When Should You Refinance Your Car: Top Signs & Benefits

Refinancing your car can save you money. But when is the right time to do it?

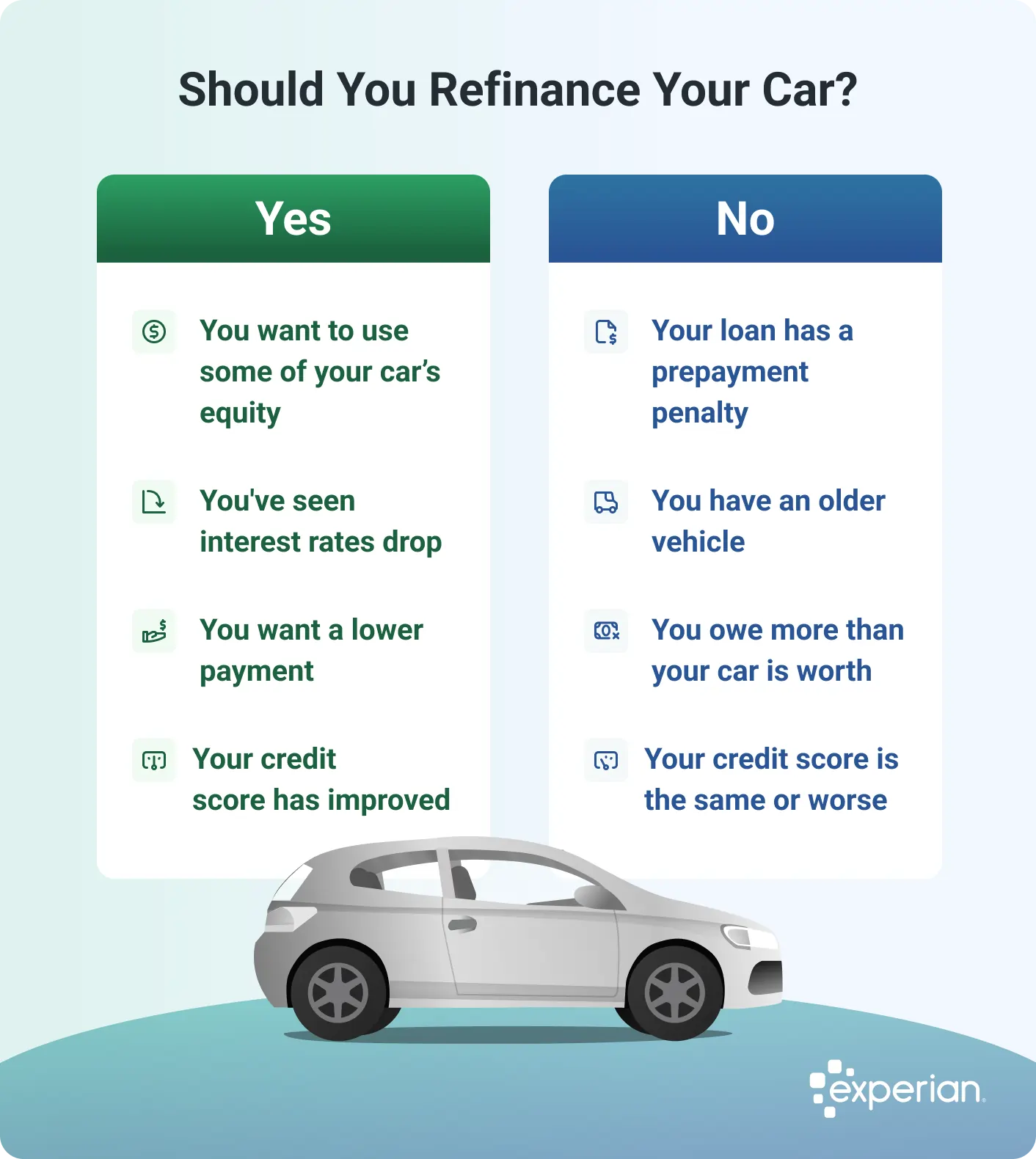

Deciding to refinance your car loan can be a smart financial move. You might get a lower interest rate, reduce your monthly payments, or shorten the loan term. But it’s not always the best choice for everyone. Understanding when to refinance can help you make the best decision for your finances.

In this post, we will explore the factors that indicate it’s time to refinance. By the end, you’ll know if refinancing your car is the right step for you. Let’s get started!

Signs It’s Time To Refinance

Paying a high interest rate on your car loan? You may save money by refinancing. Check the current rates. If they are lower, consider refinancing. This could reduce your monthly payments. It can also save you money over time.

Has your credit score improved? You might qualify for a better loan. A higher credit score often means a lower interest rate. This can make your payments easier to manage. A new loan with a lower rate could be a smart move.

Benefits Of Refinancing

Refinancing can help in reducing your monthly car payments. This means more money in your pocket each month. It can make your budget more flexible. Lower payments can also reduce financial stress.

