Compare Car Insurance by State: Find the Best Rates Today

Car insurance rates vary widely by state. This can impact your budget significantly.

Understanding these differences is crucial for making informed decisions. Comparing car insurance by state helps you find the best coverage at the most affordable price. Each state has its own regulations and factors that influence insurance rates. These include traffic laws, accident statistics, and weather conditions.

By comparing, you can see which states offer cheaper rates and better coverage options. This knowledge empowers you to choose the right insurance plan for your needs. Whether you’re relocating or just curious, understanding state-by-state differences ensures you get the best deal. So, let’s explore how car insurance varies across the U. S. And what it means for you.

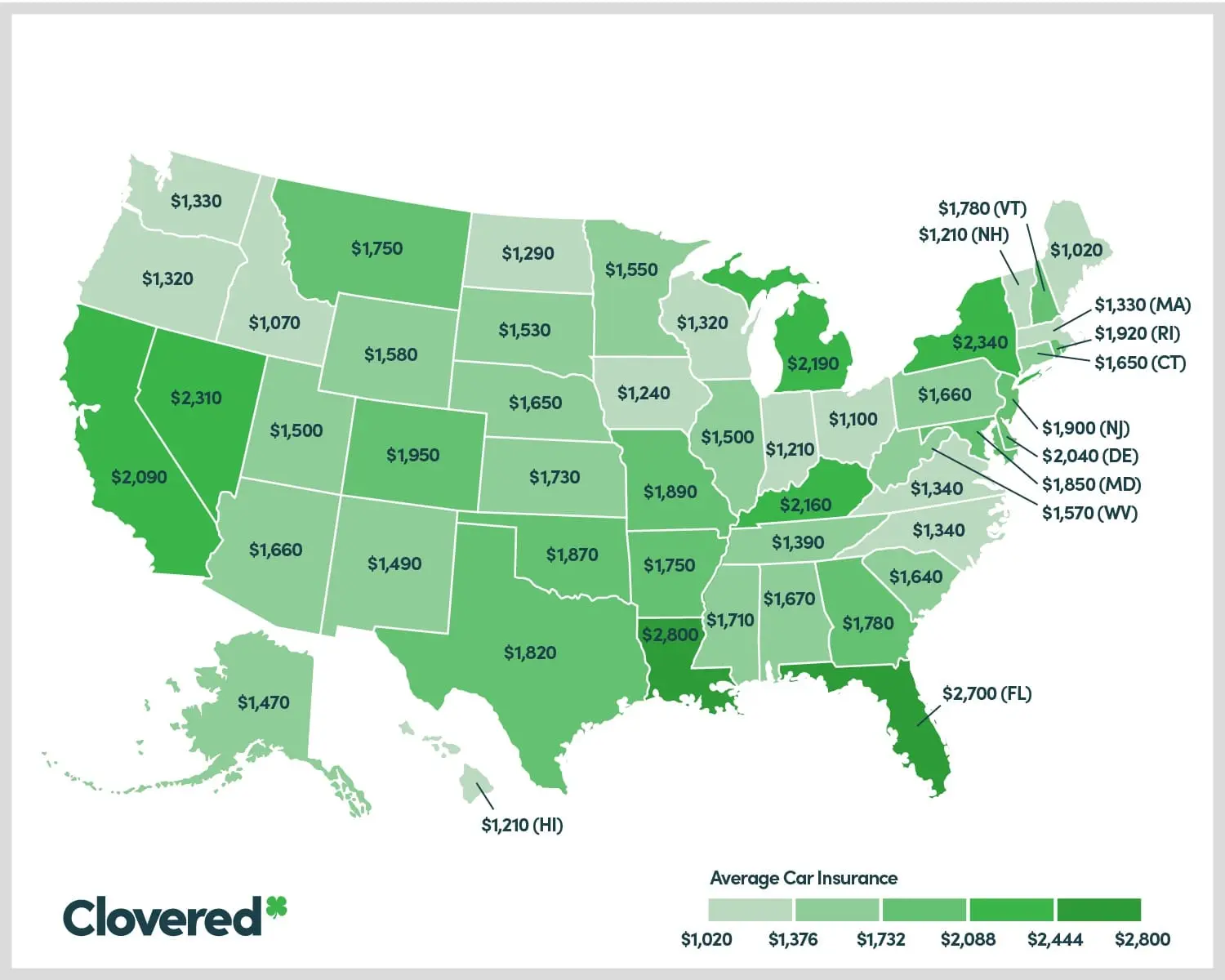

Credit: clovered.com

Introduction To Car Insurance

Car insurance protects you from financial loss. It covers damages in accidents. It also helps with medical costs. Without insurance, you pay all costs yourself. Most states require car insurance. This ensures everyone is protected. Car insurance gives peace of mind. You drive knowing you are covered.

