How Much to Save for a Car: Ultimate Guide to Smart Saving

Saving for a car can seem daunting. But with a plan, it’s achievable.

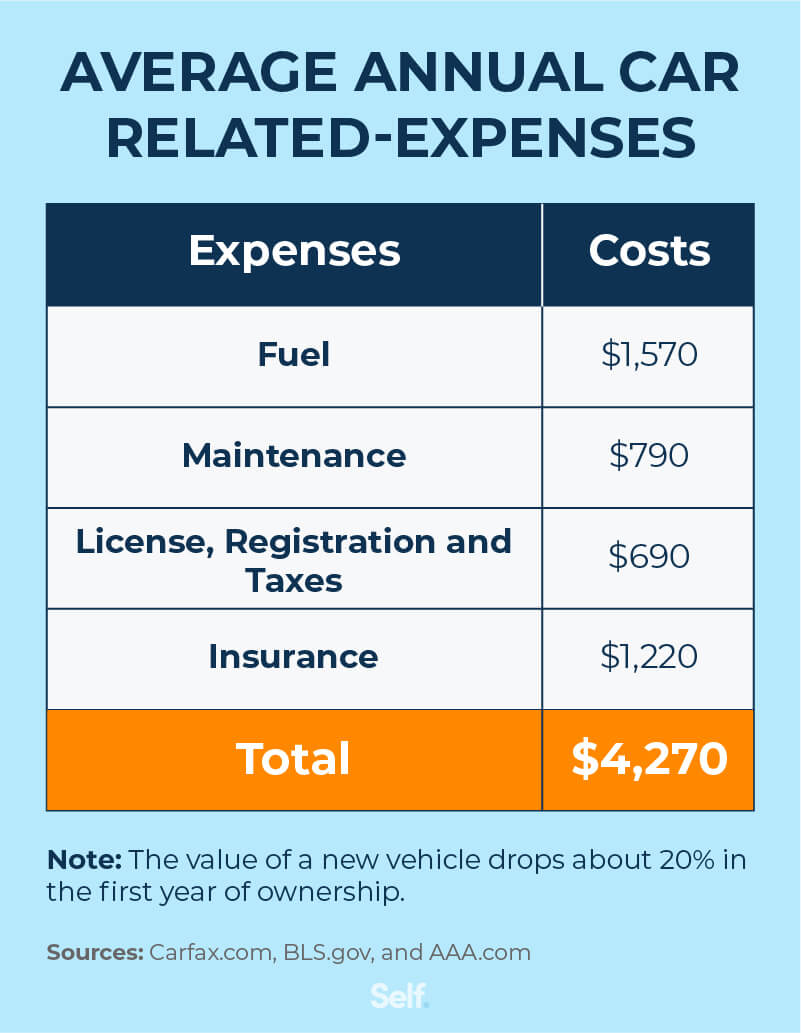

Understanding how much to save involves many factors. The car’s price, your monthly budget, and financing options all matter. You need to think about down payments, loan terms, and interest rates. Also, factor in insurance and maintenance costs. Breaking it down helps you see the full picture.

This guide will help you plan your savings. Let’s dive into how much you should save for your dream car.

Setting Your Savings Goal

First, decide how much you want to spend. Research car prices online. New cars cost more than used ones. Think about what type of car you need. Do you need a small car or a big one? This helps in setting a clear budget.

Do not forget about extra costs. These include insurance, taxes, and registration. Maintenance is also important. Oil changes, tire rotations, and other repairs add up. Budget for these costs too.

You might also need to buy accessories. Floor mats, seat covers, and more. These small things can cost a lot. Plan for them in your budget.

Credit: www.thelordlovesyou.com

Evaluating Your Financial Situation

Start by listing all sources of income. Include salaries, side jobs, and any other earnings. Then, write down your monthly expenses. This includes rent, groceries, utilities, and other bills.

To find your disposable income, subtract your total expenses from your total income. This amount is what you can save each month. Knowing this helps you plan better for your car savings goal.