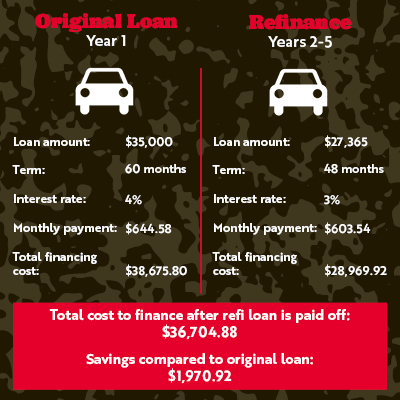

Refinancing may get you a lower interest rate. This can save you money over the life of the loan. Lower interest means you pay less in the long run. It helps you pay off your car faster.

Impact On Loan Terms

Refinancing can lead to a longer loan term. This means lower monthly payments. But it also means you pay more interest over time. A longer term can give more financial flexibility. It is important to check the total cost.

Refinancing can also shorten your loan term. This means higher monthly payments. But it helps pay off the loan faster. Shorter terms save on interest costs. This option is good if you have more income now.

Credit: www.experian.com

Evaluating Your Financial Situation

Check your current income. Make sure you know how much you earn. Then, list all your monthly expenses. This includes rent, food, bills, and more. Compare your income to your expenses. This helps you see if you have extra money. If you spend more than you earn, refinancing might not be a good idea. Keep track of your budget.

Think about your future financial goals. Do you want to save money? Or maybe buy a house? Refinancing can help you save on interest. This can help you reach your goals sooner. But make sure it fits your plan. Consider the long-term impact. Will it help you in the future? Make sure it aligns with your goals.

How Market Conditions Affect Refinancing

Interest rates can change often. When rates go down, it might be a good time to refinance. Lower rates can mean lower monthly payments. This can save you money. Keep an eye on the news. Rate cuts are often announced.

Compare rates from different lenders. This helps you find the best deal. Even a small drop in rates can make a big difference. For example, a 1% decrease can save a lot over time.

The economy affects car refinancing. When the economy is strong, rates are stable. In a weak economy, rates might go up or down. Job stability also matters. If you have a steady job, lenders see you as a lower risk.

Inflation can impact refinancing. High inflation may lead to higher rates. Keep your credit score in good shape. A good credit score can help you get better rates. Plan ahead and stay informed.

:max_bytes(150000):strip_icc()/when-can-i-refinance-my-car-315100-v1-7b5d435f0460419ca707f6d53ca45c6b.png)

Credit: www.thebalancemoney.com

Steps To Refinance Your Car

First, collect all the important papers. You need your current loan statement, car title, and proof of income. These help the lender see your ability to pay. Have your credit report ready too. This shows your credit history. Also, get your car’s value. Use online tools to find this. Having these documents makes the process smooth.

Next, look at different lenders. Check their interest rates. Lower rates save money. Look at their loan terms. Shorter terms mean higher payments but less interest. Long terms mean lower payments but more interest. Read reviews from other customers. This helps find a trustworthy lender. Compare fees too. Some lenders charge high fees. Others have no fees. Choose the lender with the best offer for you.

Common Mistakes To Avoid

Refinancing a car loan might seem like a good idea. Yet, it can lead to higher costs if done improperly. Always check the new interest rate and loan terms before making a decision.

Ignoring Loan Fees

Refinancing your car loan often involves extra fees. Many people ignore these costs. They might include application fees, title transfer fees, or even penalties for early repayment. These fees can add up. Make sure to check all costs before deciding to refinance. This ensures you know the real cost of refinancing.

Not Checking Credit Score

Your credit score affects your interest rate. A low score can result in high rates. Always check your credit score before refinancing. If your score has improved, you may get a better deal. If it’s low, consider improving it first. This could save you money in the long run.

Credit: www.frontwavecu.com

Questions To Ask Your Lender

Some lenders charge a fee for paying off your loan early. This is called a prepayment penalty. Ask your lender if they have this fee. Knowing this helps you decide if refinancing is a good idea. If the fee is high, refinancing might not save you money. Always check this before making a decision.

Refinancing your car loan often comes with fees. These may include application fees, title fees, and more. Ask your lender for a list of all fees. Compare these fees with the savings from a lower interest rate. Only refinance if the savings outweigh the fees. This ensures you make a smart financial decision.

Frequently Asked Questions

What Is Car Refinancing?

Car refinancing is the process of replacing your current car loan with a new one. It often has different terms and interest rates. This can help lower your monthly payments or reduce the total interest paid.

When Is The Best Time To Refinance?

The best time to refinance is when interest rates drop. It can also be beneficial if your credit score improves. Lowering your monthly payments can make finances easier.

Can Refinancing Save You Money?

Yes, refinancing can save you money. Lower interest rates can reduce your monthly payments. Over time, you can save significantly on interest costs.

Will Refinancing Affect My Credit Score?

Refinancing can temporarily lower your credit score. However, consistent, on-time payments can improve it over time. The impact is usually minimal and short-term.

Conclusion

Refinancing your car can save you money. Check your current loan rates. Compare them with new offers. Consider your credit score. It affects the interest rate. Think about your car’s age. Older cars may not qualify. Calculate the costs involved.

Refinancing isn’t always free. Weigh the pros and cons. Make an informed decision. Your wallet will thank you.