Several factors affect car insurance rates. Age is a key factor. Young drivers pay more. Older drivers often pay less. Driving record impacts rates too. Many accidents or tickets raise your cost. Type of car matters. Expensive cars cost more to insure. Location is important. Urban areas have higher rates. Rural areas tend to be cheaper. Credit score can also affect rates. Good credit often means lower costs.

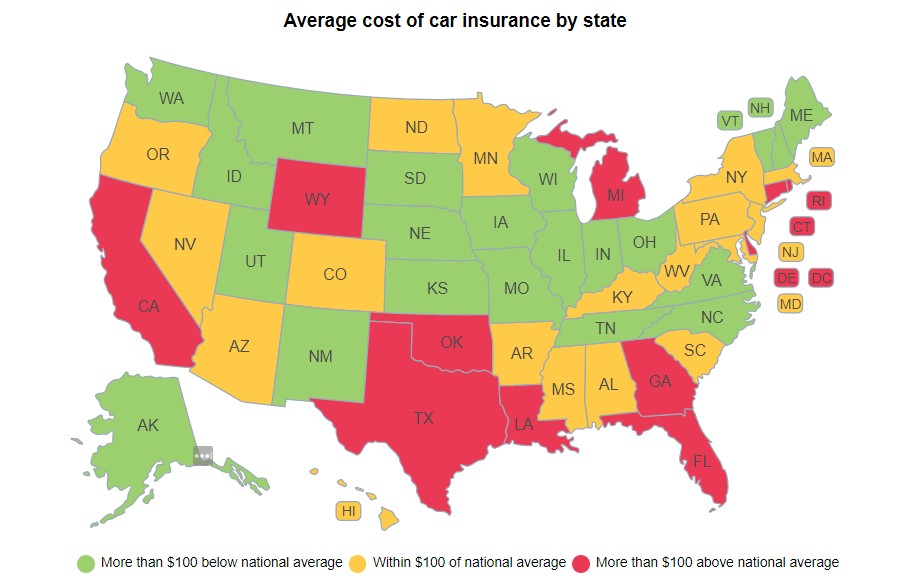

State-by-state Comparison

Car insurance rates differ by state. Some states have higher rates. Others offer lower premiums. Urban areas often cost more. Rural regions can be cheaper. Weather also affects rates. States with harsh climates may charge more. Population density impacts costs too. More cars mean more accidents.

Each state has unique regulations. These laws affect your insurance cost. Minimum coverage requirements vary. Some states need more coverage. This increases your premium. Other states have fewer requirements. This can reduce your costs. Certain states also have no-fault insurance laws. These laws impact how claims are handled.

Top States With Lowest Rates

Ohio has some of the lowest car insurance rates. Virginia also offers affordable rates. North Carolina is known for its cheap insurance. Idaho and Iowa have low rates as well.

Compare quotes from different companies. Maintain a clean driving record. Increase your deductible to lower premiums. Bundle policies for discounts. Take advantage of discounts for good grades or safe driving.