Choosing The Right Savings Account

High-Yield Savings Accounts offer higher interest rates than regular accounts. They help your money grow faster. These accounts are good for saving for a big purchase. Your money is safe and easy to access. Look for accounts with no fees. Some banks even offer bonuses for opening an account. Always read the terms before you open an account.

Certificates of Deposit (CDs) can help you save. They have fixed terms and interest rates. Your money stays in the account for a set time. You get higher interest than regular savings accounts. But you can’t take out money before the term ends. CDs are good for saving over time. Choose a term that matches your goal. Always check the penalties for early withdrawal.

Credit: www.self.inc

Creating A Savings Plan

First, decide when you want to buy the car. This is your savings timeline. It could be six months or one year. Next, find out the cost of the car. Divide the total cost by the number of months. This gives you the monthly savings goal. Stick to this plan.

Set up an automatic transfer from your paycheck to your savings account. This ensures you save money each month. It reduces the temptation to spend. Many banks offer this service for free. Make saving a habit. Watch your savings grow.

Cutting Expenses

Saving for a car requires careful planning. Set aside 20% of your monthly income. This helps cover down payments and future expenses.

Reduce Non-essential Spending

Start by cutting down on non-essential spending. Skip eating out often. Cook more meals at home. Choose free activities over paid ones. Cancel unused subscriptions. This saves money fast.

Adopt Cost-saving Habits

Adopt habits that save money. Use public transport instead of driving. Turn off lights when not in use. Buy in bulk to save on groceries. Compare prices before buying anything. These habits help save more.

Increasing Your Income

Getting a side job can help you save faster. Think about what skills you have. Babysitting, dog walking, or tutoring can be good options. Some people also drive for ride-sharing apps. Side jobs can add extra money each month. This can go straight into your car savings.

Look around your home. You may have things you don’t use. Old clothes, gadgets, or furniture can be sold. Use online platforms like eBay or local markets. Selling these items can give you quick cash. This money can boost your car savings.

Tracking Your Progress

Budgeting apps help you track your savings. They show where your money goes. This helps you save more. Many apps are free. Some have extra features for a small fee. Choose one that fits your needs.

Check your savings often. See if you are on track. Adjust your spending if needed. Make changes to save more. Always keep your goal in mind. This helps you stay motivated.

Credit: www.tellusapp.com

Staying Motivated

Set small goals. Celebrate when you reach them. Rewards keep you motivated. They make saving fun. Buy a small treat. Enjoy a night out. Save more, reward more. Stay excited about your progress.

Picture yourself driving your new car. Feel the joy. Imagine the freedom. Visualization helps you stay focused. Print a photo of your dream car. Look at it daily. It will remind you why you save. Dream big and stay determined.

Frequently Asked Questions

How Much Money Should I Have Saved To Buy A Car?

Save at least 20% of the car’s price for a down payment. Also, have funds for taxes, fees, and insurance.

Is $1000 A Month For A Car A Lot?

Yes, $1000 a month for a car is considered a lot. It depends on your budget and financial situation.

Is $10,000 A Good Budget For A Car?

Yes, $10,000 is a good budget for a reliable used car. You can find many quality options within this price range.

What Should My Salary Be To Afford A Car?

Your salary should be at least 20% of the car’s total cost. Aim for a monthly car payment under 15% of your gross income. Consider additional costs like insurance, maintenance, and fuel. Use online calculators to estimate affordability based on your specific financial situation.

Conclusion

Saving for a car requires careful planning. Start with setting clear goals. Determine the total cost, including insurance and maintenance. Create a budget and stick to it. Save consistently every month. Consider high-yield savings accounts for better returns. Research and compare prices to find the best deal.

Avoid unnecessary expenses to save more. Stay disciplined and patient. Reaching your savings goal will be rewarding. Enjoy the journey to owning your dream car. Your efforts and planning will pay off. Keep focused and motivated to achieve your financial goals.