How Much Can You Depreciate a Car for Business: Maximize Savings

You can depreciate a car for business based on specific IRS rules. Generally, depreciation allows you to deduct the car’s cost over time.

Understanding car depreciation for business use can save you money. It’s essential to know how much you can deduct and the methods available. Depreciation reduces taxable income, making it a valuable tool for business owners. This blog post will explore key factors and guidelines for car depreciation.

We’ll cover IRS regulations, different depreciation methods, and how to maximize your deductions. Knowing these details can help you make informed decisions and optimize your tax savings. Dive in to learn more about how car depreciation works for your business.

.png)

Credit: www.keepertax.com

Introduction To Car Depreciation

Car depreciation helps businesses save money. It reduces taxes. Business owners can write off car costs each year. This helps manage expenses better. It also frees up cash for other needs.

Depreciation is the loss of value over time. Cars lose value as they age. You can claim this loss on your taxes. This is important for businesses. It means lower taxable income.

Two common methods are used. Straight-line and declining balance. Choose the one that fits your needs. Keep good records. This makes tax time easier.

Credit: www.trustedchoice.com

Depreciation Methods

The straight-line method is simple. Spread the car’s cost evenly over its useful life. For example, if the car costs $10,000 and lasts 5 years, depreciate $2,000 each year. This method is easy to use. Many small businesses prefer it.

The declining balance method is different. Depreciate a higher amount in the early years. For example, if the car costs $10,000, depreciate 20% in the first year. This means $2,000 in the first year. In the second year, depreciate 20% of the remaining $8,000. This means $1,600. This method matches higher expenses with higher revenues.

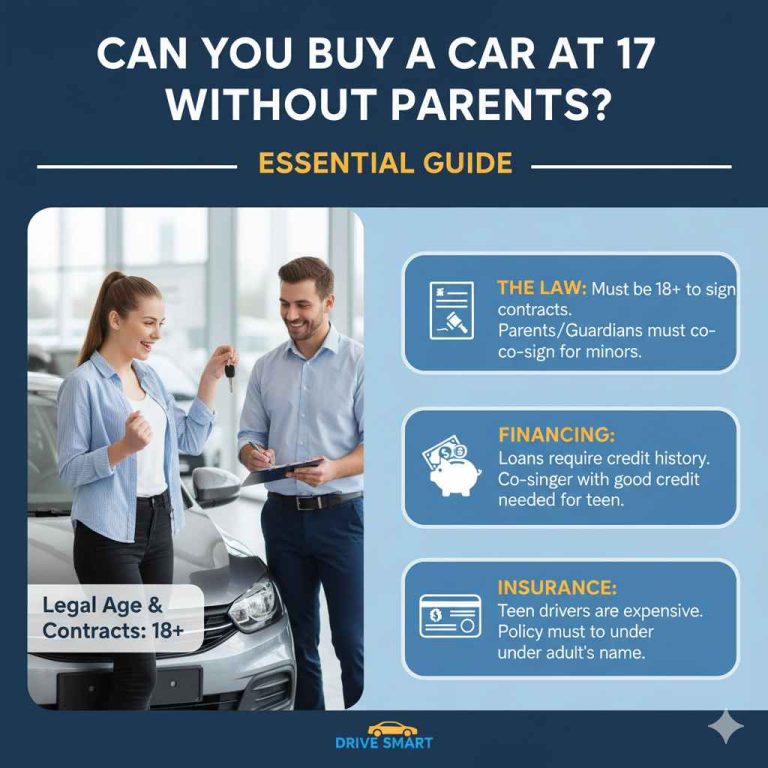

Eligibility Criteria

Determine car depreciation for business by considering its cost, usage, and IRS rules. Qualify based on business use percentage and vehicle type.

Qualifying Vehicles

Vehicles used for business must meet certain criteria. The car should be used mainly for business activities. A personal car used occasionally for business doesn’t qualify. Also, the vehicle should not be used for personal reasons more than 50% of the time. The IRS has specific rules for different types of vehicles. Trucks, vans, and cars all have their own guidelines.

Business Use Percentage

Depreciation depends on how much the car is used for business. Calculate the business use percentage. Drive the car for business trips only. Keep detailed records of miles driven. Business use percentage is important. It affects how much you can depreciate. If you use the car 70% for business, you can depreciate 70% of its value. If you use it 50%, then you can depreciate 50%. Keep accurate records for the best results.