Credit: www.thecarconnection.com

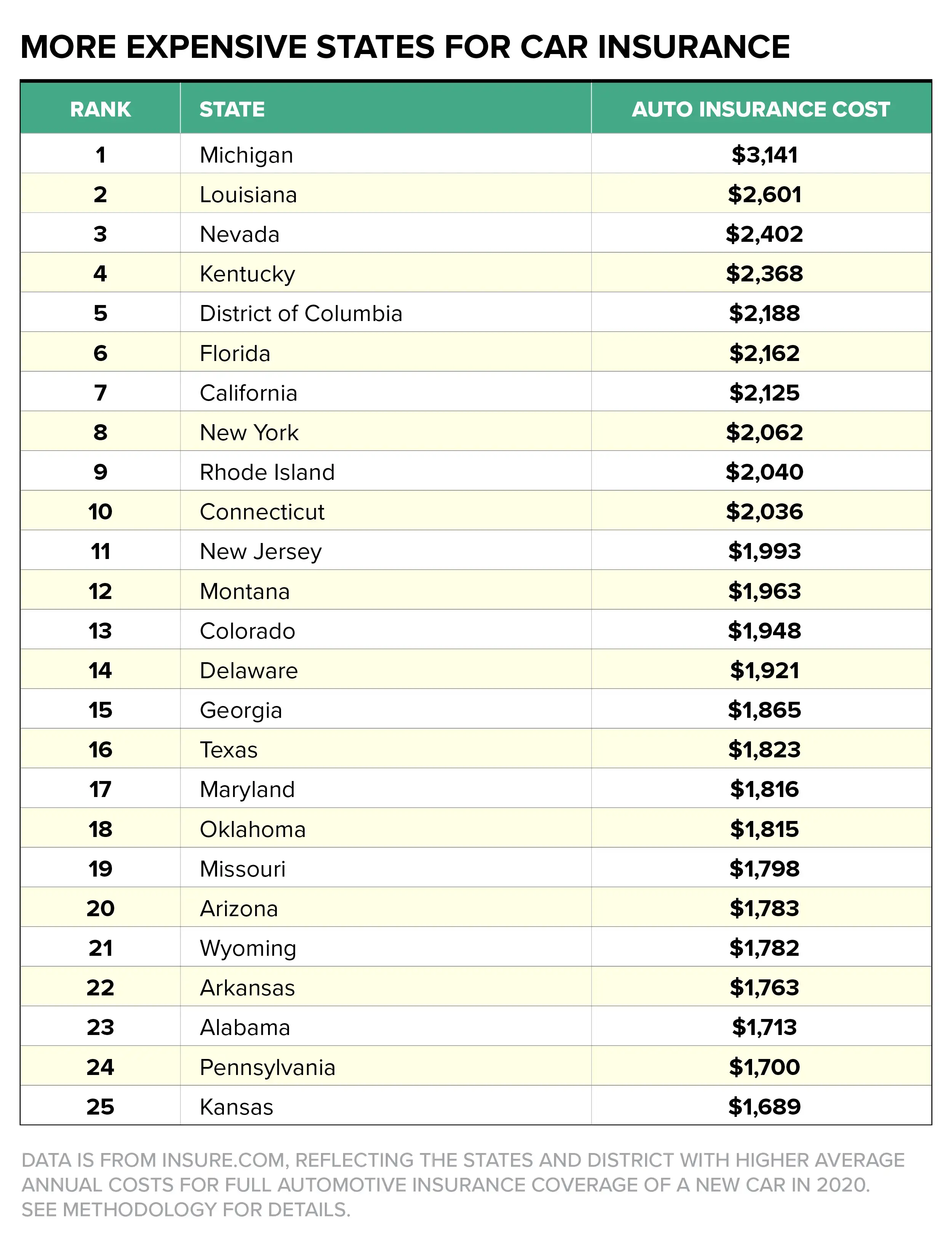

States With Highest Rates

Car insurance in some states costs a lot. These states have higher rates. Michigan, Louisiana, and Florida are known for expensive insurance. In Michigan, rates are high due to no-fault laws. Louisiana has many accidents, raising costs. Florida faces frequent storms, which increases rates.

