cars usually have lower premiums. They have lower market value. This makes them cheaper to replace. They may have fewer features to fix.

New cars may need full coverage. This includes collision and comprehensive insurance. Lenders often require this. Used cars may need less coverage. Owners might choose liability-only insurance. This can save money. Each driver must decide the right coverage. It depends on the car’s value and their needs.

Impact Of Vehicle Age On Insurance Rates

New cars lose value quickly. This is called depreciation. Insurance companies know this. They often charge more for new cars. Older cars have lower values. They usually cost less to insure. The risk of losing a lot of money is smaller. Thus, insurance rates are lower.

New cars often need expensive repairs. Parts for new models can be costly. This raises insurance rates. Older cars may have cheaper parts. The repairs can be less costly. This can lower insurance rates. Insurance companies look at repair costs.

Credit: apnews.com

Role Of Advanced Technology In Insurance Costs

Telematics uses GPS and other sensors to track car data. It monitors speed, braking, and mileage. This data helps insurance companies set prices. Safe drivers can get lower premiums. But, risky drivers may pay more.

New cars have driver assistance systems. These include lane assist, automatic braking, and adaptive cruise control. They make driving safer. Fewer accidents mean lower insurance costs. But these systems are expensive to fix. Higher repair costs can increase premiums. So, it can be a balance between safety and costs.

Manufacturer Warranties And Insurance

New cars often come with manufacturer warranties. These warranties cover major repairs. Insurance may cost less with this coverage. Some warranties last up to 3 years. Others may cover up to 5 years. This can save money on repairs. Insurance companies consider this when setting rates.

Extended warranties provide coverage beyond the original warranty. These can last up to 10 years. They cover more parts and services. This may reduce the need for claims. With extended warranties, insurance premiums might be lower. Always check what is included before buying.

Influence Of Car Model And Make

Luxury cars often come with higher insurance costs. They have expensive parts. Repair costs can be quite high. Thieves target luxury cars more often. This risk increases insurance prices. Owners may also drive them faster. This can lead to more accidents.

Economy cars usually cost less to insure. They have cheaper parts. Repairs do not cost as much. Thieves are less interested in economy cars. This reduces the risk. Owners of economy cars may drive more carefully. Fewer accidents can occur.

Regional Insurance Rate Variations

Insurance costs differ between urban and rural areas. Urban areas often have higher rates. More traffic and accidents in cities. More risks and claims. Rural areas see fewer accidents. Less traffic means fewer claims. So, lower rates apply.

State laws impact insurance rates. Some states have strict rules. They need more coverage. This can raise costs. Other states have lenient rules. They need less coverage. This can lower costs. Your state’s laws matter. They affect what you pay.

Tips To Lower Insurance Costs For New Cars

Bundling policies can save money. Combine car and home insurance. You might get a discount. Insurance companies like loyal customers. Bundling shows loyalty. It’s easy to manage too. One bill, one company.

Safe driving discounts help too. Drive carefully. Avoid accidents. Avoid tickets. Insurance companies reward safe drivers. They offer discounts. Install a tracking device in your car. Show your good driving habits. Get lower rates.

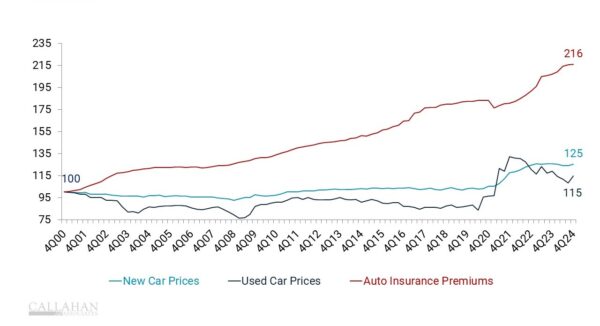

Credit: creditunions.com

Frequently Asked Questions

Is Insurance More Expensive With New Cars?

Yes, insurance for new cars is often more expensive. New vehicles have higher replacement costs and advanced technology.

Is It Cheaper To Insure A New Car Or Old Car?

Insuring an old car is generally cheaper than a new car. New cars have higher replacement costs and advanced technology, leading to higher premiums.

Is It Cheaper To Insure Newer Or Older Cars?

Insuring older cars is usually cheaper. Newer cars often cost more to repair or replace, increasing insurance premiums.

How Much Does Your Insurance Increase With A New Car?

Insurance costs for a new car can increase by 10% to 20%. Factors include car make, model, and your driving history.

Conclusion

New cars often cost more to insure due to various factors. They have higher repair costs and advanced technology. Insurance companies consider these elements when calculating premiums. Older cars usually have lower insurance rates. Choosing a new car might mean higher insurance expenses.

Consider both your budget and needs. This helps in making a well-informed decision. Balancing the benefits and costs is crucial. Always compare insurance quotes before purchasing. This ensures you find the best deal for your new vehicle.