Calculating Depreciation

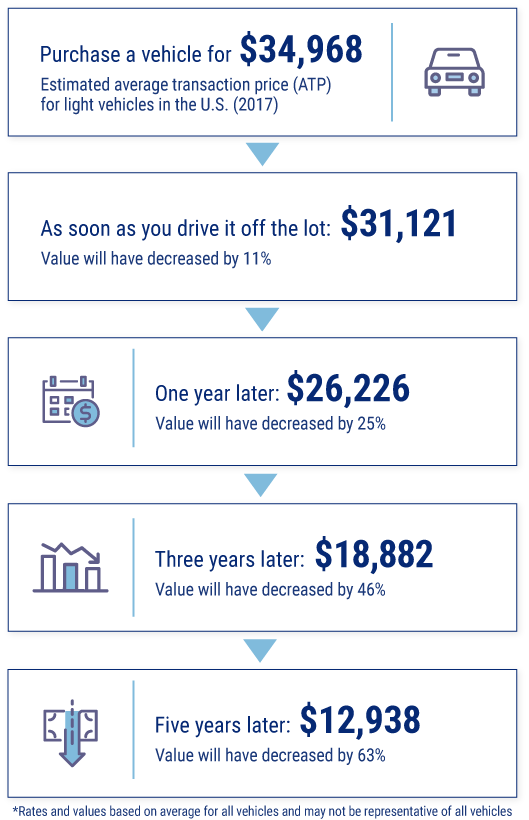

Depreciation starts with the car’s initial value. This is the price you paid. Include taxes and fees. Subtract any discounts or rebates. This gives the total cost of the car.

Next, find the annual depreciation rate. This rate varies. Some cars lose value faster. Others hold value longer. Use a standard rate if unsure. A common rate is 20% per year. Multiply the initial value by the rate. This gives the annual depreciation amount.

Tax Implications

A car used for business can have deductible expenses. These include gas, repairs, and insurance. Depreciation is also deductible. This reduces your taxable income. Keep records of all costs. This helps in tax filing. Only business use counts for deductions. Personal use does not.

The IRS has specific rules for car depreciation. Use the Modified Accelerated Cost Recovery System (MACRS). This system spreads costs over years. The IRS sets limits on annual deductions. Cars placed in service after 1986 follow these rules. Check the IRS website for details. Always consult a tax professional.

Credit: www.patriotsoftware.com

Maximizing Savings

Buying a car at the right time can save you money. Dealers often have sales at year-end. This can reduce the purchase price. Lower prices mean you can depreciate less. This helps in tax savings.

Some cars offer tax credits. Electric and hybrid cars often qualify. These credits reduce the amount you owe in taxes. Lower taxes mean more savings for your business. Always check current tax laws.

Record-keeping Best Practices

Keep detailed records of your car’s business use. Log each trip. Write the date, purpose, and miles driven. This helps at tax time. Tax rules are strict. Accurate logs save you from trouble.

Store all receipts for car expenses. This includes gas, repairs, and insurance. Keep them in one place. A folder or a digital file works well. These receipts prove your business use. They support your depreciation claims.

Common Mistakes To Avoid

Many people think they can depreciate a car quickly. This is not true. You can only depreciate a car at a set rate. This rate is set by the IRS. Overestimating depreciation can lead to problems. You could face penalties. Or worse, you could owe back taxes. So, always use the correct rates.

Ignoring IRS rules is a big mistake. The IRS has strict rules for car depreciation. You must follow these rules. If not, you could get in trouble. Always keep good records. Know the rules and stick to them. This will save you from many headaches.

Conclusion And Final Tips

Depreciating a car for business use can offer significant tax savings. Keep accurate records and follow IRS guidelines. Consult a tax professional to maximize your benefits.

Recap Of Key Points

Depreciating a car for business use can save money on taxes. Remember to track your miles and car expenses. Use the correct depreciation method. Follow IRS rules for business use.

Final Recommendations

Keep accurate records. Choose the best method for your car. Consult a tax expert if unsure. Stay within the law. Review your car’s value yearly. Make adjustments if needed.

Frequently Asked Questions

How Much Can You Write Off For Vehicle Depreciation?

You can write off up to $18,200 in the first year for vehicle depreciation, based on IRS guidelines.

How To Calculate Car Depreciation For Business?

To calculate car depreciation for business, use the straight-line method. Determine the car’s initial cost, then subtract its salvage value. Divide this amount by the car’s useful life in years. This gives the annual depreciation expense.

Can I Fully Depreciate A Car For Business?

Yes, you can fully depreciate a car for business use. Follow IRS guidelines for vehicle depreciation. Check Section 179 for immediate expensing options.

How Much Of A Car Can You Write Off For Business?

You can write off a portion of your car expenses based on business use percentage. Keep detailed records for accurate deductions.

Conclusion

Depreciating a car for business can save you money. Remember, follow IRS guidelines for accuracy. Keep records of all expenses. This will help during tax season. Calculate depreciation using the right method. Consult a tax professional if needed. Accurate records and proper methods lead to savings.

Make informed decisions to maximize deductions. This ensures your business benefits financially.