Many factors raise insurance costs. In some states, more accidents happen. This increases claims and rates. Bad weather like hurricanes also drives up costs. Laws in some states make insurance expensive. Medical costs can be high too. All these factors lead to higher premiums.

Influence Of Driving Records

Driving records impact car insurance rates significantly. States with stricter regulations may result in higher premiums for drivers with poor records. Comparing insurance by state helps find better deals.

Impact Of Violations

Violations like speeding and drunk driving can raise insurance costs. Serious violations make insurance costs higher. Minor violations can also increase costs. Some states have higher penalties for violations. Repeat violations lead to even higher costs. Keeping a clean driving record saves money.

Benefits Of Clean Records

A clean driving record means lower insurance costs. Insurance companies trust safe drivers more. Safe drivers get better rates and discounts. Clean records help avoid fines and penalties. States reward safe drivers with lower costs. Keeping a clean record is very beneficial.

Role Of Vehicle Type

Different cars have different insurance rates. Popular cars usually have lower rates. They are often cheaper to repair. Parts are easy to find. Rare cars cost more to fix. Insurance rates go up.

Luxury cars cost more to insure. They have high repair costs. They have advanced features. Economy cars are cheaper. They have fewer features. Repairs are cheaper. Insurance rates are lower.

Discounts And Savings

Finding the best car insurance rates can save you money. Compare car insurance by state to uncover discounts and savings. Each state offers different deals, so shop around.

Common Discounts

Car insurance companies offer many discounts. These help you save money. Some common discounts include safe driver, multi-policy, and good student.

Safe driver discounts are for those with no accidents. Multi-policy discounts apply if you have more than one policy with the same company. Good student discounts are for students with high grades.

How To Qualify

To qualify for these discounts, you need to meet certain criteria. For safe driver discounts, you must have a clean driving record. Multi-policy discounts need you to bundle car and home insurance.

Good student discounts require you to show your grades. Insurance companies want proof of your good performance. Always ask your insurance agent about all available discounts.

Choosing The Right Policy

Different states have different car insurance rules. It is important to know what coverage options are available. Basic coverage usually includes liability, collision, and comprehensive. Some policies offer uninsured motorist coverage. Others include medical payments. Be sure to understand each option.

Compare premiums from different insurers. Look at deductibles and coverage limits. Check if the policy offers roadside assistance. Read customer reviews to know about service quality. Speak to an insurance agent if needed. Always read the fine print before buying. Compare quotes from multiple sources.

Credit: money.com

Frequently Asked Questions

Who Is The Best Car Insurance Comparison Site?

The best car insurance comparison site is subjective, but popular options include NerdWallet, The Zebra, and Compare. com. They offer extensive comparisons.

What Is The Most Expensive State For Car Insurance?

Michigan is the most expensive state for car insurance. High premiums result from comprehensive coverage requirements and no-fault insurance laws.

Do Car Insurance Rates Differ By State?

Yes, car insurance rates differ by state. Each state has unique regulations and risk factors that influence premiums.

Who Has The Lowest Auto Insurance Rates?

Geico and State Farm often offer the lowest auto insurance rates. Rates vary by location, driving history, and other factors. Compare quotes to find the best deal.

Conclusion

Comparing car insurance by state helps find the best rates. Each state has different rules and costs. Understanding these differences saves money. Research various providers and policies. Choose one that fits your needs. Remember, a good car insurance plan offers peace of mind.

Always review and update your policy regularly. This ensures you have adequate coverage. With careful comparison, you can secure affordable and reliable insurance. Make informed decisions and drive confidently.